Panther Metals Soars 21% Following Bold $5.4M Bitcoin Bet on Mineral & Gold Acquisitions

Another day, another crypto-fueled pivot—this time with a side of shiny rocks.

Panther Metals just pulled off a 21% price surge after deploying $5.4 million in Bitcoin to snap up mineral rights and gold assets. Because nothing screams 'hedge against volatility' like swapping one speculative asset for another, right?

The Bitcoin-to-Bullion Play

Forget traditional financing. Panther’s move taps into crypto’s growing role as a treasury asset—even if it gives goldbugs existential dread. The market’s response? A 21% leap that’d make a Wall Street analyst choke on their avocado toast.

Why It (Kinda) Makes Sense

Miners backing miners. By converting BTC into hard assets, Panther’s hedging against crypto’s infamous swings while doubling down on real-world value. Or maybe they just really like digging holes.

Either way, it’s a masterclass in 2025’s favorite game: 'How to launder crypto hype into something institutional investors might tolerate.'

Minerals and crypto combo

Pick Lake is part of the larger Winston Project, hosting around 85% of the total mineral resources on the project.

The Winston deposit is described as an “advanced-stage polymetallic zinc, copper, and precious metal property” with a high-grade mining redevelopment and resource building opportunity.

Zinc is considered a critical mineral essential for galvanizing steel and battery technologies.

“By blending the stability of physical resources with the flexibility of digital capital, Panther is building a business that can thrive through market cycles and remain ahead of the curve,” said Hazelwood.

Panther Metals Plc shares leap

Investors agreed with the sentiment and loaded up on Panther stock (PALM), which surged 21% on the London Stock Exchange on Monday.

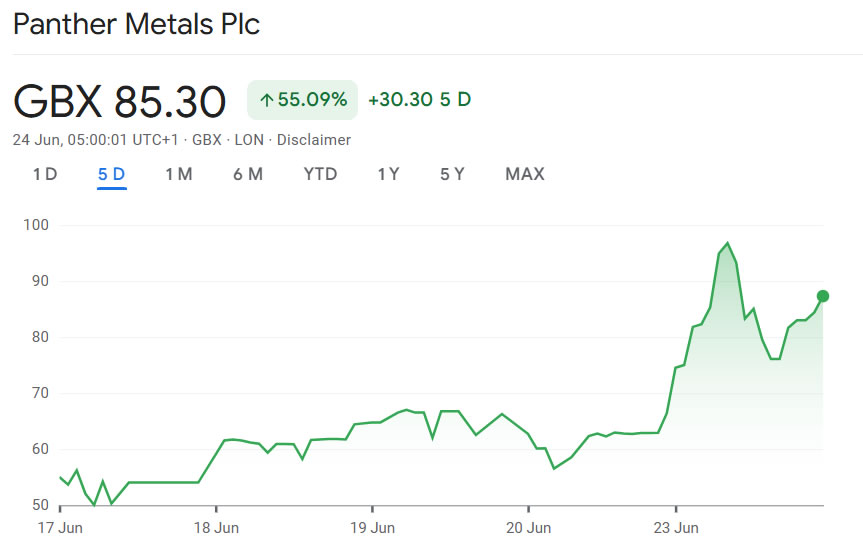

Panther shares have surged a whopping 125% over the past month and 55% over the past week, according to Google Finance.

PALM price, 5 days. Source: Google Finance

Corporations continue to accumulate

The number of corporations adopting Bitcoin treasuries is surging. Earlier this week, real estate mogul Grant Cardone announced his firm’s first Bitcoin purchase with 1,000 BTC for its corporate treasury.

Meanwhile, Bitcoin stalwarts Michael Saylor’s Strategy and Japanese Metaplanet continue to load up, increasing their holdings to 592,345 BTC and 11,111 BTC, respectively.