🚀 Bitcoin & Altcoins Surge: July 8 Price Predictions – Will Pi Network Join the Rally?

Crypto markets defy gravity as Bitcoin flirts with new highs—while Wall Street still scrambles to explain the 'magic internet money' phenomenon.

Bitcoin's bullish momentum: The OG crypto shakes off regulatory FUD, charging toward resistance levels unseen since 2021. Institutional inflows suggest this isn't just retail euphoria.

Altcoin season heating up: Ethereum leads the charge as DeFi tokens wake from hibernation. Even meme coins show surprising resilience—much to traditional financiers' dismay.

The Pi Network wildcard: Mainnet launch rumors swirl around the mobile-mining project. Skeptics yawn; believers stack—typical crypto polarization at work.

As always in crypto land: euphoria and despair trade places hourly. Today's winners could be tomorrow's bagholders—unless you're one of those 'long-term investors' (read: stubborn hodlers).

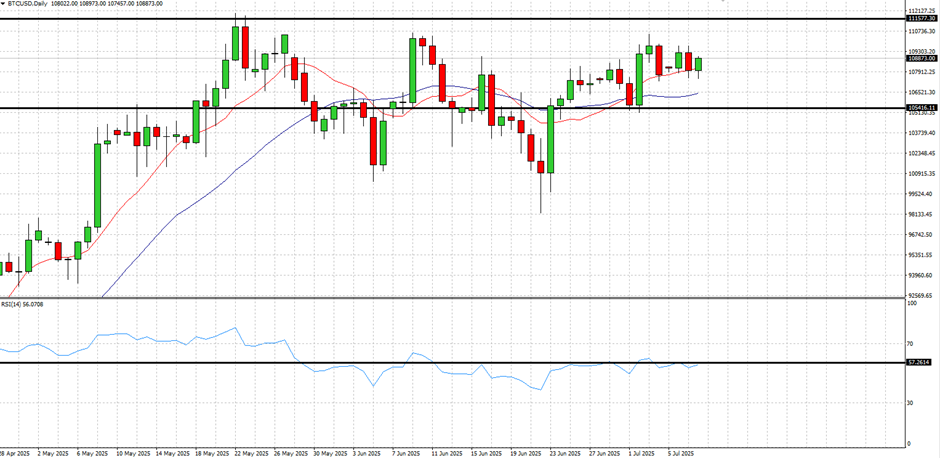

When will the Bitcoin price surge above $111,000?

Since reaching an all-time high of $111,970.17 in May, BTCUSD has failed to recapture this level. Could this be set to change in July?

Bitcoin’s price has consolidated in recent months, mainly due to uncertainty surrounding the TRUMP tariffs, Fed policy, and geopolitics.

These factors have spooked investors, who’ve instead leaned on SAFE havens like Gold, which has risen by over $300 from May to date.

Pi Network Price Forecast: Confident whale adds 7.92 million PI in a week as bearish trend holds

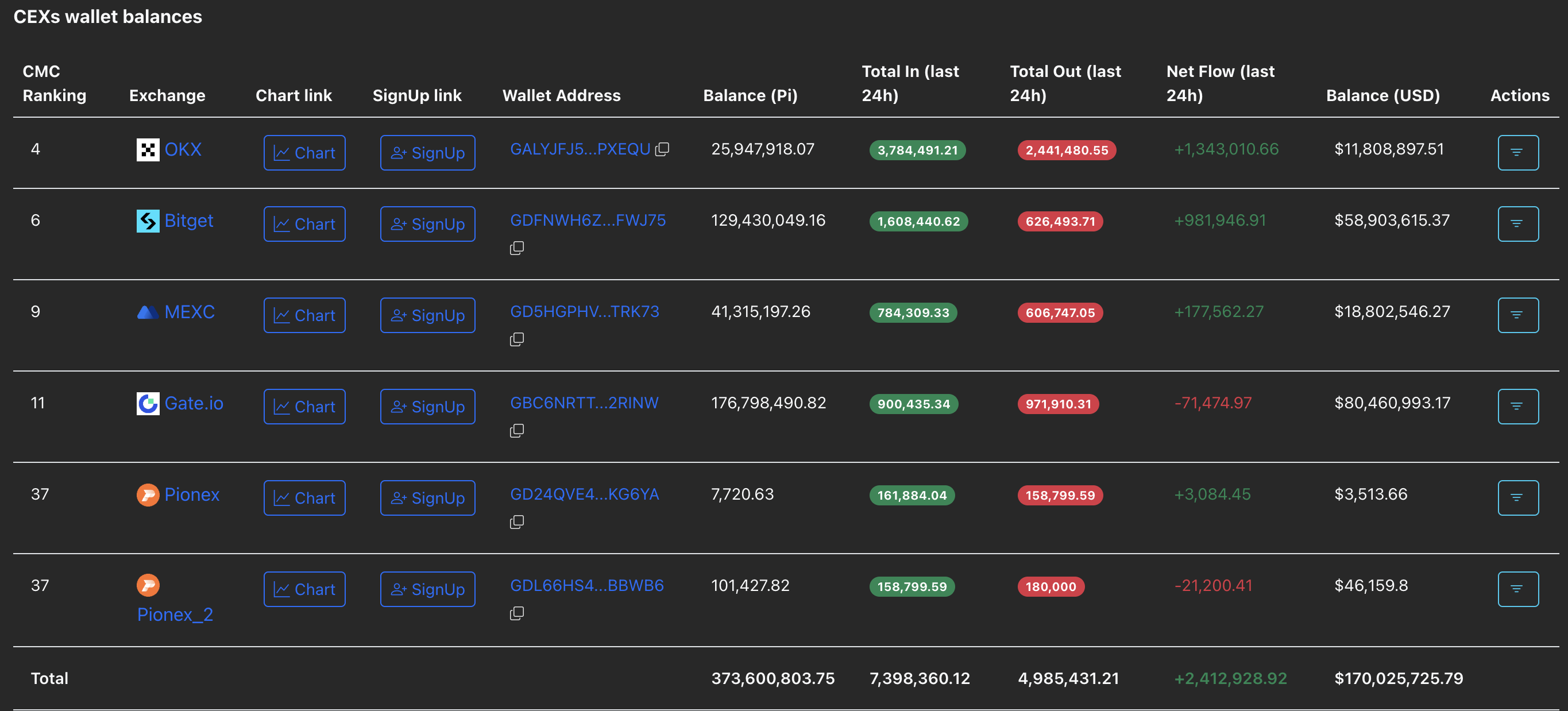

Pi Network (PI) edges lower by nearly 1% and trades at $0.45 at press time on Tuesday as the available wallet balance of centralized exchanges (CEX) grows, suggesting increased supply pressure. However, the large transactions over the last 24 hours reveal two whale transactions acquiring over 2 million Pi tokens. Still, the technical outlook suggests a bearish bias, indicating a potential retest of the $0.40 mark.

The crypto market continues to rise, stumbling along the way

The crypto market capitalisation retains its weekly growth of approximately 1.8%, losing about 0.6% over the last 24 hours to $3.35 trillion. This is another round of buyer indecision at high levels, even though declines were actively bought up. At the same time, capitalisation continues to move away from its 200-day moving average, indicating continued bullish sentiment.