🚀 Avalanche, Celestia & Bitcoin Price Forecasts: Where Will the Crypto Rally Go Next? | Europe Update July 2

Crypto markets flex bullish momentum as top assets defy traditional finance logic—again. Here's where smart money's betting.

Avalanche (AVAX): The Scalability Play Heating Up

Layer-1 contender Avalanche shows institutional accumulation patterns while TradFi analysts still debate 'blockchain use cases.'

Celestia (TIA): Modular Hype Meets Market Reality

The data availability network's token tests resistance levels as crypto degens ignore its actual tech—price action trumps utility, per usual.

Bitcoin (BTC): The Macro Hedge That Won't Quit

Despite three Fed hikes this year, BTC holds $60K like a Wall Street banker clings to outdated inflation models.

Bonus jab: Meanwhile, gold bugs sob into their physical ETFs as digital scarcity outpaces 5,000 years of shiny rock economics.

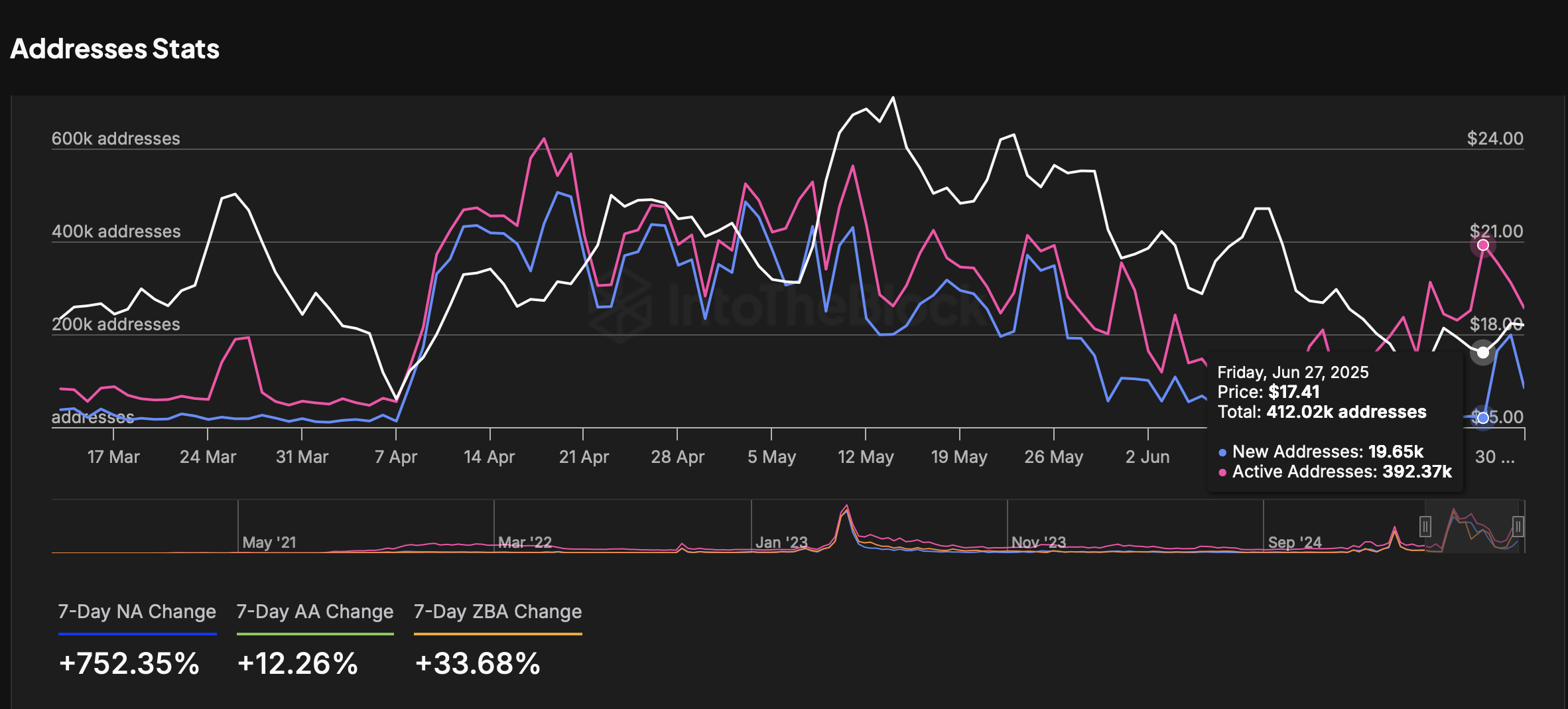

Avalanche, Toncoin Price Prediction: AVAX, TON active addresses double, signaling bullish breakout

The cryptocurrency market generally edges higher on Wednesday, with select altcoins such as Avalanche (AVAX) and Toncoin (TON) staging minor recoveries. AVAX has increased over 3% on the day and is currently trading at $17.59. The bullish outlook extends to TON, which is currently trading at $2.82, representing an increase of over 1%.

Celestia Price Forecast: Bullish RSI divergence in TIA fuels channel breakout chances

Celestia (TIA) edges higher by over 5% at press time on Wednesday, hinting at a morning star pattern to initiate a trend reversal. The technical outlook suggests a bullish bias, marked by an RSI divergence, while the rising anticipation of a falling channel breakout boosts TIA Open Interest in the derivatives market.

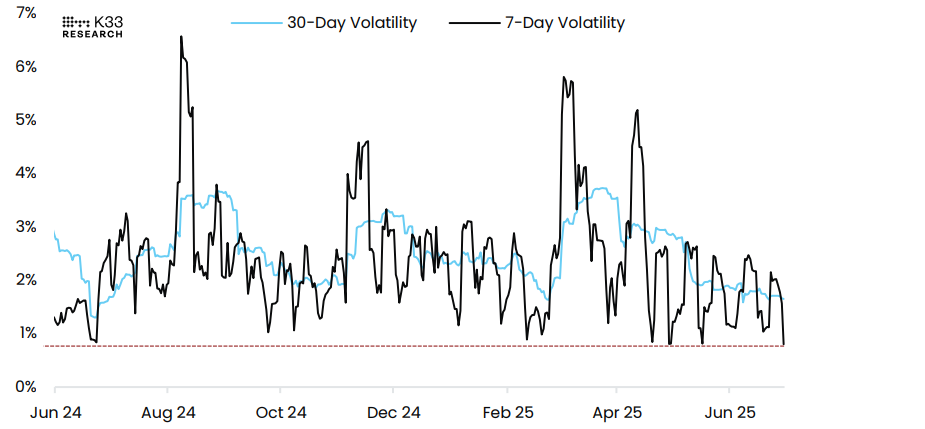

Bitcoin Price Forecast: BTC consolidates as Trump’s budget bill and tariff chatter resume

Bitcoin (BTC) is trading within a tight range after last week’s strong rally as traders turn cautious ahead of key macroeconomic developments. Reports indicate that the upcoming US President Donald Trump’s One Big Beautiful Bill deadline is on Friday, and the tariff pause expiration in early July could introduce fresh uncertainty into the market. This cautious sentiment could be seen in the spot bitcoin exchange Traded Fund (ETF) data, which recorded over $340 million in outflows on Tuesday, ending its 15-day streak of steady inflows since June 9.