DeFi Revival Sends Ethereum TVL Soaring—And Bitcoin Wants a Piece Too

Decentralized finance isn't dead—it's just been reloading. Ethereum's Total Value Locked (TVL) surges as yield-hungry investors flood back into smart contracts, while Bitcoin maximalists scramble to prove their chain can play the DeFi game too.

The Ethereum Juggernaut Rolls On

Gas fees are up, memecoins are pumping, and the DeFi bluechips are printing fresh liquidity. The OG smart contract platform is flexing its network effects again—developers keep building, even when Wall Street isn't watching.

Bitcoin's Awkward DeFi Dance

Wrapped BTC bridges? Sidechain hacks? The original crypto keeps trying on DeFi outfits that never quite fit. Meanwhile, Ethereum L2s eat its lunch with actual utility (and fewer 'not your keys' horror stories).

Wake up, TradFi—while you were worrying about compliance, the degens rebuilt the financial system with code. Now they're charging you rent.

Ethereum dominates the DeFi growth story

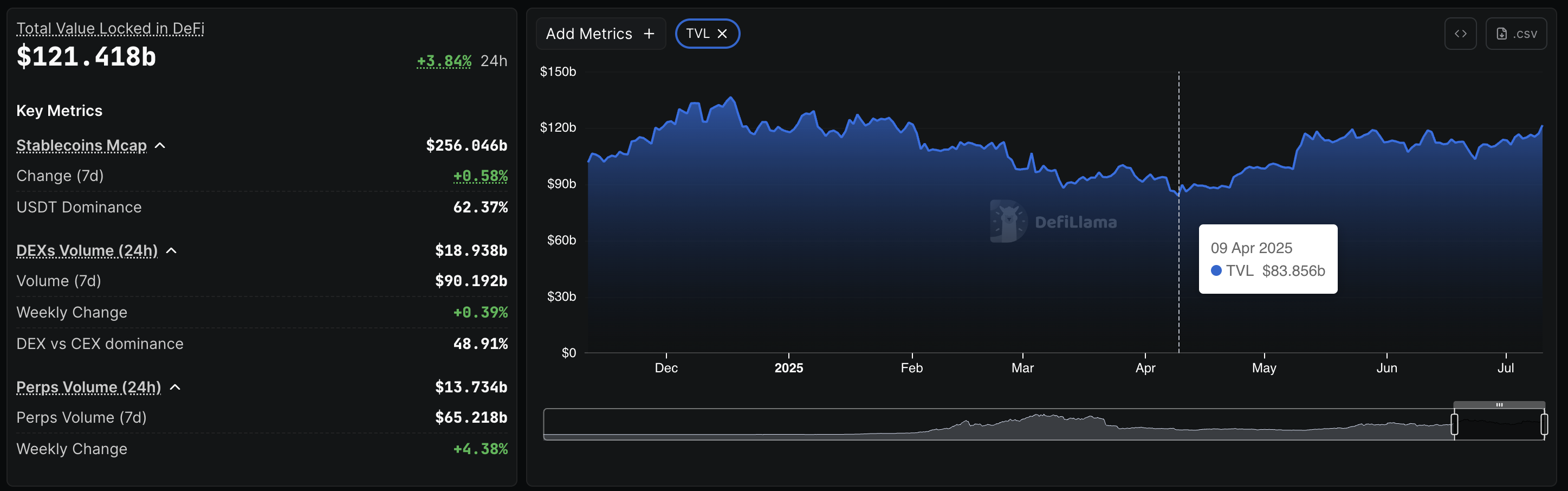

The DeFi market’s total value locked (TVL) represents the US Dollar value of digital assets locked across all protocols. DeFiLlama’s data indicates that the market’s TVL stands at $121.41 billion, having risen from the year-to-date low of $83.85 billion on April 9. Inflows of over $34 billion in the last three months highlight renewed interest in DeFi services.

