Japan Eyes Bitcoin ETF Revolution: Crypto Tax Cuts Loom in 2025

Tokyo shakes up crypto winter with regulatory thaw.

The Financial Services Agency (FSA) is reportedly drafting plans to greenlight Bitcoin ETFs—a move that could make Japan the first Asian market to embrace institutional crypto products. Sources say the proposal includes slashing capital gains taxes on digital assets from the current 55% to match stock trading rates.

Wall Street's watching. Again.

This comes as Japan's Web3 startups hemorrhage talent to Singapore and Dubai. The tax overhaul—still needing parliamentary approval—would let crypto investors keep nearly 30% more profits. Traders are already calling it 'the Abe-nomics of crypto.'

One banking exec quipped: 'They'll tax your salary at 45% but your memecoins at 20%. Priorities.'

The FSA's expected to finalize ETF rules by Q4. Meanwhile, local exchanges are scrambling to upgrade infrastructure—because nothing motivates innovation like the threat of losing rich clients to BlackRock.

Japan's FSA proposes crypto asset regulation reforms

The FSA's general meeting on Wednesday will discuss the proposed changes, primarily focusing on the transfer of cryptocurrency assets from the current framework under the Payment Services Act to the Financial Instruments and Exchange Act (FIEA).

In addition to referring to crypto assets as "financial products," as reported by Coinpost, the system change would pave the way for the establishment of a task force to oversee the industry.

Other key changes include a significant tax cut from the current progressive system, with a maximum rate of up to 55%, to a self-reporting taxation framework with an approximate rate of around 20%.

Japan's intended shift to a more progressive regulatory framework for digital assets comes amid a widespread push for friendlier rules, particularly in the United States (US), which aims to facilitate innovation, adoption and financial inclusivity.

Regulation under FIEA would bring crypto taxation into parity with the stock market in Japan, making it possible to lift the ban on bitcoin ETFs and support institutional interest in digital assets.

Customer protection remains a priority for the FSA, with the shift to FIEA likely to strengthen the structure. Known for its progressive outlook on crypto assets, Japan is working to achieve the goal of becoming an investment-based country. This WOULD be supported by the creation of new opportunities for its citizens across key web3 platforms and Decentralized Finance (DeFi) platforms.

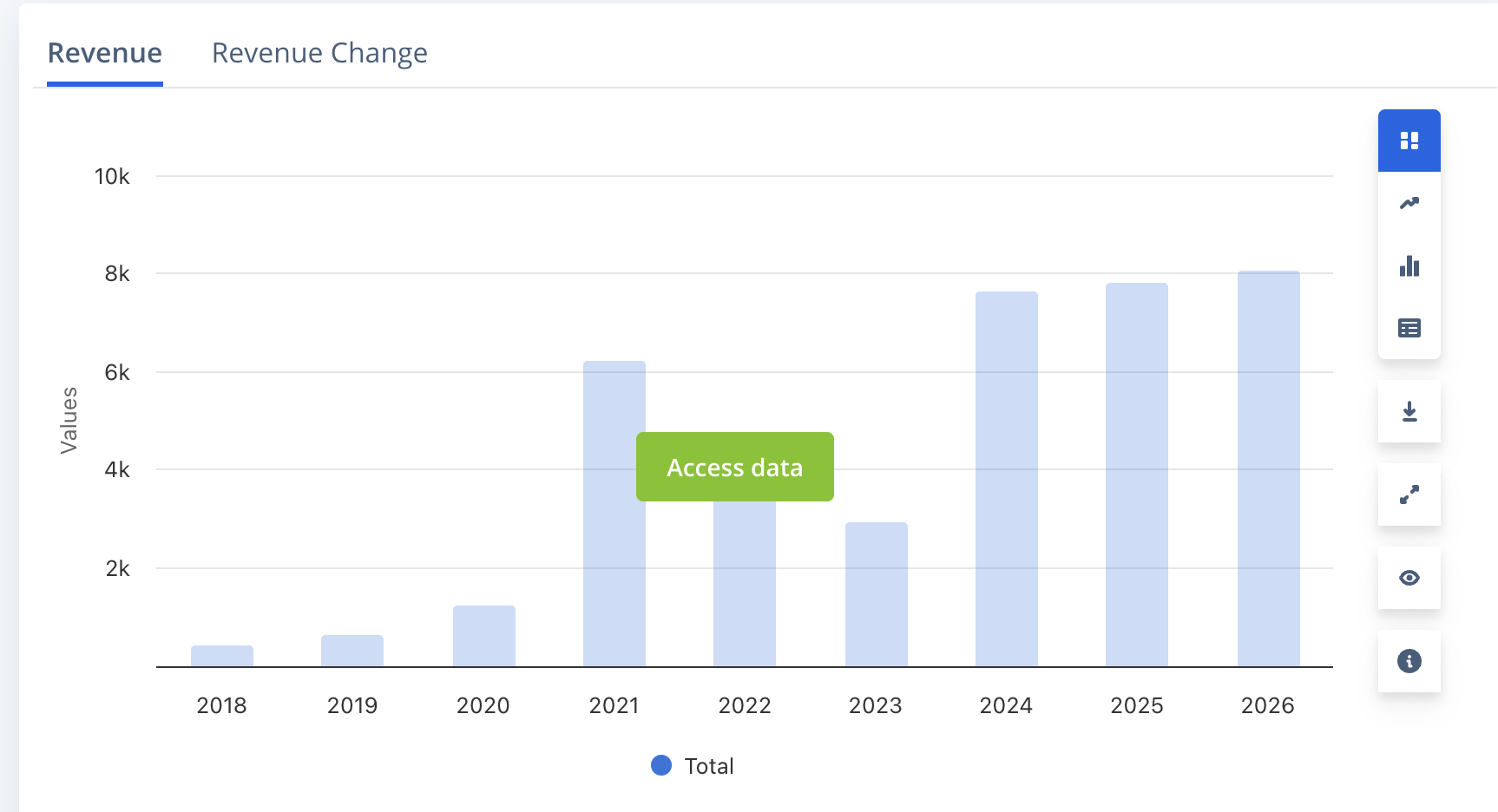

Japan's crypto market is estimated to hit $2 billion in revenue by the end of 2025, with an annual growth rate (CAGR 2025-2026) of 3.44%, according to Statista.

Japan's crypto revenue | Source: Statista Market Insights

Statista also projects that the number of cryptocurrency users in Japan will grow to 18.69 million by 2026, underscoring the need for a progressive regulatory environment.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.