Solana Eyes $140 as Bulls Lose Steam—Will the Rally Hold?

Solana’s SOL is pushing toward $140, but the momentum isn’t what it used to be. Traders are watching closely—will the next move be a breakout or a classic crypto fakeout?

The ’Ethereum killer’ has been on a tear, but even the hottest altcoins need to catch their breath. Meanwhile, Wall Street still can’t decide if crypto is the future or just a very expensive spreadsheet.

Solana targets below $150

Solana trades at $162.72, with over a 2% drop at press time on Friday, marking its third consecutive bearish candle. Over the last three weeks, SOL has traded in a sideways range between $185 and $165.

During the consolidation phase, the Relative Strength Index (RSI) has dropped to 46 from the overbought region, flashing a bearish divergence with price action. As RSI slips under the halfway line, it indicates a surge in bearish momentum. The indicator also warns of the potential for a steeper correction, as it remains far above the oversold zone.

The Moving Average Convergence/Divergence (MACD) indicator and its signal line are on a downtrend towards the centre line, reflecting a loss of bullish momentum. Additionally, the red histogram bars intensify, flashing a bearish trend reversal possibility.

The bullish failure to cross above the 50% Fibonacci retracement, drawn from $261.97 on January 18 to $105.40 on April 8, reflects profit booking by investors amid uncertain market conditions.

If solana fails to hold above $165.94, the lowest closing price in the last three weeks on May 17, investors could witness SOL testing lower levels. The immediate support lies at $140.32, highlighted by the previous low on April 30.

SOL/USDT daily price chart. Source: Tradingview

To nullify the bearish thesis, Solana must sustain a daily closing price above $165. Doing so could help SOL retest the $185 supply zone.

Bearish intent on a rise in Solana derivatives

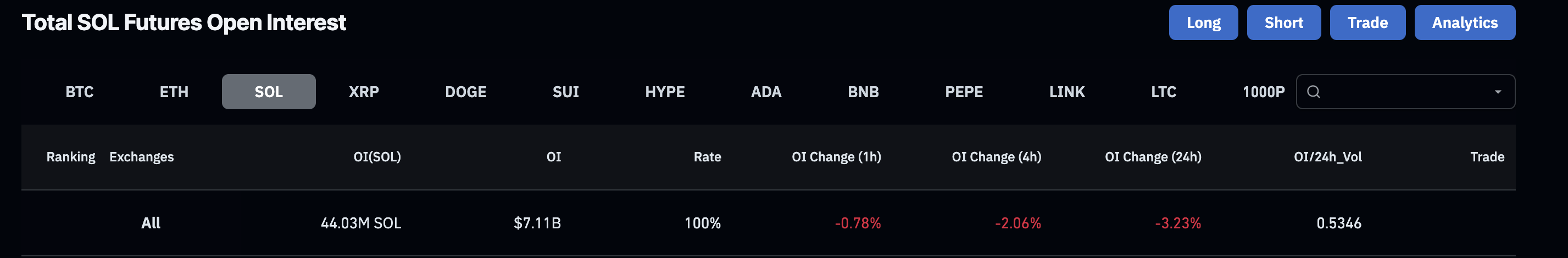

As Solana’s technical outlook turns bearish, the derivatives market reports a massive wipeout of bullish traders. According to Coinglass, Solana Futures Open Interest (OI) has decreased by 3.23% over the past 24 hours at press time, reaching $7.11 billion. This reflects a sudden drop in traders’ interest in Solana, mainly due to increased volatility.

