XRP Primed for 14% Surge as SEC’s DeFi Roundtable Looms—Traders Bet Against Regulatory Theater

Ripple’s XRP defies gravity with a technical setup hinting at a double-digit breakout—just as the SEC hosts another ’groundbreaking’ DeFi talkfest. Will regulators finally catch up, or is this another case of ’innovation theater’ while markets move on?

Chart patterns suggest a 14% upside target, proving once again that crypto markets couldn’t care less about bureaucratic posturing. The SEC’s roundtable—featuring the usual suspects—conveniently coincides with XRP’s bullish momentum. Coincidence? Never.

Pro tip: Watch the 200-day moving average. If history rhymes, traders will front-run any regulatory ’surprises’ with the precision of a high-frequency algo—only slightly less predictable than the SEC’s playbook.

SEC announces DeFi roundtable agenda and panelists

The Securities and Exchange Commission’s (SEC) crypto Task Force has announced the agenda and panelists for its June 9 roundtable. The roundtable, dubbed "DeFi and the American Spirit," will be held at the agency’s headquarters in Washington, D.C.

Nine members will be on the panel, including Jill Gunter from Espresso Systems, Omid Malekan from the Columbia Business School, Rebecca Rettig from Jito Labs and Peter Van Valkenburgh from Coin Center, among others.

"DeFi exemplifies the promise of crypto, as it allows people to interact without intermediaries," Commissioner Hester M. Peirce, head of the Crypto Task Force, said. "I look forward to learning from the panelists about how we can create a regulatory environment in which DeFi can thrive," he added.

Technical outlook: Can XRP validate a potential 14% breakout?

XRP’s price uptrend in early May has been overshadowed by a strong bearish trend in the past two weeks as it eyes the potential to extend losses toward $2.20, the next area of interest for traders eyeing dips.

The money remittance token is holding beneath key moving averages on the 4-hour chart, including the 50-period Exponential Moving Average (EMA), the 100-period EMA, and the 200-period EMA. This gives credence to the short-term bearish momentum, which is accentuated by the Relative Strength Index (RSI) reversal below the 50 midline.

Should the Moving Average Convergence Divergence (MACD) indicator flash a sell signal as the blue MACD line crosses below the red signal line, key liquidity-rich areas, such as the demand zones at $2.20, $2.21, and $2.00, respectively, will come into sight.

XRP/USDT 4-hour chart

The falling wedge pattern illustrated on the chart above suggests that XRP has the potential to reverse its downward trend. This bullish pattern is characterized by two downward-sloping trendlines that converge to the right of the chart, indicating declining volume and sell-side pressure.

Traders look for a break above the upper trendline, accompanied by rising trading volume, to validate the falling wedge. As observed on the chart, the 14% target of $2.63 is determined by measuring the distance between the pattern’s widest points and extrapolating above the upper trendline.

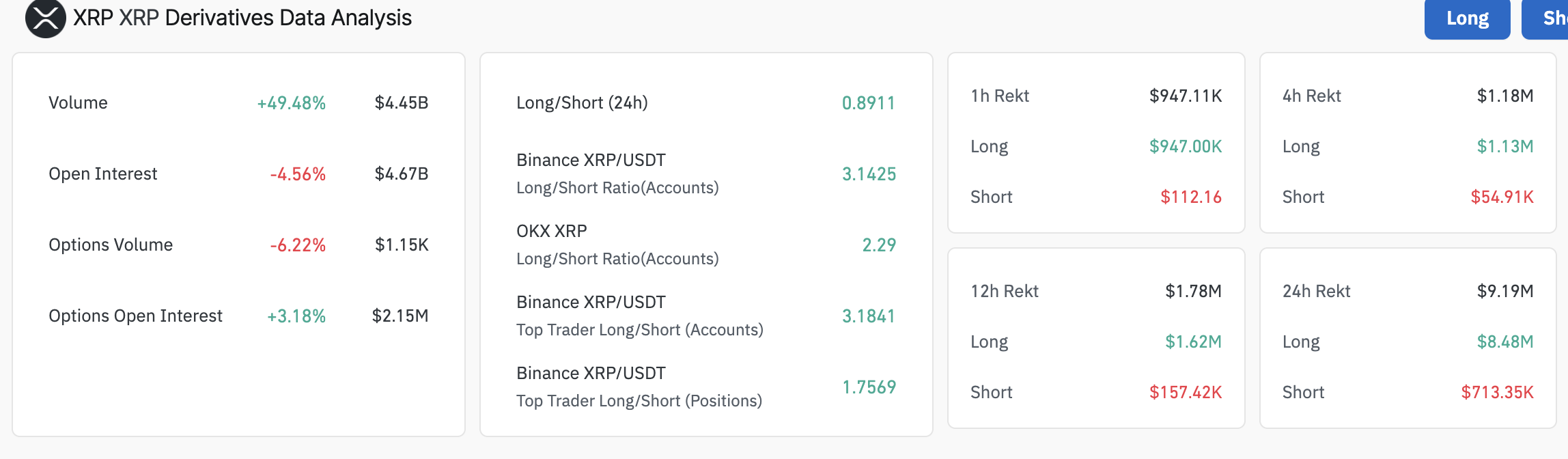

Meanwhile, XRP derivatives data indicate that Open Interest (OI) has decreased by approximately 4.6% to $4.67 billion over the past 24 hours. This coincides with a NEAR 50% increase in volume to $4.45 billion, hinting at a developing bearish bias as traders close positions in futures and options.

XRP derivatives data | Source CoinGlass

The drop in OI as volume increases underpins a noticeable increase in long position liquidations, which reached $8.5 million over the past 24 hours compared to approximately $713,000 in shorts.

If this situation persists, traders may MOVE cautiously amid anticipated volatility, especially with the release of the Personal Consumer Expenditure (PCE) Price Index inflation data on Friday.

Open Interest, funding rate FAQs

How does Open Interest affect cryptocurrency prices?

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

How does Funding rates affect cryptocurrency prices?

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.