🚀 Bitcoin Soars: BTC Closes Q2 Up 30%, ETF Frenzy Fuels Run at New ATH

Wall Street's latest gold rush—spot Bitcoin ETFs—just lit a rocket under BTC. The OG crypto posted a 30% gain last quarter, flirting with record highs as institutional money floods in. Guess hedge funds finally realized 'digital gold' beats digging actual holes in the ground.

• ETF Effect Goes Supernova: Inflows smash records while traditional finance bros play catch-up

• Technicals Scream Bullish: Key resistance levels shattered like 2017 ICO promises

• Macro Tailwinds: Fed dovishness meets institutional FOMO—perfect storm for price discovery

Analysts warn volatility ahead, but let's be real—since when does Bitcoin care about 'reasonable valuations'? The market's pricing in a supply shock that'll make 2021's bull run look like a test net.

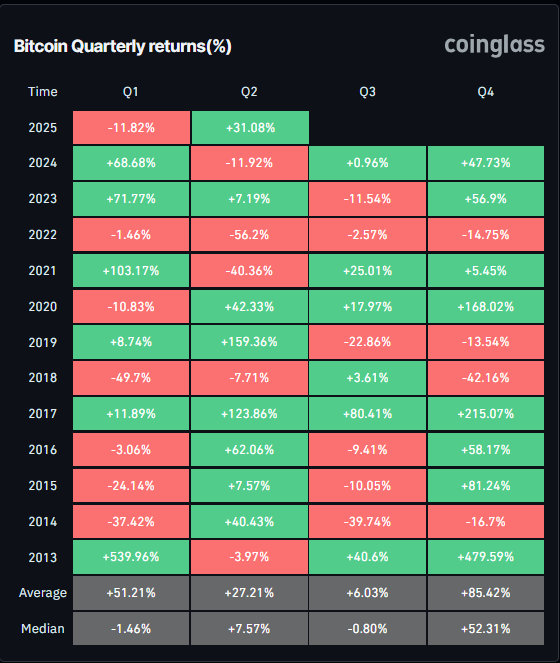

Bitcoin’s Q2 return of more than 30%

BTC’s Q2 returns were positive, at 31.08%, marking the best second quarter since 2020 and surpassing the average returns.

