XRP surges 14% in a month—$3.00 target in sight, but on-chain red flags wave caution

XRP bulls are back in the saddle—riding a 14% monthly rally that’s reigniting whispers of a $3.00 price target. But before you mortgage your dog for a bag, the blockchain’s whispering warnings.

The Good:

Price action’s painting a bullish breakout. Traders are piling in, betting the SEC’s legal shadow won’t kill the vibe.

The Bad:

On-chain metrics flash amber. Whale wallets are shuffling coins like a magician’s deck—smart money might be prepping an exit.

The Ugly (finance jab incoming):

If ‘past performance’ guaranteed crypto gains, we’d all be retired on a private island—next to the bankrupt hedge fund managers.

Watch those network activity stats. If adoption lags the speculation? That $3.00 dream could turn into a liquidation nightmare.

What's next for XRP as exchange balance, supply in profit expand

XRP has sustained the uptrend since the drop to the June low of $1.90, accruing nearly 50% in gains.

The steady price increase can be attributed to growing risk-on sentiment and a stronger derivatives market, as evidenced by the futures Open Interest's (OI) recovery to $5.9 billion, up from $3.5 billion on June 23.

XRP futures Open Interest | Source: CoinGlass

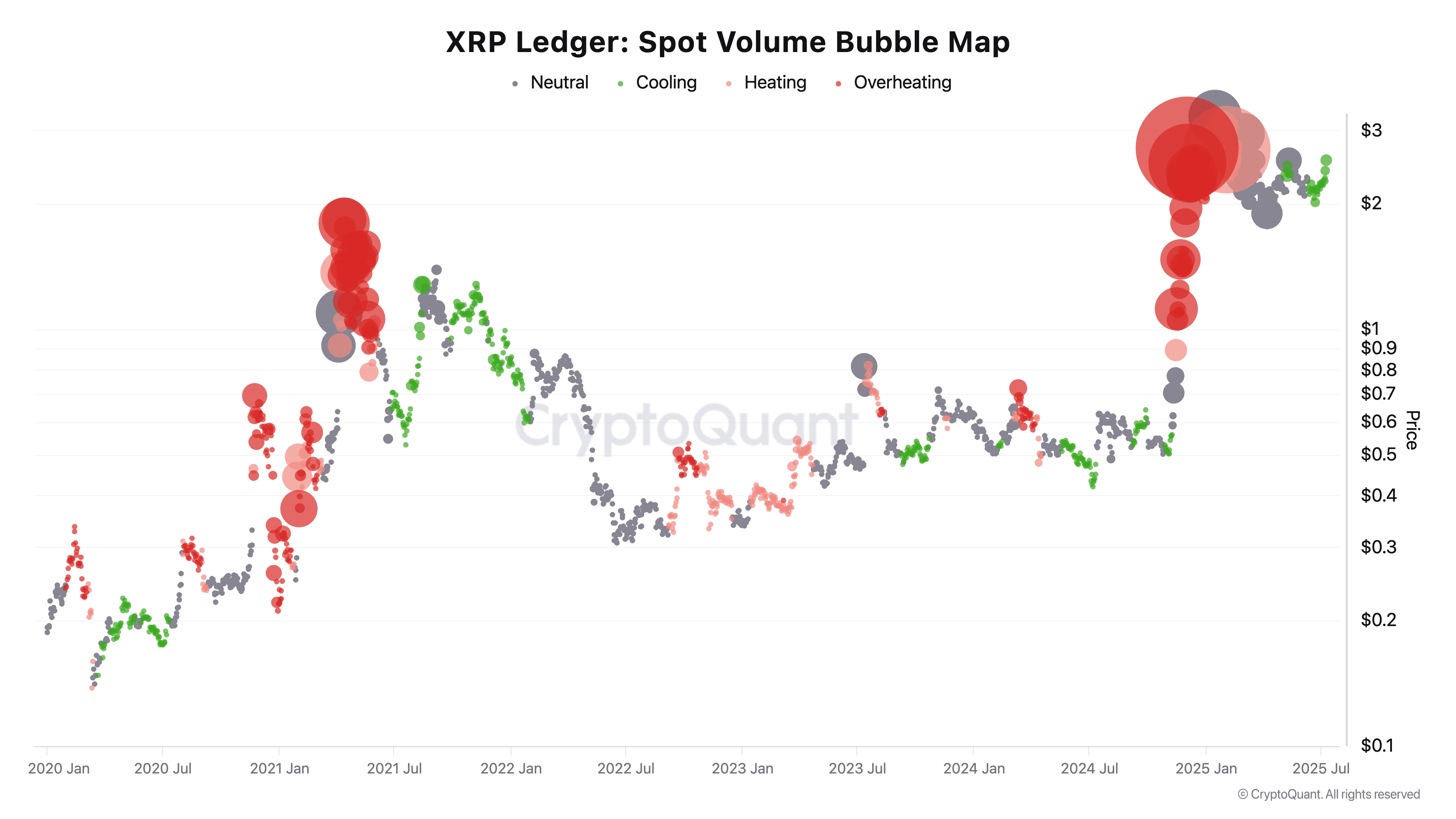

CryptoQuant's Spot Volume Bubble Map shows that trading volume in the spot market is declining or cooling. Subdued activity in the spot market often indicates falling interest in XRP, which could hinder further price increases.

XRP Spot Volume Bubble Map | Source: CryptoQuant'

At the same time, investors are increasing transactions toward exchanges, with Glassnode's Total Exchange Balance metric rising by 2.9% to 3.5 billion XRP, as seen on June 23.

A surge in the exchange balance signals incoming selling pressure as holders prepare to sell or trade their XRP. If supply overshadows demand, this could result in a decline or price consolidation.

XRP Total Exchange Balance metric | Source: Glassnode

Additionally, a subsequent increase in the total supply, which creates a profit, predisposes XRP to overhead pressure, as holders are likely to sell to realize profit. The green line on the chart below represents the supply currently in profit at approximately 57.6 billion XRP.

A similar uptrend in May saw the supply in profit approach 62 billion XRP, but a sell-off followed, capping price action at $2.65 and extending the decline to $1.90 in June.

XRP Total Supply in Profit metric | Glassnode

Technical outlook: XRP completes technical pattern breakout

XRP price rally has surpassed $2.76, a target from an inverse Head-and-Shoulders (H&S) pattern, which was validated on Wednesday when bulls broke above the neckline resistance at $2.33.

The cross-border money remittance token is trading at $2.80 at the time of writing, buoyed by rising trading volume of $165 million. Similarly, the Money FLOW Index (MFI), which tracks the amount of money entering or leaving XRP, backs this bullish outlook, holding at 89.

XRP/USDT daily chart

Still, the Relative Strength Index (RSI) overbought 88, suggesting that the rally could cool off before continuing toward $3.00. Hence, there is a need to tread carefully and prepare for a potential trend reversal. Profit-taking and risks highlighted by on-chain will likely be the main drives of the pullback.

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.