DeFi TVL. Source: DeFiLlama

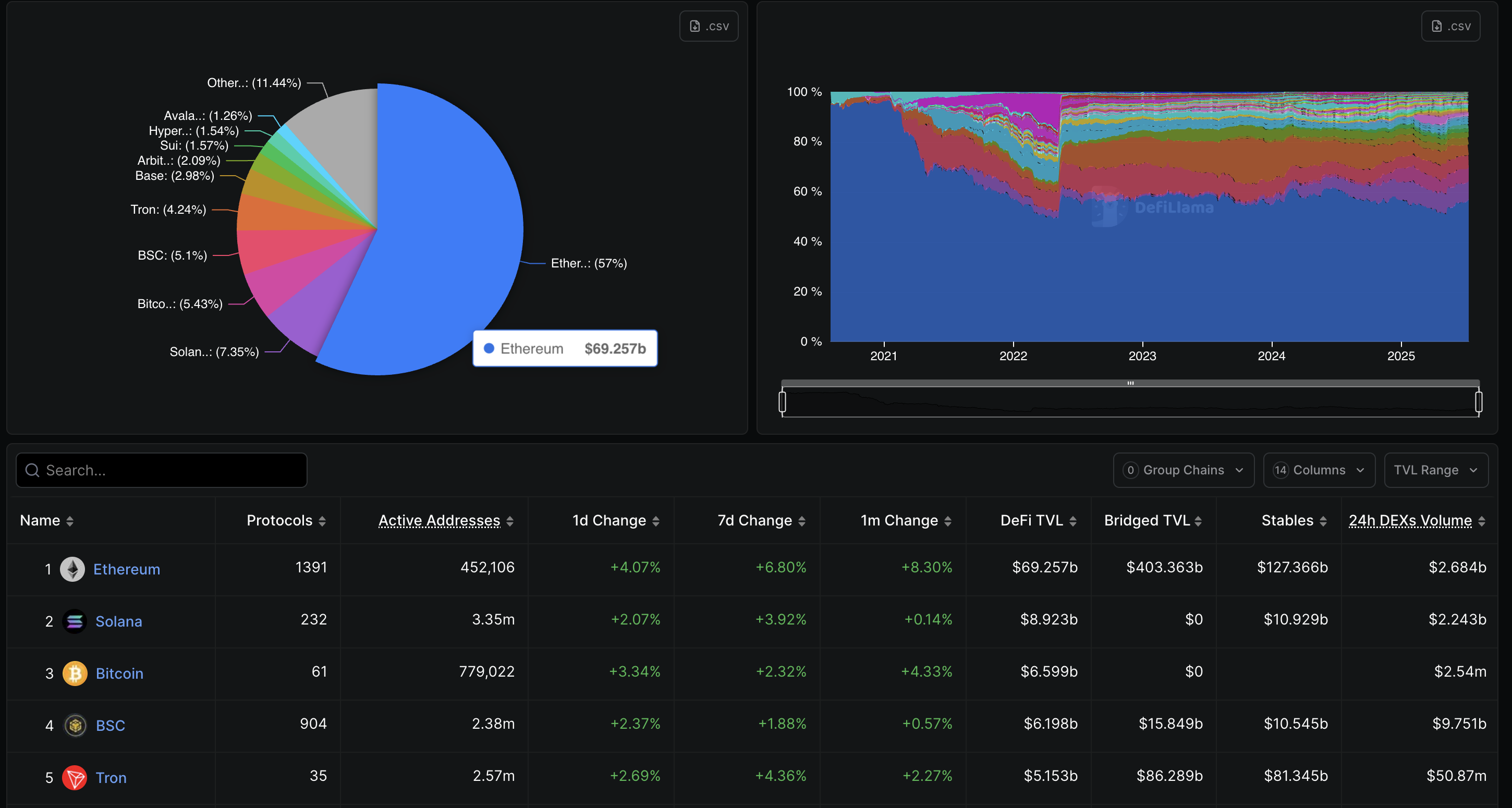

Ethereum holds $69.25 billion in TVL, up from $44.04 billion on April 9, accounting for a 57% share of the market TVL. This translates to $25 billion of inflow for ethereum out of the total $34 billion inflow seen across all protocols.

Ethereum TVL share. Source: DeFiLlama

Investors could find the push from Ethereum Exchange-Traded Funds (ETFs) issues for staking as the next catalyst. With institutions entering the fray, massive inflows could further boost TVL. According to SoSoValue, as of July 9, the total ETH held by the US spot Ethereum ETFs accounted for $11.84 billion.

Institutions could unlock the Bitcoin DeFi case

Bitcoin, worth over $2.21 trillion, holds a 64.63% market share based on valuations. Despite a short-term decline in dominance, Bitcoin is worth more than all the altcoins combined.

BTC dominance chart.