BTC Quarterly returns (%) chart. Source: Coinglass

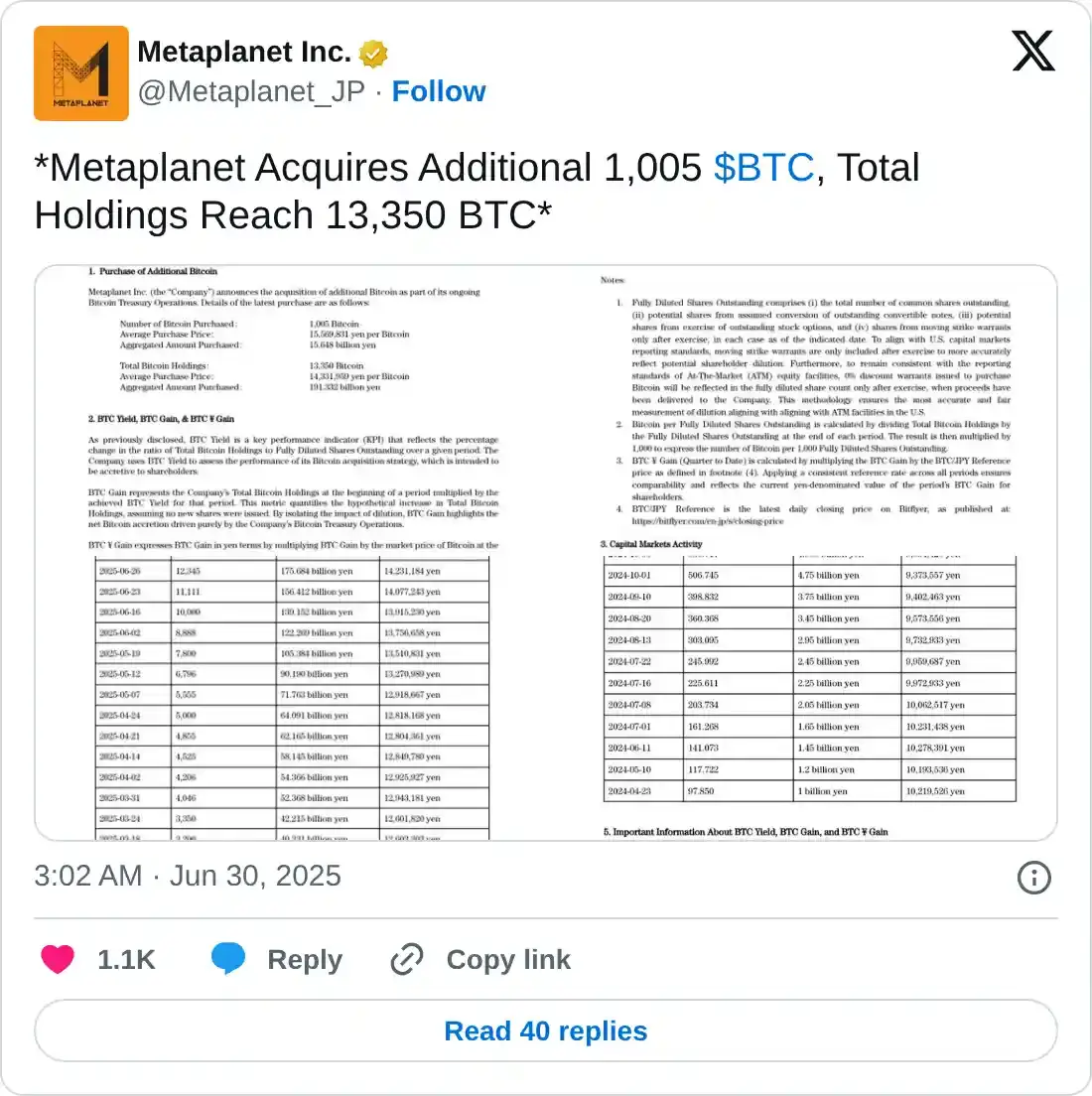

Corporate and institutional demand continues to strengthen

Bitcoin demand starts the week on a positive note. Japanese investment firm Metaplanet announced on Monday that it has purchased an additional 1,005 BTC, bringing the total holding to 13,350 BTC. On the same day, the firm also announced that it is issuing $208 million in 0% interest-rate ordinary bonds to enhance its Bitcoin acquisition strategy further.

Apart from the corporate demand, institutional demand also remained robust. According to SoSoValue data, the spot BTC ETFs recorded a weekly inflow of $2.22 billion last week, the highest level since late May. If the inflow continues and intensifies, BTC could reach or even surpass its all-time highs.

Total bitcoin spot ETF net inflow weekly chart. Source: SoSoValue

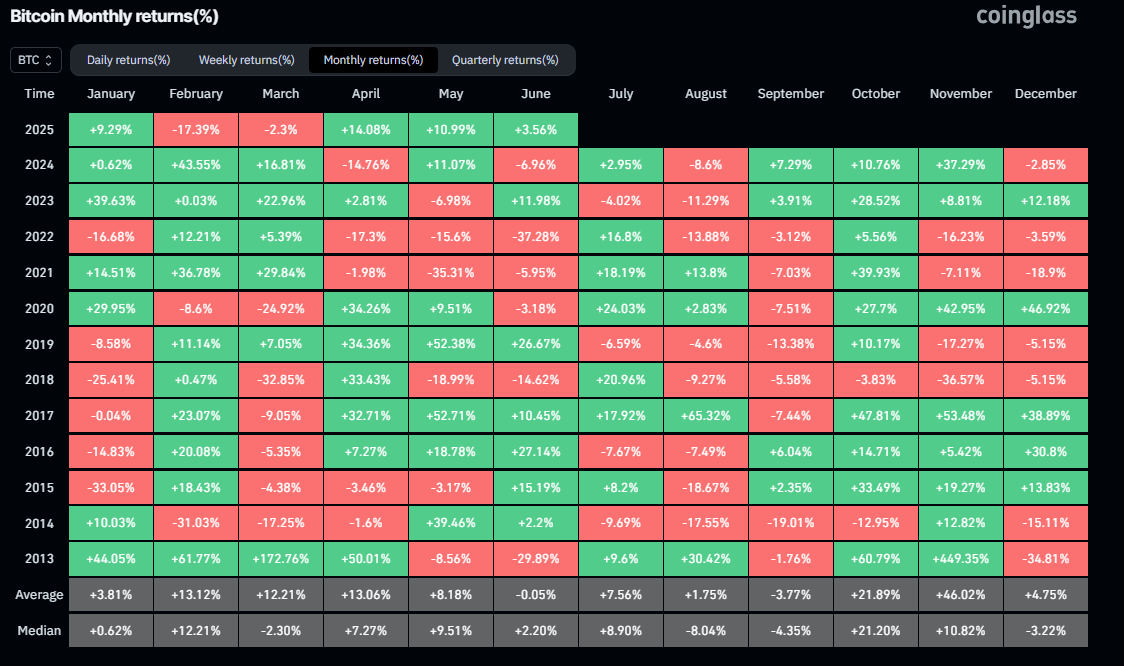

What is there for Bitcoin in July?

Bitcoin reached a new all-time high of $111,980 in May and stabilized above $107,000 in June, marking a 3.56% return for the month. According to Bitcoin’s historical data, BTC generally yielded a positive return for traders in July, with an average gain of 7.56%. If the ETFs’ demand continues to strengthen and tariffs and geopolitical uncertainty ease, traders could see positive returns in July.

Bitcoin historical monthly returns chart. Source: Coinglass

Bitcoin Price Forecast: BTC is a few inches from its record highs

Bitcoin price ROSE sharply by 7.32% last week, closing above $108,000. At the time of writing on Monday, it hovers at around $107,600.

If BTC continues its ongoing rally, it could extend toward the May 22 all-time high at $111,980. A successful close above this level could extend additional gains to set a new all-time high at $120,000.

The Relative Strength Index (RSI) on the daily chart reads 56, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) on the daily chart also displayed a bullish crossover on Thursday, providing a buy signal and indicating an upward trend.

BTC/USDT daily chart

However, if BTC faces a correction, it could extend the decline to find support around the 50-day Exponential Moving Average (EMA) at $104,126.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a VIRTUAL currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.