🚀 Crypto Bulls Charge: Dogecoin & Bitcoin Price Predictions – Europe’s June 11 Market Pulse

Crypto markets refuse to sit still—Dogecoin’s meme magic and Bitcoin’s relentless dominance are writing today’s headlines. Here’s where the smart money’s betting.

### Dogecoin: From Joke to Juggernaut?

Elon’s favorite joke coin keeps defying gravity. Retail traders pile in, while institutional investors pretend not to notice—until their clients ask about it.

### Bitcoin: The ATH Whisperer

BTC’s flirting with previous all-time highs again. Miners are hodling, ETFs are buying, and Jamie Dimon’s still yelling at clouds.

### The European Angle

While regulators draft their 47th MiCA amendment, traders bypass paperwork with decentralized gusto. Because nothing says ‘compliance’ like a self-custody wallet.

Cynical finance jab: Meanwhile, traditional banks still charge €25 for international transfers slower than a 2017 Bitcoin transaction.

Top Meme Coins Price Predictions: Dogecoin, Shiba Inu, Pepe target new swing highs

Meme coin Dogecoin (DOGE), shiba inu (SHIB) and Pepe (PEPE) recover sharply this week, overcoming the flash crash on Thursday. With a renewed risk-on sentiment, these top meme coins are projected to extend their bullish trend this week.

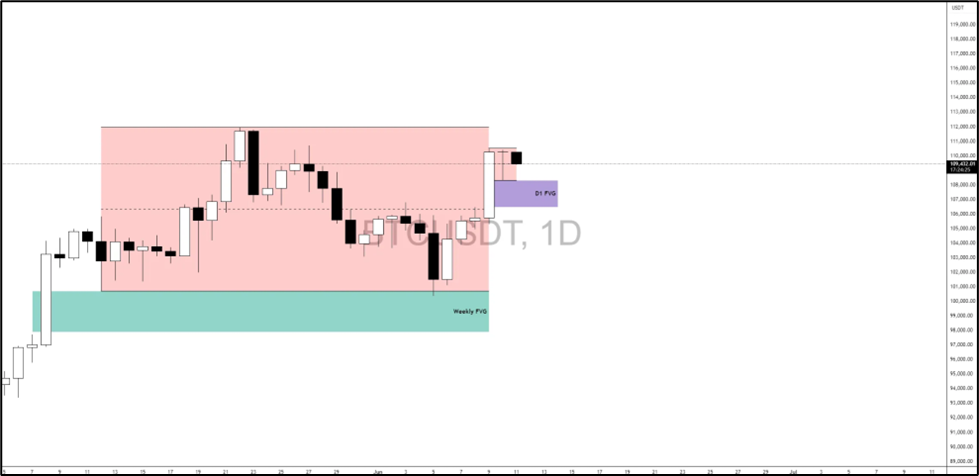

BTC awaits CPI shock: Is $112K next or a fakeout before the fall?

Bitcoin has rallied sharply in recent sessions, recovering from its June lows and reclaiming the $109K level. However, just as BTC approaches a key resistance level, the market is now bracing for today’s U.S. CPI release at 8:30 AM EST, a macro event that could heavily sway risk sentiment and crypto flows.

Crypto Today: Bitcoin, Ethereum, XRP mute reaction to US-China trade agreement

The cryptocurrency market is generally holding onto most of the gains accrued during the euphoric rally on Monday, when Bitcoin (BTC) cracked the resistance at $111,000 to post weekly highs at around $110,516. Meanwhile, the largest digital asset by market capitalization hovers at $109,274 at the time of writing on Wednesday, down over 0.5% on the day as investors digest the aftermath of the trade talks between the United States (US) and China.