Polymesh Defies Market Slump: The Altcoin to Watch as Bitcoin Stumbles Below $109K

While Bitcoin trips over its own volatility—dipping below $109,000 this week—Polymesh (POLY) is flexing its resilience. The institutional-grade blockchain for security tokens isn’t just surviving the chaos; it’s thriving. Here’s why.

The Institutional Edge

Polymesh’s niche? Regulatory compliance baked into its DNA. While other chains scramble to retrofit KYC checks, Polymesh cuts through red tape like a hot knife through bureaucratic butter. TradFi players are noticing.

Volume Tells the Story

Despite BTC’s slide, POLY’s trading volume spiked 22% in 48 hours. Someone’s accumulating—and it’s not retail tourists chasing memecoins.

The Cynic’s Corner

Let’s be real: Wall Street’s ‘blockchain revolution’ still runs on Excel spreadsheets. But if they ever get serious, Polymesh is the only chain dressed for the meeting.

POLYX’s derivatives data shows a bullish bias

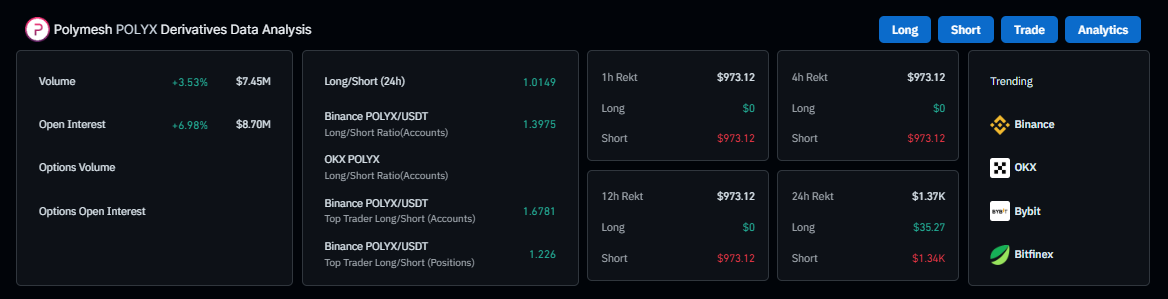

Coinglass derivatives data show that POLYX Open Interest (OI) surged by nearly 7% in the last 24 hours, reaching $8.70 million. An increased buying activity fuels the OI spike, suggesting heightened Optimism surrounding Polymesh. Additionally, its long-to-short ratio also stands at 1.01, indicating that traders are betting on the asset price to rise.

Polymesh derivatives data chart. Source: Coinglass

Coinglass’s OI-weighted Funding Rate data shows that the metric has flipped to a positive rate, reading 0.0097% on Tuesday, indicating that longs are paying shorts. Historically, as shown in the chart below, when the funding rates have flipped from negative to positive, POLYX’s price has generally rallied sharply.

Polymesh funding rate chart. Source: Coinglass

Polymesh’s technical outlook suggests a double-digit gain

Polymesh price broke above a descending trendline (drawn by connecting multiple highs since mid-May) on Sunday and rallied by nearly 5% until the next day. At the time of writing on Tuesday, it continues to trade higher by 2.2% at around $0.132.

If POLYX continues its upward momentum, it could extend the rally by nearly 10% from its current levels to retest the 100-day Exponential Moving Average (EMA) at $0.146.

The Relative Strength Index (RSI) on the daily chart reads 53 and points upwards, indicating that bullish momentum is gaining traction. Additionally, the Moving Average Convergence Divergence (MACD) indicator showed a bullish crossover on June 28. It also shows rising green histogram bars above its neutral zero line, suggesting bullish momentum is gaining traction and continuing an upward trend.

POLYX/USDT daily chart

However, if Polymesh faces a correction, it could extend the decline to retest its Sunday low at $0.122.