🚀 Trump’s $3.3T ’Big Beautiful Bill’ Could Send Bitcoin Soaring Past $120K by July 2025

Bitcoin's next moonshot might come from an unlikely source—Washington. Former President Trump's proposed $3.3 trillion spending package could turbocharge crypto markets, with analysts predicting a potential breakout beyond $120,000 before month's end.

The fiscal fuel injection

When governments start printing money like confetti at a parade, Bitcoiners start polishing their Lambo dreams. The 'Big Beautiful Bill'—with its eye-watering price tag—could flood markets with liquidity that inevitably seeks hard assets.

Institutional FOMO meets retail mania

Wall Street's recent Bitcoin ETF embrace combined with retail traders' leverage addiction creates perfect conditions for parabolic moves. Just don't ask what happens when the music stops—this isn't financial advice, it's financial Darwinism.

As the Fed's balance sheet balloons and politicians rediscover Keynesian economics, Satoshi's creation stands ready as the ultimate protest trade against monetary madness. Whether it's hedge against inflation or pure speculation, one thing's clear: when fiat systems sneeze, Bitcoin catches a bid.

Bitcoin could rally toward $120,000 by July-end, says Bitget Research Chief Analyst Ryan Lee

To gain a holistic perspective on the impact of the One Big Beautiful Bill Act, FXStreet reached out for exclusive comments from Bitget, the third-largest cryptocurrency exchange, with a 24-hour trading volume of approximately $2.1 trillion, according to CoinGecko.

US fiscal spending has continued to boost corporate profits and personal income despite the ongoing debt ceiling debate. The labor market remains steady amid what appears to be tamed inflation.

Meanwhile, Bitget Research Chief Analyst Ryan Lee predicts a significant increase in Bitcoin's price, augmented by expectations of progressive monetary expansion.

"Given these conditions, Bitcoin is well-positioned to break its previous high in July, with upside potential toward $120,000 by month-end. Institutional demand and consistent spot Exchange Traded Fund (ETF) inflows continue to reinforce bullish momentum," Lee told FXStreet.

