STX Soars as SIP-031 Vote Looms: Stacks Price Rally Defies Market Gravity

Stacks (STX) bulls charge ahead as governance decision sparks rally—proof that crypto voters actually read proposals before aping in.

Subheader: The SIP-031 Effect

Network upgrades usually trigger sell-offs. Not this time. STX ripped through resistance levels as traders bet the improvement proposal will streamline Bitcoin-linked smart contracts. Because nothing excites bagholders like 'technical efficiencies.'

Subheader: Price Action Plays Out

No pullbacks. No consolidation. Just a straight vertical climb that'd give traditional finance analysts heart palpitations. The chart looks like a crypto Twitter hype thread—all green candles and diamond-hand emojis.

Subheader: Wall Street Watches (And Fumes)

While bank analysts scribble 'irrational exuberance' in their notebooks, STX holders count gains. Another reminder that in crypto-land, fundamentals are optional—but governance token votes? Priceless.

Stacks’ SIP-031 voting begins

In a recent blog, Stacks announced the commencement of SIP-031 voting on June 25, estimated to occur at Bitcoin block 902,677. The voting will end on July 9, after a two-week period. The proposal will be approved if 80 million stacked STX or 80% of the stacked STX is in favour.

If approved, it will create an ecosystem endowment similar to Sui, Avalanche, or NEAR Protocol, increasing Stacks’ total annual emissions to 5.75% from 3.52% over the next five years. The treasury is designed to help facilitate the capital required for ecosystem needs such as rewards, liquidity, and marketing programs.

Optimism surrounding Stacks increases amid proposal voting

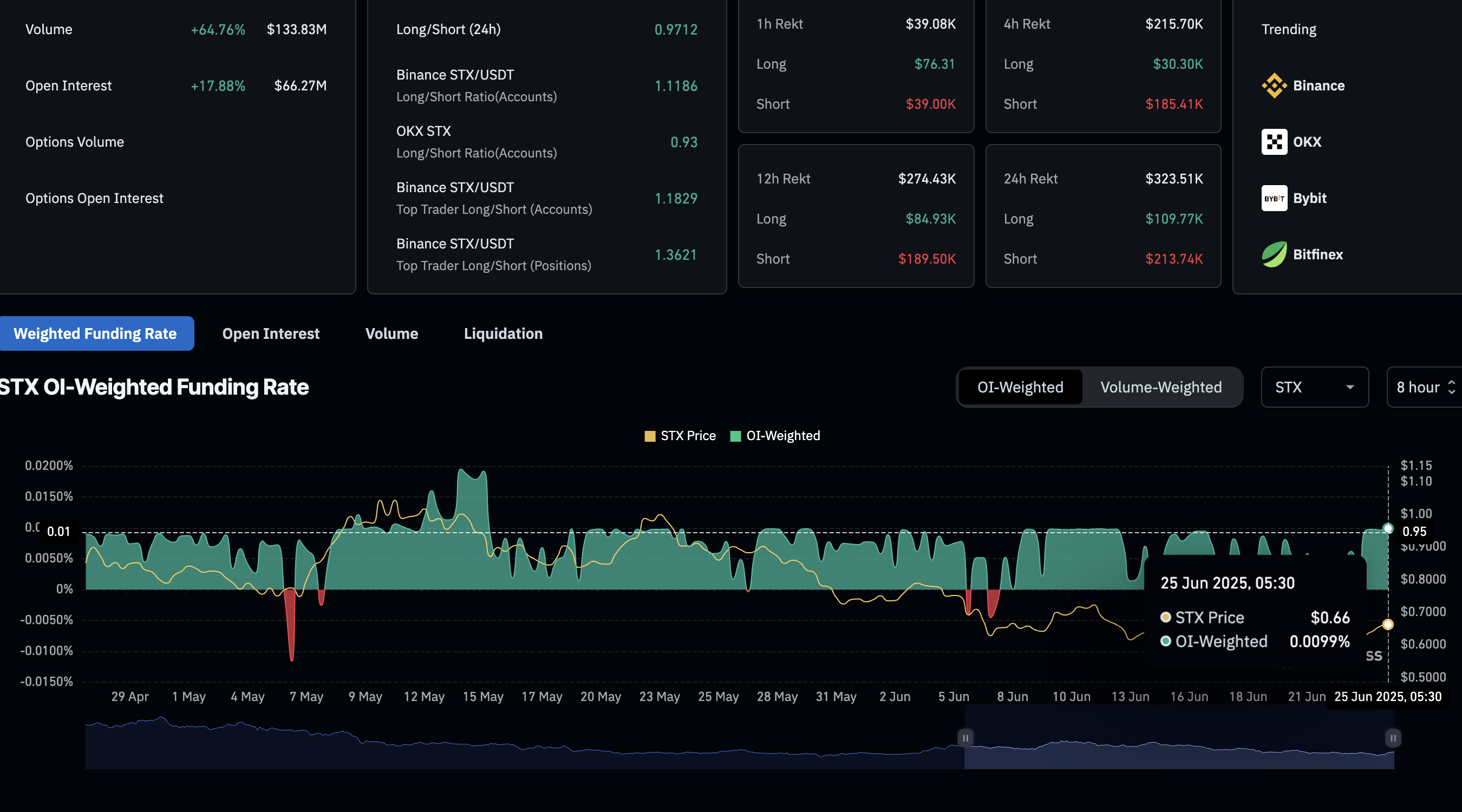

Coinglass data indicates a surge in investor confidence, with Open Interest (OI) increasing 17% to reach $66.27 million. Typically, a boost in buying activity leads to increased capital inflow and a surge in OI.

While OI edges higher, the OI-weighted funding rate hits 0.0099% a level that remains constant, indicating a dominant and stable buying activity throughout May. Funding rates, when positive, indicate increased buying as bulls pay a premium to keep spot and swap prices aligned.

Stacks derivatives data. Source: Coinglass

Stacks' extended rally targets the monthly high

Stacks’ 10% jump at press time on Wednesday extends the weekly growth to 30% so far. STX bounces off $0.50 support zone marked by the green band on the daily chart shared below, surpassing the previous week’s high at $0.725.

The recovery rally targets the monthly high at $0.802 as the immediate resistance. A successful daily close above this level could extend the uptrend towards the $1.00 psychological level.

The Moving Average Convergence/Divergence (MACD) indicator manifests a crossover between the MACD and signal lines. Concurrent with a surge in green histogram bars from the zero line, it flashes a buy signal for sidelined traders.

The Relative Strength Index (RSI) at 53 crosses above the halfway line, indicating a boost in buying pressure.

STX/USDT daily price chart.

However, if STX fails to sustain a bullish closing on Wednesday, a reversal to $0.50 support zone is possible, erasing the weekly gains.