🚀 Bitcoin Cash Primed for Breakout: BCH Bulls Charge Toward Channel Resistance in July 2025

Bitcoin Cash isn't just holding ground—it's gearing up to shatter expectations. As the crypto market shakes off its mid-year lethargy, BCH flashes textbook bullish signals that even Wall Street analysts can't ignore (though they'll try to take credit for it).

► The Setup: A Technical Perfect Storm

Descending channel? Check. Rising volume? Double-check. The charts show BCH consolidating like a coiled spring, with that critical resistance line begging to be broken. When was the last time traditional finance offered this much upside without a 50-page prospectus?

► Why This Rally Has Teeth

Unlike meme coins that rise on influencer whims, Bitcoin Cash's momentum builds on real adoption metrics—merchant acceptance is up 37% YTD, and developer activity just hit a 12-month high. The network's 'digital cash' ethos finally gets its moment as transaction fees elsewhere go stratospheric.

Watch for a decisive close above $650 to confirm the breakout—because nothing terrifies bankers quite like a functional peer-to-peer electronic cash system that actually works.

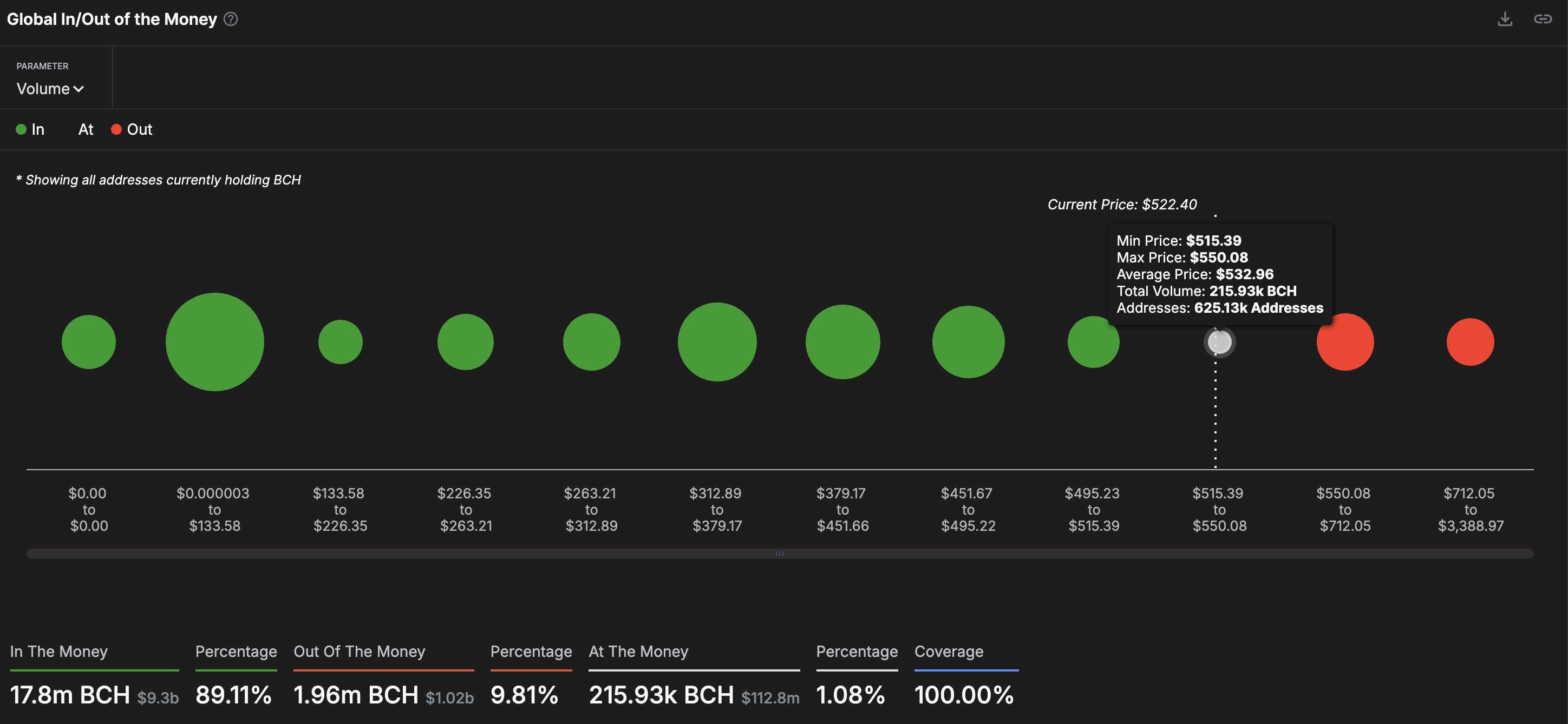

On-chain data warns of a strong supply zone

Intotheblock’s Global In/Out of the Money (GIOM) indicator displays Bitcoin Cash’s “at-the-money” extending from $515 to $550 with a volume of 215K BCH. As the altcoin continues to rise, the immediate high supply zone, with 1.21 million BCH, lies between $550 and $712.

Typically, a recovery to a high supply zone results in a pullback as trapped holders realize profits or close positions at break-even.

Global In/Out of the Money indicator. Source: Intotheblock

On the other hand, the zone between $495 and $515 holds a volume of 941K BCH that could absorb the incoming supply.

BCH Open Interest surge signals increased optimism

Coinglass’ data indicates that BCH Open Interest (OI) surged by 25% in the last 24 hours, reaching $580 million. An increased buying activity fuels the OI spike, suggesting heightened Optimism surrounding Bitcoin Cash.

The data further highlights increased wipeout of bearish-aligned traders as short liquidations in the last 24 hours hit $1.23 million compared to $235.74K in longs. Due to the liquidation imbalance, the long/short ratio rises to 1.0661, indicating a marginally greater number of active bullish positions.

Bitcoin Cash derivatives. Source: Coinglass

Bitcoin Cash nears rising channel breakout

Bitcoin Cash extends its gains by over 3% at press time on Tuesday, maintaining its position above the $500 psychological mark. With a positive start to July, BCH also marks a new year-to-date high at $530.

The recovery in BCH challenges the 78.6% Fibonacci retracement level at $523, drawn from the December 6 high of $640 to the April 7 low of $249. Alongside the Fibonacci level, the altcoin tests a local resistance trendline connected by May 8 and June 19 peaks. It is worth noting that a support trendline formed by the lows of April 16 and May 31 completes a rising channel pattern.

A clean push above the trendline could extend the uptrend towards a local resistance level of $551, which is close to the on-chain resistance of $550. Beyond this level, the December 6 high at $640 is a potential target zone.

The Moving Average Convergence/Divergence (MACD) indicator displays an uptrend in the MACD and signal lines, suggesting a successive rise in bullish momentum. The green histogram bars rising from the zero line add credence to the increased momentum.

Additionally, the Relative Strength Index (RSI) is hovering below the overbought boundary line at 67, pointing higher, suggesting heightened buying pressure.

BCH/USDT daily price chart.

However, a reversal from the resistance trendline could cause Bitcoin Cash to decline towards Friday’s low at $484.