Injective Soars as Testnet Launch Fuels Frenzy for Tokenized Stocks—Wall Street Sweats

Injective's blockchain just flipped the switch on its Testnet—and traders are piling in like it's a Black Friday sale on fractionalized equities. The protocol's native token rides the hype wave as traditional finance scrambles to keep up.

Tokenized stocks: The new casino chips

Forget paper certificates—decentralized derivatives are eating Wall Street's lunch. Injective's latest move taps into the institutional FOMO driving demand for synthetic assets. No custody headaches, no 9-to-5 trading windows—just 24/7 exposure to Tesla and Apple with crypto's signature volatility.

The Testnet effect

Every protocol loves a good test phase—it's like a chef letting VIPs sample the menu before the restaurant opens. Early adopters get to break things (intentionally or not) while developers fine-tune the infrastructure for mainnet launch. Pro tip: Watch the bug bounty payouts for clues about real-world readiness.

Meanwhile in traditional finance...

Bankers are still arguing about whether blockchain is a fad while their clients quietly allocate to synthetics. The irony? Tokenized stocks might finally bring real adoption—not because of decentralization ideals, but because they bypass settlement delays and margin requirements. Sometimes greed beats ideology.

Closing thought: When the SEC eventually cracks down, remember today's Testnet launch as the moment Wall Street's disruption went from theoretical to inevitable—right before the usual cycle of denial, lawsuits, and reluctant acceptance.

Injective’s network upgrade could boost DeFi activity

Injective announced on Wednesday the launch of its Testnet, a significant milestone in the development of its decentralized finance (DeFi) space. With the testnet live, Injective claims to be the only Layer-1 chain to have unified VIRTUAL machine (VM) layers.

Typically, developers use multiple VMs to build decentralized applications (dApps) that raise complexities in the use of native tokens for dApps built on different VMs. The unified VM LAYER provides a framework for a MultiVM Token Standard (MTS) to unify liquidity across multiple dApps.

With the network upgrade increasing interoperability, developer and user activity could surge across Injective dApps.

Injective's Testnet launch aligns with the launch of tokenized stocks by Robinhood, Kraken, and Gemini. Notably, Injective holds nearly $1 billion in volume from tokenized stocks.

Traders anticipate an extended rally in Injective

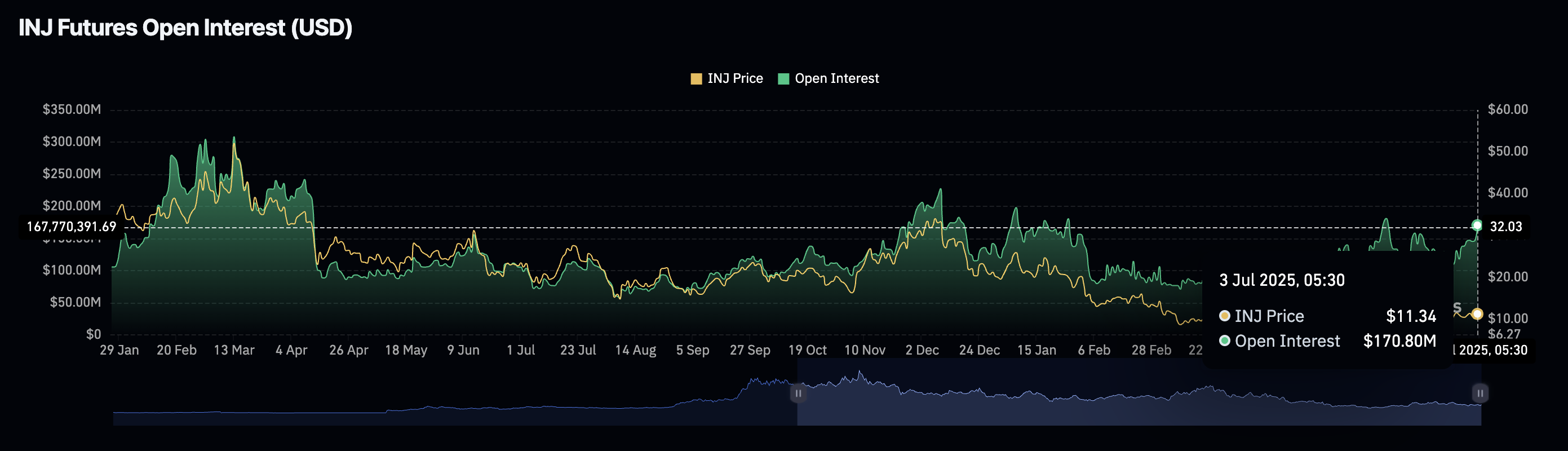

CoinGlass’ data shows that the Injective Open Interest (OI) reached a 30-day high of $170.80 million on Thursday, up from $146.90 million on Wednesday. A surge in OI relates to additional or new purchases in the derivatives market, increasing the chances of a leverage-driven rally.