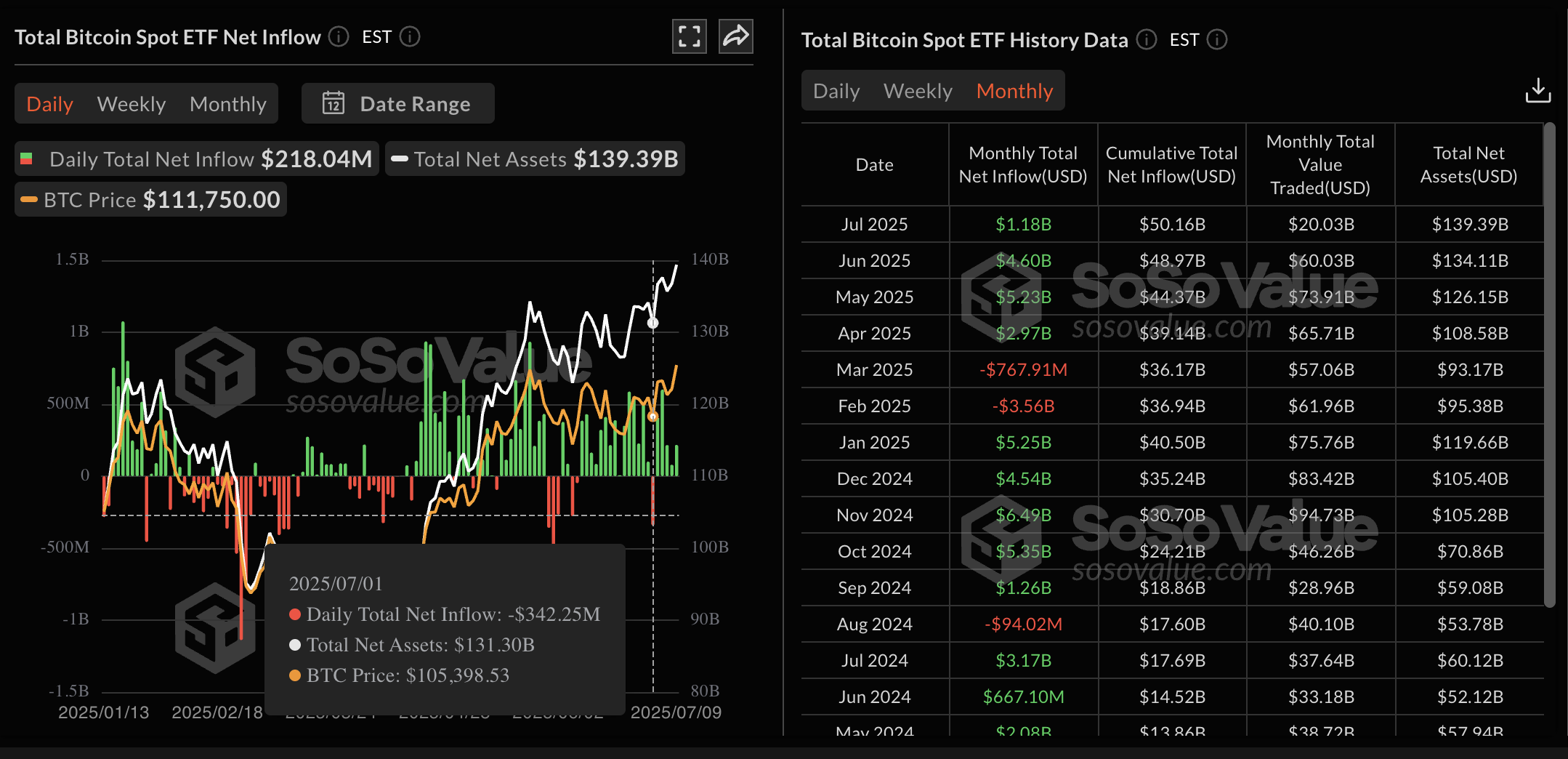

As a digital store of value, the increased institutional appetite for bitcoin has driven a net inflow of $14.90 billion in 2025 so far. As of July 9, the US spot Bitcoin ETFs held $139.39 billion worth of BTC. It is worth noting that since June 9, the US spot Bitcoin ETFs have recorded just a single day of outflow, amounting to $342.25 million on July 1.

Bitcoin ETF netflows. Source: SoSoValue

However, Bitcoin’s expanding use case merges into the DeFi space with staking and other features. DeFiLlama data shows that Bitcoin holds a TVL of $6.59 billion, the third largest in the segment.

A push similar to Ethereum staking by ETF issuers for Bitcoin could boost its DeFi market share. If the authorities greenlight staking and/or DeFi services for ETF issuers, a potential massive inflow could undermine Ethereum’s dominance.