SPX6900 Meme Coin Stages Comeback as Traders Bet Big on Golden Cross Signal

Open interest spikes as degenerate gamblers—sorry, ’traders’—pile into the meme coin’s latest technical setup.

Golden cross formation flashes bullish despite crypto’s collective amnesia about past failures.

Will this time be different? (Spoiler: Wall Street still laughs at your ’chart patterns’ while sipping martinis.)

SPX breaks above a rounding bottom pattern

The SPX6900 meme coin surged nearly 80% in May, following a 25% rise in April, showcasing a bullish trend in motion. The recovery rally in the SPX breaks above a U-shaped price pattern, known as a rounding bottom, as shown in the daily price chart below.

The price zone between $0.89 and $0.94 acted as the neckline of the bullish reversal pattern. As the meme coin’s rally peaked at $1.22 before taking a pullback to retest $0.92 or the 50% Fibonacci level, extending from $1.55 on January 6 to $0.29 on March 11. Notably, the previously mentioned supply zone overlaps the 50% Fibonacci level, reflecting a confluence of key support elements that increases the chances of a bullish reversal.

However, the Relative Strength Index (RSI) at 60 retraces down from the overbought zone, suggesting that bullish momentum is gradually declining.

Despite the short-term loss in momentum, the 50-day and 200-day Exponential Moving Average (EMA) gave a golden cross on Sunday. This marks the recent bullish recovery outgrowing the longer-term price movement.

With the long-tailed candles on the weekend, SPX shows readiness to take off for a post-retest reversal of the rounding bottom breakout. According to the Fibonacci levels, the $1.28 mark, which aligns with the 78.6% retracement, is the immediate resistance.

SPX/USDT daily price chart. Source: Tradingview

Conversely, a clean push in SPX below $0.90, leading to a daily candle close, will invalidate the bullish pattern. Thus, increasing the likelihood of the 23.6% Fibonacci level retest at $0.59. Hence, traders can wait for a closing under $0.90 or above the $1 mark before deciding the next wave in SPX to capture.

Open interest soars 10% as optimism emerges for SPX

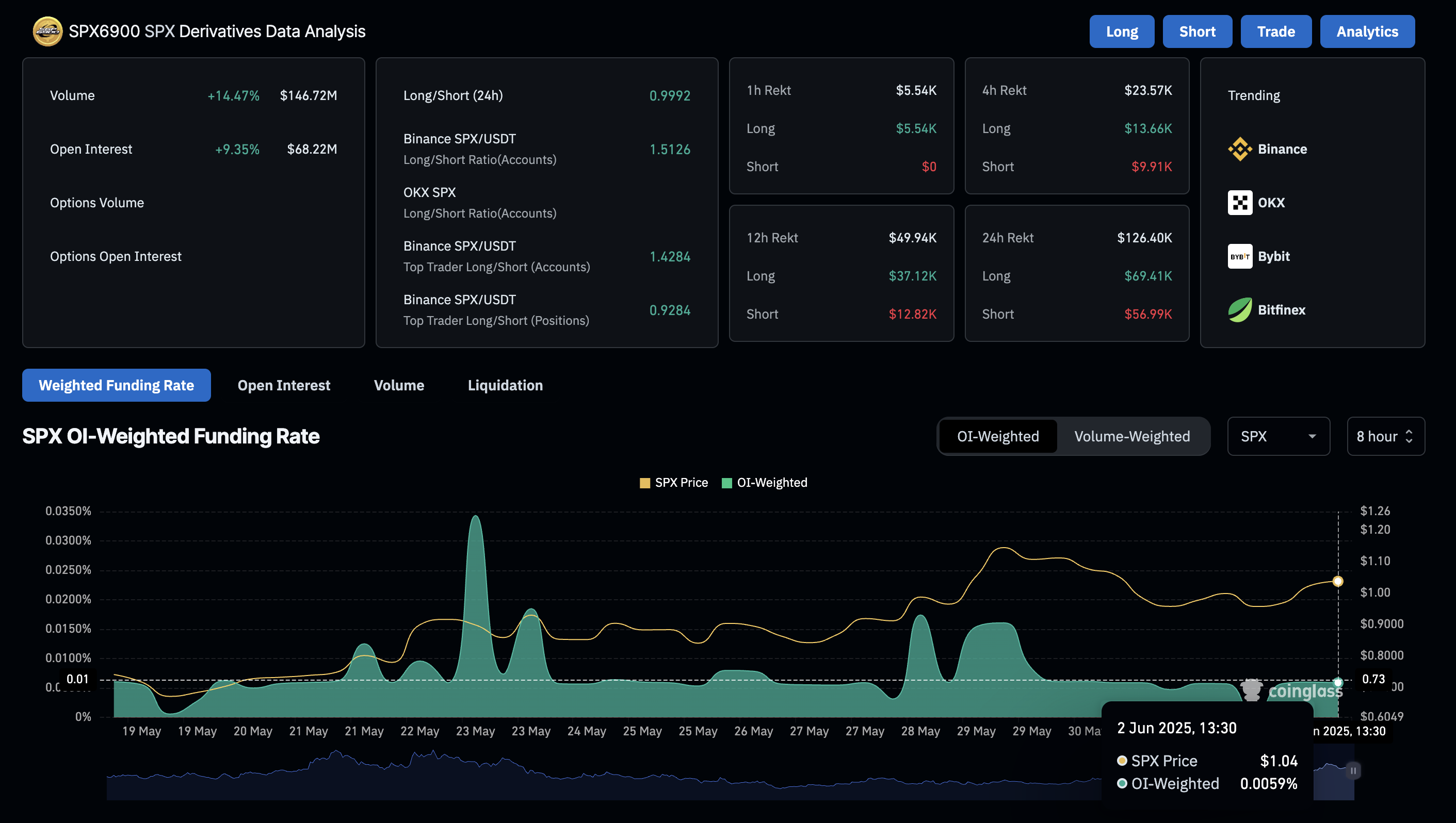

Coinglass data shows SPX6900 meme coin witnessing a 10% spike in OI, reaching $68.22 million. This suggests that the interest of derivative traders has significantly increased in the meme coin.

Concurrent with the OI surge, the OI-weighted funding rate remains at 0.0059%, indicating a sustained bullish inclination among traders. Additionally, the volume of SPX has increased by 13.47% to $145 million, indicating projected increased trading activity.

The 24-hour liquidation data points to a larger wipeout of bullish positions worth $74.88K, while the short liquidation is at $54.85K. Consistent with the exit of bulls, the long/short ratio at 0.9881 reveals a slightly larger number of short positions amid rising OI and stable funding rates conditions.

SPX Derivatives Data. Source: Coinglass

In a nutshell, the mixed sentiments of derivatives data and the bullish, reversal-inclined technical outlook suggest an increased chance of resurfacing above $1.