Bitcoin Treasury Companies Gobble Up Record 159,107 BTC in Q2—Bullish Signal or FOMO?

Corporate Bitcoin hoarding hits all-time high as treasury strategies pivot hard into crypto.

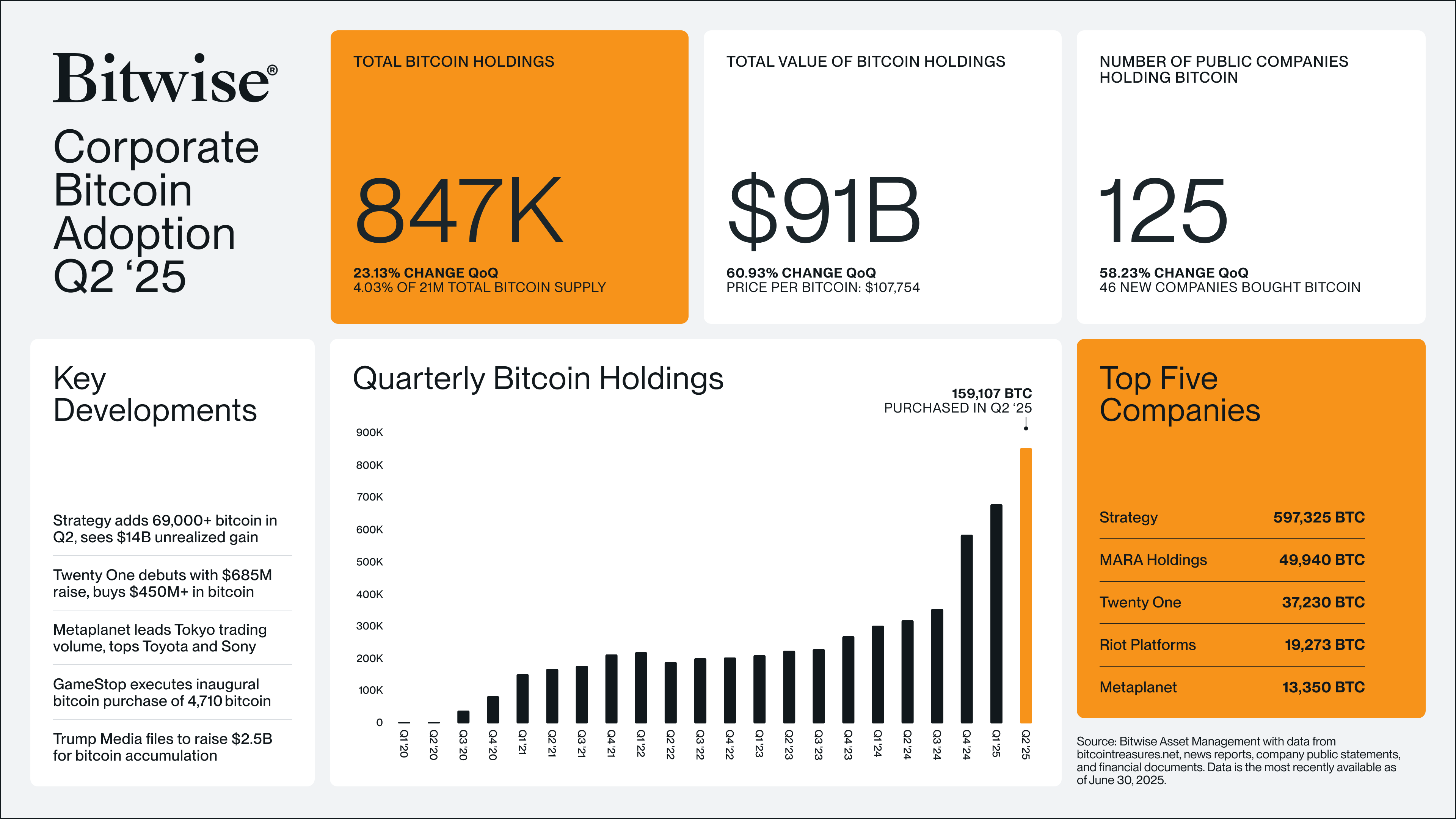

The big number: 159,107 BTC—enough to make even Michael Saylor raise an eyebrow.

Public companies doubled down on Bitcoin as a treasury asset last quarter, betting against fiat debasement (and maybe their own CFOs' sweaty palms). The move signals growing institutional conviction—or just desperation to outrun inflation with digital scarcity.

Why it matters: When balance sheets start mooning, traditional finance suddenly remembers how to pronounce 'blockchain.'

One cynical footnote: Wall Street still can't decide if this is 'adoption' or 'the greater fool theory' in pinstripes.

Bitcoin treasury companies in Q2. Source: Bitwise

Saylor’s strategy leads the charge

Leading the charge is Strategy, with a massive BTC stash of 597,325 coins. The firm, led by Bitcoin bull Michael Saylor, has championed the Bitcoin accumulation strategy by consistently issuing convertible notes and at-the-market (ATM) equity offerings to fund aggressive Bitcoin purchases.

Strategy’s Bitcoin accumulation has also fueled a strong performance in its stock price. The company’s stock is up 43% year-to-date, far outperforming the S&P 500’s modest 6.4% gain over the same period. It has increased by more than 6% over the past month and by around 9% over the past week, according to data from Google Finance.

Strategy shares are up 43% YTD. Source: Google Finance

Bitcoin miner MARA Holdings is the second-largest corporate holder of Bitcoin, with 49,940 BTC. The company’s shares have gained more than 10% YTD.

New entrants are also making waves in the Bitcoin treasury space. Twenty One launched with a $685 million capital raise and quickly deployed over $450 million into Bitcoin. In Japan, Metaplanet has emerged as a powerhouse, dominating Tokyo’s trading volume and even surpassing household names like Toyota and Sony, while amassing 13,350 BTC.

Meanwhile, GameStop grabbed headlines with its first-ever Bitcoin purchase, adding 4,710 BTC to its balance sheet and further cementing the trend of non-crypto-native companies entering the space. TRUMP Media also entered the fray, filing to raise $2.5 billion for further Bitcoin accumulation.

London BTC company raises $2 million for more purchases

On Wednesday, London BTC Company, previously Vinanz, secured 1.5 million pounds ($2 million) in new funding through the issuance of 11.5 million ordinary shares. The company, with active mining operations in the US and Canada, says the capital will support further BTC accumulation.

Despite its aggressive Bitcoin accumulation, the company’s stock, which trades on the London Stock Exchange, has struggled. It is down over 42% YTD and fell more than 7% in the past 24 hours.