US Bitcoin ETFs Defy Geopolitical Chaos with 8-Day Inflow Streak

Wall Street's crypto love affair just hit a new milestone—while missiles flew in the Middle East.

Bitcoin ETFs keep printing green

Eight straight days of inflows for US spot Bitcoin ETFs prove institutional money's playing the long game. Even as traditional markets flinch at geopolitical risks, crypto's proving its uncorrelation thesis—or maybe just revealing hedge funds' addiction to volatility.

The real shocker? These inflows came during a risk-off period that saw oil spike and gold rally. Either Bitcoin's becoming a true macro asset, or TradFi finally found something shinier than their vintage 2008 CDOs.

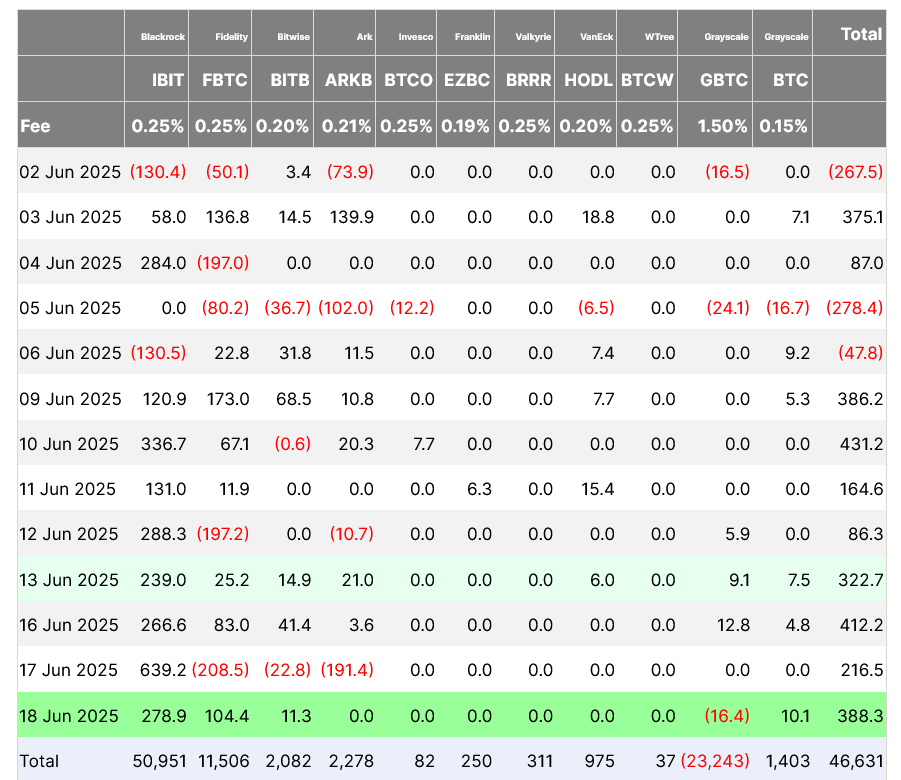

Only Grayscale’s Bitcoin products in the red

The Grayscale Bitcoin Trust ETF (GBTC) bled $16.4 million, while the asset manager’s low-fee Grayscale Bitcoin Mini Trust also saw $10.1 million in outflows.

Daily flows into the spot Bitcoin ETFs between June 2 and 18. Source: Farside Investors

Inflows into Bitcoin ETFs on a tear

After a slow first few months of 2025, inflows into the spot Bitcoin ETFs have picked up pace recently, tallying a staggering $11.2 billion since April 17.

There have been only eight days of outflows since then, during which Bitcoin’s price has risen from below $85,000 to $104,950.

More than $46.3 billion has flowed into the 11 Bitcoin products, led by BlackRock’s IBIT and Fidelity’s FBTC at $50.6 billion and $11.5 billion, respectively.

The tally includes $23.2 billion worth of outflows from Grayscale’s GBTC.

Ether ETFs pulling their weight

The US spot Ether (ETH $2,524) ETFs saw a 19-day inflow streak before it broke on June 13 — but rebounded with three consecutive days of fresh inflows between June 16-18, including over $19.1 million on Wednesday.

BlackRock’s iShares ethereum Trust ETF (ETHA) is leading the pack, with total net outflows of $5.28 billion, Farside Investor data shows.

BlackRock’s ETHA has recorded an inflow on every trading day except two since May 20 and hasn’t recorded an outflow since May 7.

The strong flows come as the Securities and Exchange Commission’s Crypto Task Force has taken a more collaborative approach with industry players and recently clarified that protocol-level staking isn’t a securities transaction — potentially opening the door to Ether ETFs with staking features in the future.