Ethereum’s Path to $6000+ Remains Unshaken – Here’s Why

Ethereum defies market jitters as its $6000+ trajectory holds firm. The smart contract giant continues to bulldoze through resistance levels, leaving skeptics scrambling.

Why the bullish momentum won’t quit:

Institutional inflows are flooding in—Wall Street’s latest ''discovery'' after a decade of pretending crypto didn’t exist. Layer-2 adoption is exploding, slashing gas fees to levels that almost feel reasonable. And the Merge? That energy-efficient proof-of-stake pivot turned ETH into the ESG darling of finance (how quaint).

The road ahead? Bumpy but bright. Regulatory hawks circle, and competitors nip at Ethereum’s heels. Yet the network effects are undeniable—developers build, users flock, and that $6000 target looks increasingly like a pit stop. Just don’t tell the ''stablecoin maximalists'' busy counting their 2% yields.

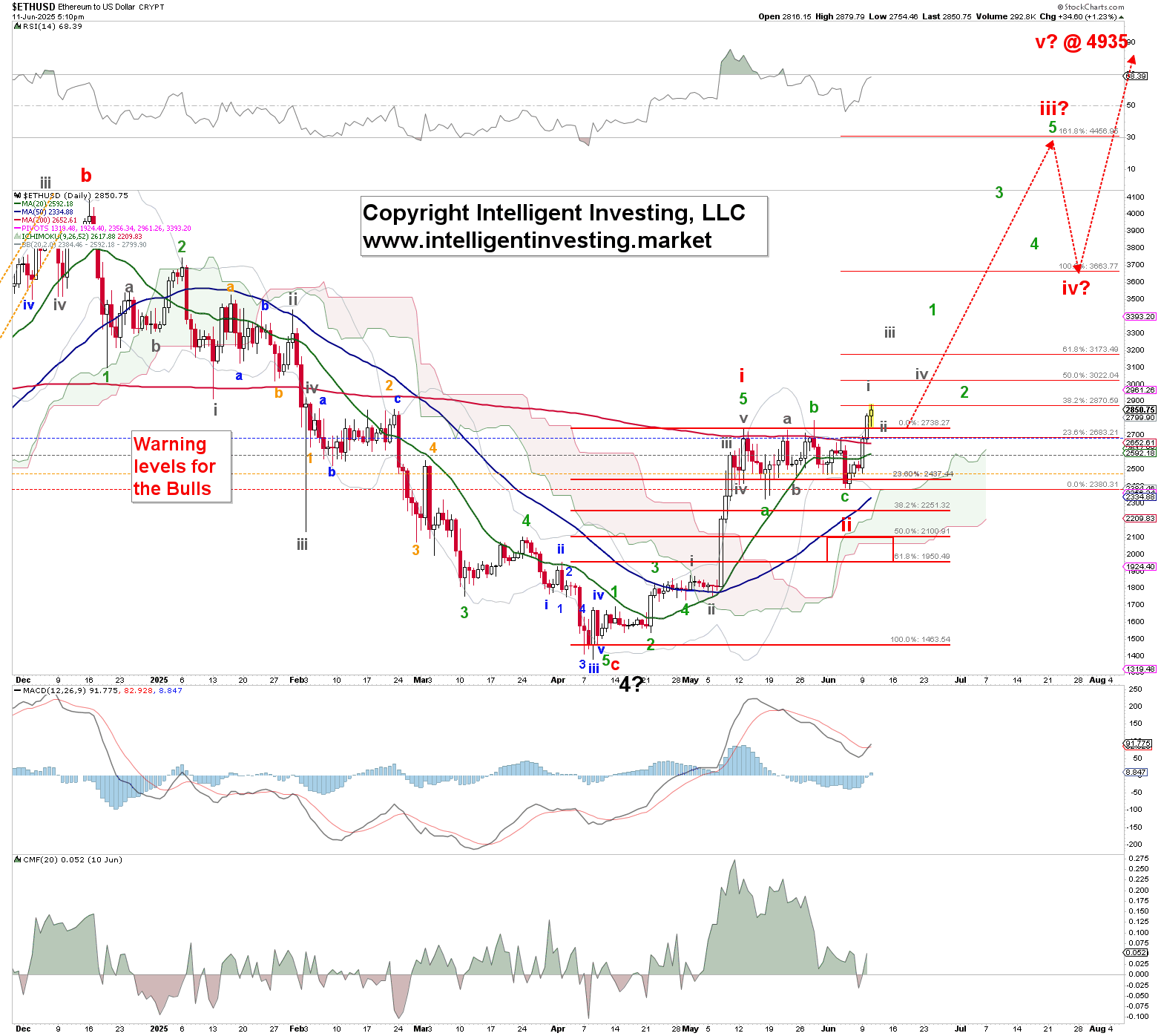

Although its shallow, the red W-ii is acceptable and the red W-iii is starting, as ETH is finally breaking

through its (Red) 200d SMA. Therefore, the red W-iii should now be underway and will subdivide into

five smaller (green) waves. Those, in turn, will further subdivide into five even smaller (gray) waves, etc.

Consequently, the gray W-i of the green W-1 of the red W-iii should now be underway. The ideal Fib-

based targets for the red W-iii, iv, and v are minimums since we still expect at least $6100+ to be

reached based on the bullish pennant pattern we’ve shared before.

