Bitcoin Smashes Records: $1B Shorts Obliterated as BTC Rockets to New ATH

Blood in the water—and it's all from bearish traders.

Bitcoin just napalmed the doubters with a violent surge to uncharted territory, triggering a record-breaking cascade of liquidations. The crypto king isn't just winning—it's humiliating institutional skeptics who bet against the rally.

The reckoning:

Over $1 billion in leveraged short positions got vaporized in hours as BTC punched through its previous all-time high. Another day, another reminder that trying to outsmart this market usually ends with margin calls and regret.

Why this hurts more:

Hedge funds and crypto 'experts' loaded up on shorts after the last pullback—classic 'this time it's different' thinking. Spoiler: It wasn't. The market doesn't care about your PowerPoint slides analyzing 'fair value'.

The kicker?

This liquidation bloodbath happened while traditional markets yawned through another mediocre quarter. But sure, keep telling us crypto's the speculative asset. (Wall Street's 2% annual returns say hi.)

One thing's clear: When Bitcoin decides to move, it eats overleveraged traders for breakfast—and leaves the suits scrambling to explain losses to their risk committees.

Bitcoin blasts through to new high following surge in futures activity

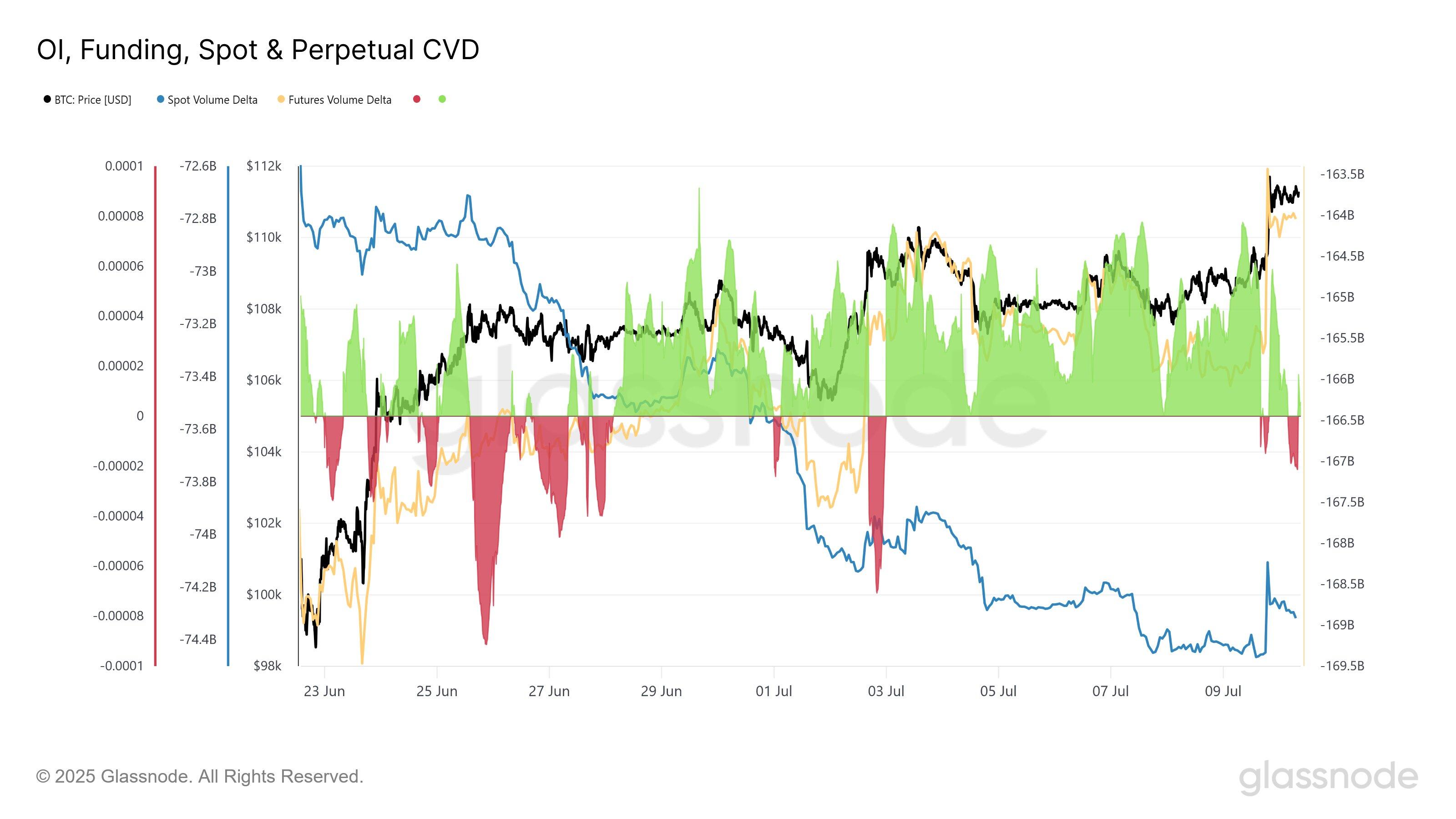

Bitcoin traded above $116,000 for the first time after surging 4% in the past 24 hours. BTC's surge has largely been dominated by futures activity, following a consistent uptrend in the Futures Cumulative Volume Delta (CVD). This indicator represents the aggregate difference between buying and selling volumes.

The Futures CVD showed signs of heavy buying activity despite low funding rates, according to data from Glassnode. This led to a spike in Bitcoin futures open interest, rising to 707,000 BTC worth $82 billion at the time on Thursday.

As a result, Bitcoin's rally has triggered over $1 billion in short liquidations across the crypto market in the past 24 hours, according to Coinglass data. Bitcoin shorts accounted for over $570 million of the total liquidations, with $415 million of that figure transpiring within one hour.

In contrast, spot volumes have trended downward in the past few weeks, with only occasional spikes recorded. "Futures traders are leaning in, but there's little confirmation from spot markets. Low funding suggests positioning isn't crowded - yet," Glassnode stated in an X post on Thursday.

BTC OI, Funding, Spot & Perpetual CVD. Source: Glassnode

The decline in spot activity comes amid the positive impact of US spot Bitcoin exchange-traded funds (ETFs) in recent months. The funds surpassed $50 billion in cumulative net inflows on Wednesday after netting $218 million, according to SoSoValue data.

The inflows were led by BlackRock's iShares bitcoin Trust (IBIT), which reached a record $77 billion in assets under management (AuM). This marks one of the fastest ETFs to achieve such a milestone, as it took the largest Gold fund 15 years to hit the same mark, analysts at The Kobeissi Letter wrote in a Thursday X post.

The fund now holds over 700,000 BTC in less than two years since its launch, totaling 81.4% of the 858,944 BTC held by public treasury companies.