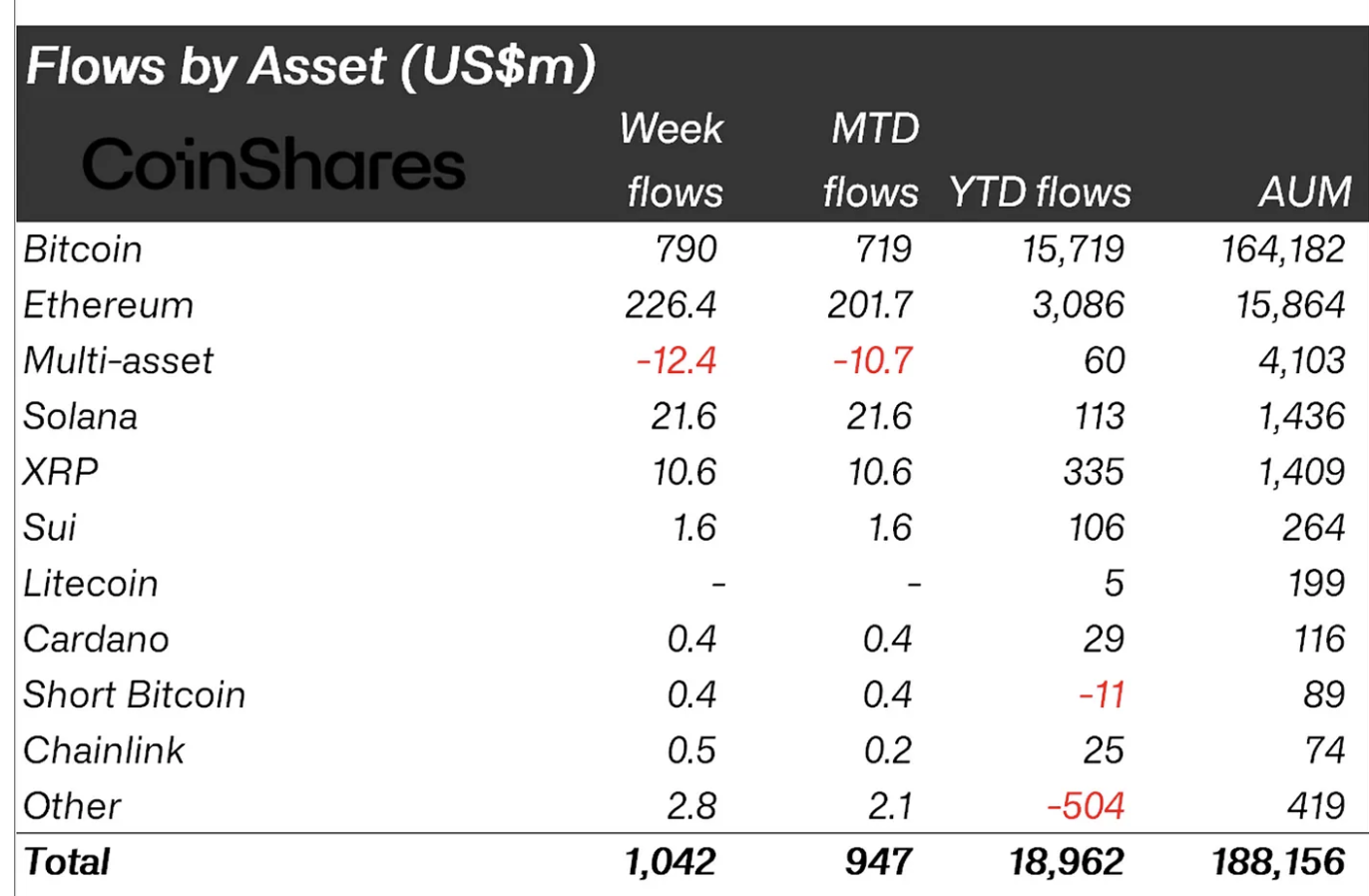

CoinShares reported on Monday that inflows into BTC-related digital investment products averaged $790 million last week. The cumulative inflows totaled approximately $1.03 billion, which accelerated the assets under management to $188 billion.

The majority of inflows originated from the US at $1 billion, with Canada and Brazil recording outflows.

"Bitcoin investment products saw inflows of US$790m last week, marking a slowdown from the previous three weeks, which averaged US$1.5bn. The moderation in inflows suggests that investors are becoming more cautious as bitcoin approaches its all-time high price levels," the CoinShare report states.

Digital investment products stats | Source: CoinShares

When asked about the impact of the One Big Beautiful Bill Act, projected by the Congressional Budget Office to add $3.3 trillion to the US deficit over the next decade, Bitget's COO, Vugar Usi Zade, told FXStreet the key element is the potential excess capital in circulation that is likely to emanate from unmonitored money printing.

"The United States is already in significant debt, currently pegged at $36.21 trillion, a figure that has prompted investors to diversify their capital into other assets, such as Bitcoin and Ethereum," Zade stated. "The 'One Big Beautiful Bill' will potentially increase this debt ceiling, a MOVE justified by proponents as a means to help the government function better. However, for the financial market, it will result in US Dollar (USD) devaluation, presenting a major adoption case for Bitcoin, Ethereum, and other risk assets," the COO added.

Regarding the impact of the implementation of higher tariffs and the extension of the deadline to August 1, Zade noted that the associated liquidity is not new to the crypto market. He argues that Bitcoin has been dealing with tariff uncertainty since the start of President Donald Trump's second term and that the cryptocurrency market is gradually pricing in the perceived volatility, "with each deadline resulting in short-term price suppression."

"There is no doubt the market will face fluctuations ahead of the new August deadline, but the overall impact may not last so long. It is also worth noting that the current trade scene is no longer one that comes with much negative pressure," Zade explained.

On the other hand, President Trump has requested that Congress fast-track the passage of the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) bill, preferably before the recess expected in early August. The legislation, if signed into law, WOULD boost clarity in the stablecoin arena, paving the way for institutional adoption in the broader digital currency environment.

"While its (GENIUS Act) influence will pale in comparison to the EU's MiCA, which has a broader scope, issuers will nonetheless have a clear framework for engagement," Zade commented.

Stablecoins enable investors to easily inject liquidity into the crypto market by stacking Bitcoin and other altcoins, such as Ethereum. Zade said that these stable digital coins serve as a conduit for liquidity into crypto assets, as they are essentially equivalent to holding the US Dollar (USD).

"Should the legislation pass as intended, it may attract more institutional investors, as they are generally drawn to sectors with some FORM of regulatory clarity," Zade added.

Technical outlook: Bitcoin eyes near-term breakout

Bitcoin's price is extending intraday gains, printing a green candle and trading at $108,712 at the time of writing. The price remains above a recently broken descending trendline, which has been in place since Bitcoin reached its all-time high of $111,954 on May 22.

BTC/USDT daily chart

There's potential for a breakout above resistance tested at around $110,527 on Monday, backed by a robust technical structure. The upward-trending moving averages, including the 50-day Exponential Moving Average (EMA) at $105,274 and the 100-day EMA at $101,507, underscore the strong technical picture. In the event of a trend reversal, these levels could serve as tentative support, limiting price movement below the $100,000 level.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.