Although the retracement for the red W-ii was not as DEEP as expected, its important to note that

markets do not have to follow textbook retracements (50-62%) as corrections. The purpose of

correcting, from a technical perspective, is to eliminate overbought conditions. This can be achieved

either through time (sideways) or price (deep). Therefore, given the sideways price action, our

alternative now is that the current rally from Friday’s low represents the green W-5 of the red W-i. See

Figure 2 below.

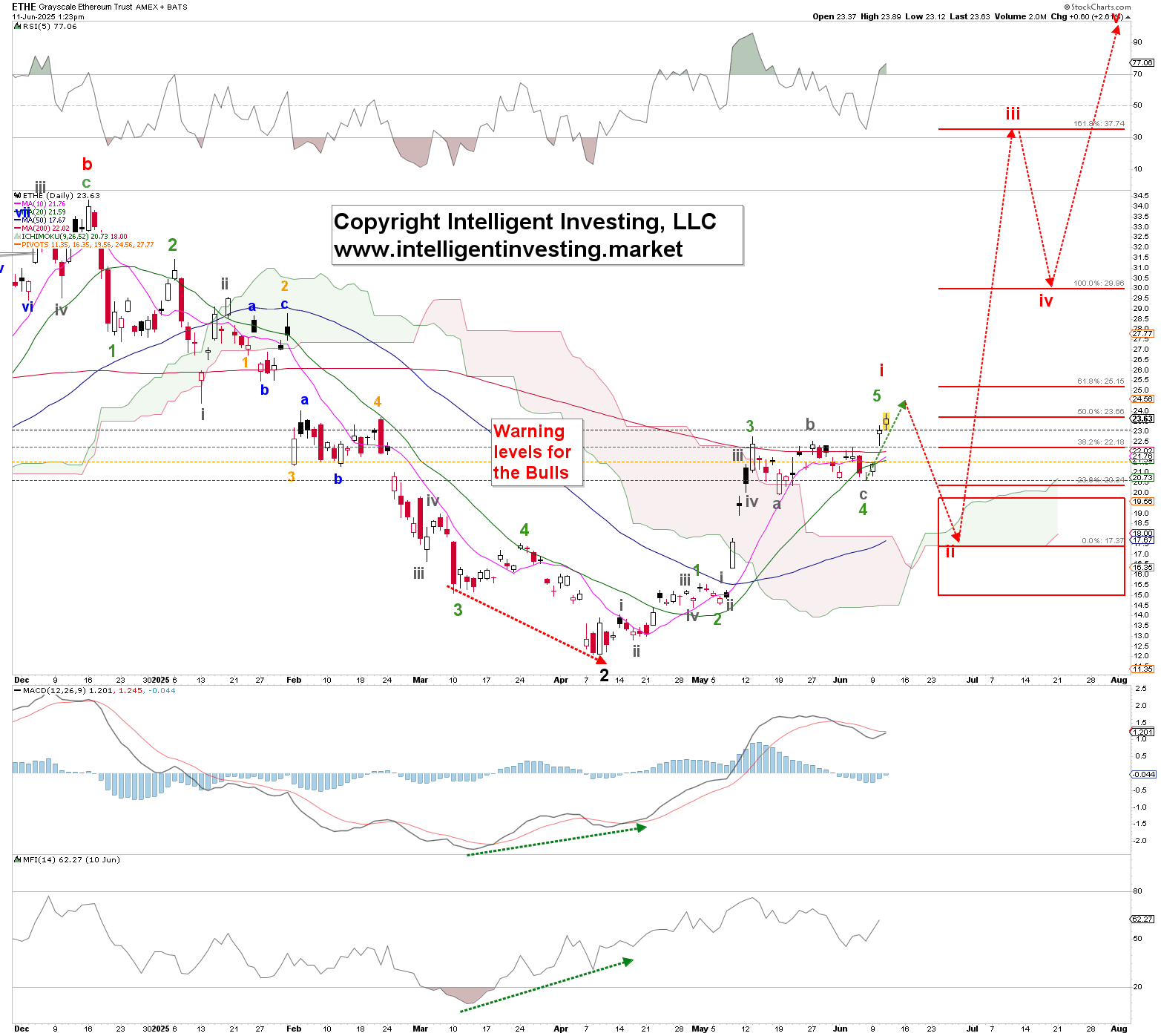

Figure 2. Our alternative, short-term EWP count for Ethereum.

Here, we use the Grayscale Ethereum Trust (ETHE) Exchange-Traded Fund (ETF) to illustrate what that

would look like. In this case, we anticipate the red W-i to peak at around $25 for ETHE and

approximately $ 3,000 for ETH. From there, we can still expect a deeper red W-ii to ideally be around $

2,250 +/- $ 75 for Ethereum and $ 17.50 +/- $ 2.50 for ETHE, before the red W-iii kicks in. However, the

bears will need to push the price back below last Friday’s low (ETHE $20.60, ETH $2385) to initiate this

alternative. Therefore, we have, thanks to the EW, an excellent stop level, i.e., risk/reward, to work with

if desired.

Regardless, both paths lead to Rome, so to speak, and we must not lose sight of what truly matters: the

third wave to ~$5000+ for ETH. See the forest for the trees, because “big gains come from big time

frames,” as the short term is always more variable and uncertain than the long term. We present these

two options not to confuse, but to clarify our expectations. We’re simply thinking ahead, and neither

price movement will catch us off guard, allowing us to be prepared. While we update our analysis and

insights daily for our Premium Newsletter members, we’ll check in with you again here in a few weeks.