INJ Open Interest. Source: Coinglass

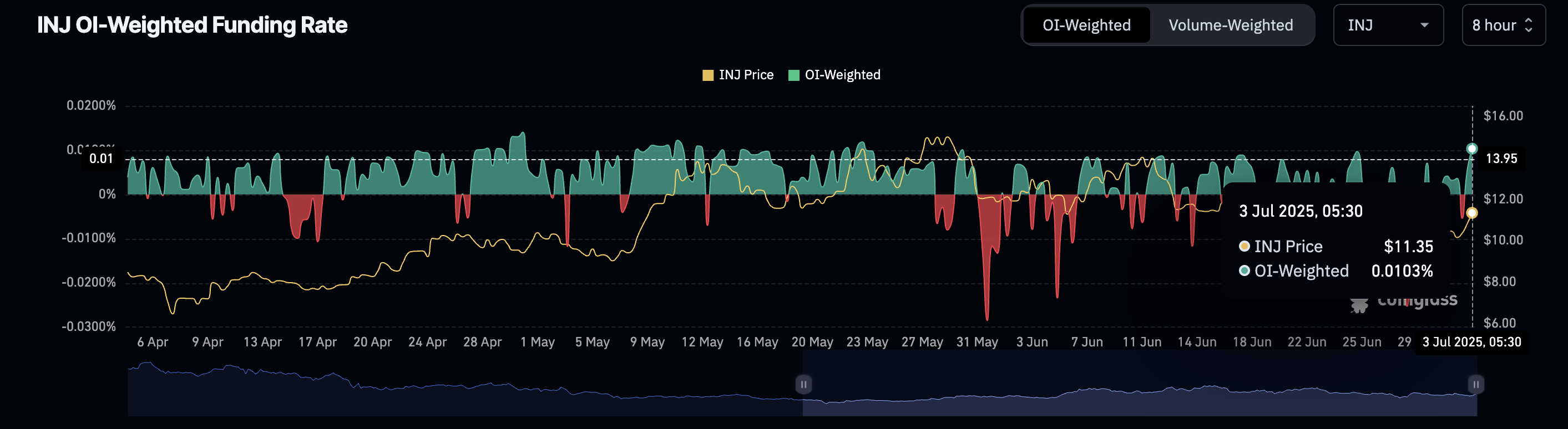

Adding credence to increased buying, the OI-weighted funding rate flips positive to 0.0103% from -0.0054% on Wednesday. Bulls pay the funding rates (positive) to offset the imbalance in spot and swap prices, which are rising due to increased buying pressure, and vice versa.

INJ OI-weighted funding rate. Source: Coinglass

Injective’s recovery targets the 200-day EMA

Injective trades NEAR the 100-day Exponential Moving Average (EMA) at $11.91, teasing a potential breakout. At the time of writing, INJ trades higher by nearly 6% on the day, extending gains after the 11.50% rise on Wednesday.

A potential daily close above the 100-day EMA could extend the uptrend towards the 200-day EMA at $13.88. Beyond the dynamic resistances, INJ could target the 50% Fibonacci retracement level at $14.95, drawn from the December 6 high of $35.26 to the April 7 low of $6.34.

The technical indicators on the daily chart suggest a shift in trend momentum. The Relative Strength Index (RSI) at 54 crosses above the midpoint level of 50, reaching a neutral range while pointing upwards.

The Moving Average Convergence/Divergence (MACD) indicator displays the MACD line bouncing off its signal line, concurrent with a green histogram bar rising from the zero line. Typically, a spike in histogram bars indicates increased momentum, while the rising trend in average lines suggests a potential shift supporting the uptrend.

INJ/USDT daily price chart.

On the downside, if Injective fails to hold the gains and momentum, it could retest the 23.6% support floor at $9.51.