Total SOL Futures Open Interest. Source: Coinglass

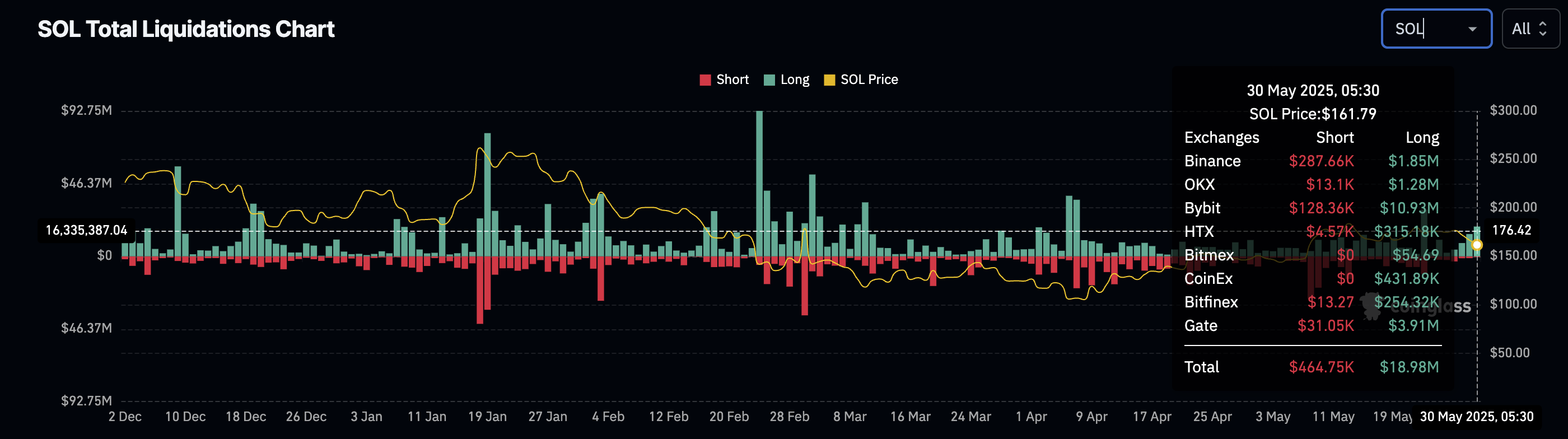

The liquidation chart shows long liquidations rising to $18.98 million on Friday. This is more than three times the number of short liquidations, limited to $464.75K, indicating the exodus of bullish-aligned Solana bulls.

SOL Liquidations Chart. Source: Coinglass

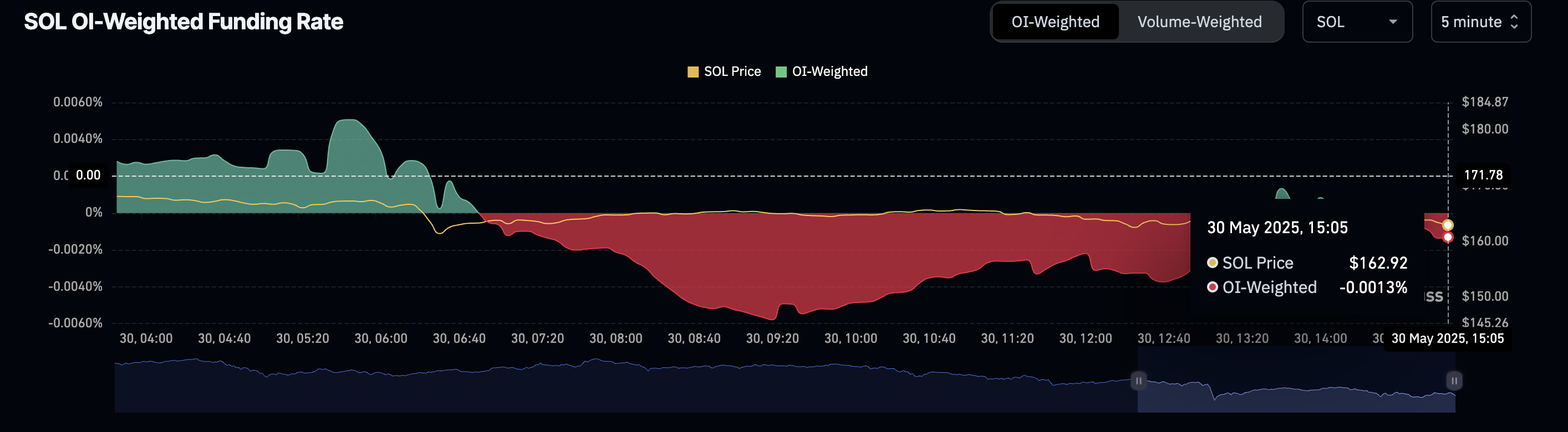

Due to the exit of Solana bulls, the OI-weighted funding rate has flipped negative to -0.0013%. This reflects declining bullish activity and paints a gloomier future for Solana.

SOL OI-Weighted Funding Rate. Source: Coinglass