🚀 SUI & Bitcoin Price Forecast: Crypto Market Heatwave – Europe Update June 13

Crypto markets flex bullish momentum as traders eye key resistance levels. Here’s the breakdown—no fluff, just alpha.

Sui (SUI): The Dark Horse

While Bitcoin hogs headlines, Sui quietly builds steam. Its scalable architecture could make it the Layer-1 sleeper hit of Q3—if it clears the $1.80 psychological barrier.

Bitcoin: The Macro Play

BTC dances around $70K like a Wall Street intern at a summer mixer—lots of enthusiasm, not much conviction. Watch for ETF inflows to break the stalemate.

Euro Traders Take Note

European markets wake up to another day of ‘risk-on’ sentiment (or as they call it in Frankfurt, ‘controlled euphoria’). Regulatory chatter remains the wildcard.

Closing Thought

Remember: When VCs start tweeting ‘long-term hold’ memes, it usually means they’re dumping bags. Trade accordingly.

Sui Price Forecast: Sui eyes triangle fallout below $3 as Open Interest, TVL plunge

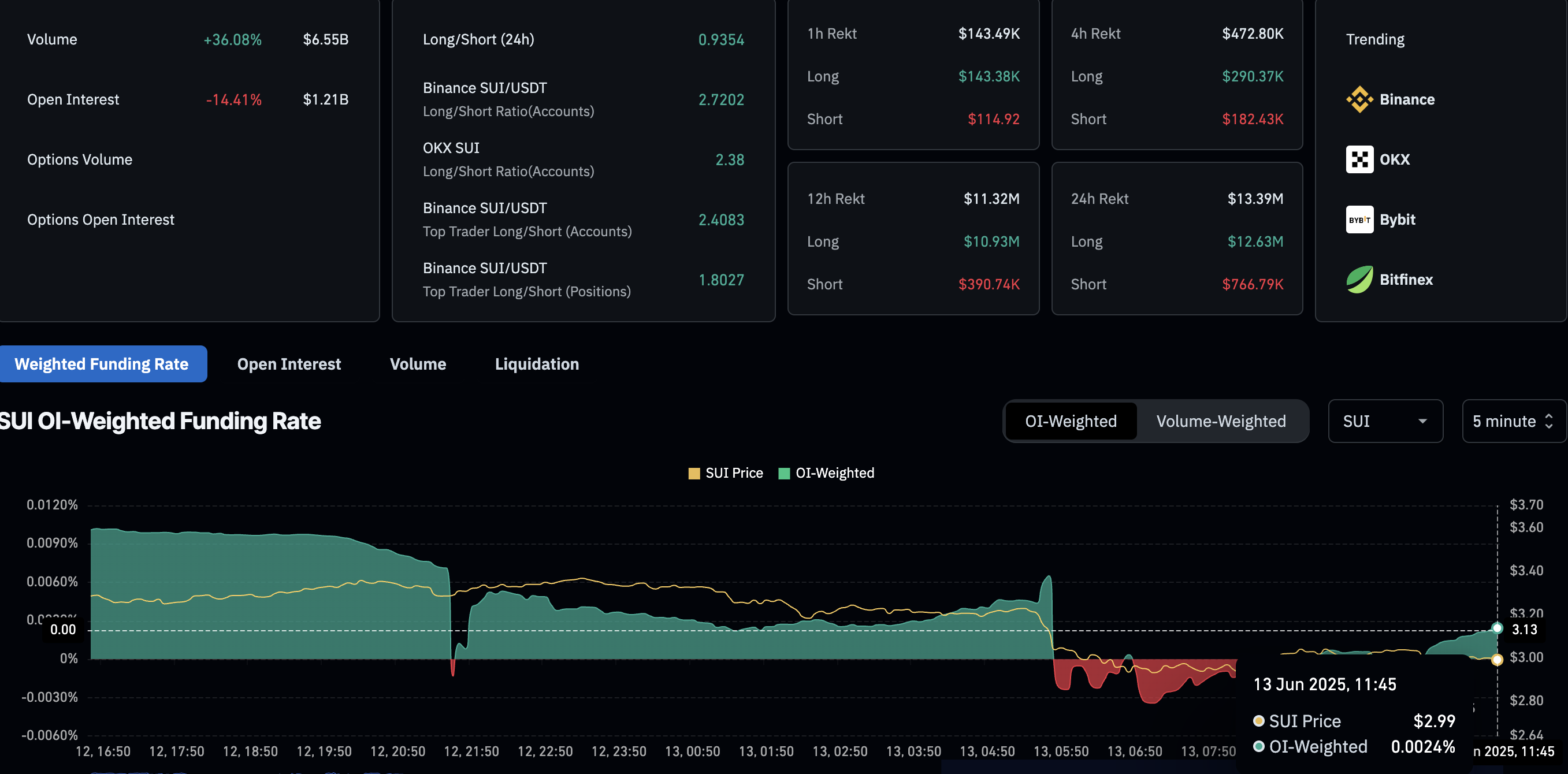

Sui (SUI) edges lower by over 5% at press time on Friday, concurrent with the broader crypto market crash due to the escalation of the conflict between Israel and Iran.

The sudden sell-off prints multiple bearish candles in the daily price chart, while Open Interest plummets to a level last seen in April. As risk-off sentiment prevails in the cryptocurrency market, the SUI price forecast indicates dire downside risk.

Bitcoin Weekly Forecast: BTC eyes a drop toward $100,000 amid cautious sentiment as Middle East tensions escalate

Bitcoin (BTC) price edges below $105,000 at the time of writing on Friday, extending the consecutive two-day drop this week. The largest cryptocurrency by market capitalization enters a cautious stance as tensions between Israel and Iran weigh on global risk sentiment. This increase in risk aversion has triggered a wave of liquidations exceeding $1.15 billion across cryptocurrency markets. Despite the overall gloomy market mood, public companies'' demand for BTC continues to strengthen as of this week.

-1749803100503-638854078465534349.png)

-1749803100503-1-638854078592857972.png)

Crypto market plunges, but expert suggests end of quantitative tightening and rising M2 supply could spur recovery

Bitcoin (BTC) and the broader crypto market declines in the early European session on Friday, with the top crypto by market capitalization sliding 3.2% in the last 24 hours, alongside ethereum (ETH) and Solana (SOL), which dips 9% and 10%, respectively. Despite the declines, HashKey Capital partner Han Xu stated that the crypto bull market looks poised for further upside, with the upcoming end of quantitative tightening (QT) and rising M2 supply signaling a potential return to bullish action.