Bitcoin’s Rally Loses Steam—Even as Whale Scoops Up 4,020 BTC

Bitcoin’s price surge hits a speed bump despite a major player gobbling up over 4,000 coins. Is this a temporary dip or a sign the bull run’s out of gas?

Whale alert: Someone just dropped nine figures on BTC while everyone else hesitates. Classic crypto—where ’smart money’ buys the dip and retail FOMO kicks in three weeks late.

Meanwhile, Wall Street’s still trying to explain Bitcoin to their golf buddies. Maybe stick to bonds, guys.

Strategy scoops $427M BTC amid cooling whale interest

Strategy continued its Bitcoin buying spree after revealing in Monday’s filing that it purchased 4,020 BTC for $427 million. The company now holds 580,250 BTC, with a total purchase price of $40.6 billion and a BTC yield of 16.8% since January.

The purchase comes after the company announced on Thursday that it WOULD offer 10% of its perpetual strife (STRF) preferred stock for sale. The STRF stock will be sold for a $0.001 value per share, with a total offering of up to $2.1 billion.

According to the latest filing, Strategy has sold 104,423 shares of its STRF stock for $10.4 million, which it used as part of its latest bitcoin purchase.

"Unlike previous bull cycles driven by retail enthusiasm, the current momentum is driven by structured capital inflow and long-term corporate positioning," Tracy Jin, COO of crypto exchange MEXC, told FXStreet. "Institutions are no longer just holding Bitcoin, they are building corporate strategies and business models around it," she added.

Bitcoin trades above $109,000 and is up 1.5% on the day following Strategy’s BTC purchase announcement. The top crypto is looking to hold its recovery from a decline on Sunday that saw it trading below $107,000 after modest distribution from larger whales.

Whales holding more than 10,000 BTC slightly shifted from accumulation to net selling despite continued accumulation from other cohorts, suggesting modest profit-taking from large holders, according to Glassnode data.

As of May 26, the >10K $BTC cohort has pivoted to net distribution (~0.3), signaling a notable shift in positioning among the largest holders. Apart from that, accumulation remains broad, but leadership is shifting down the wallet size curve:

🔸>10K BTC: ~0.3 🔻

🔸1K–10K BTC:… pic.twitter.com/VxEy2LHcFE

This aligns with two notable liquidations of long-overleveraged positions on the crypto exchange Binance after Bitcoin dropped below the $111,000 level on Thursday.

The liquidations include a $97 million wipeout after BTC dropped toward the $110,900 threshold, according to CryptoQuant data. This was followed by a second long squeeze at $109,000, which erased $88 million in long positions within a few hours.

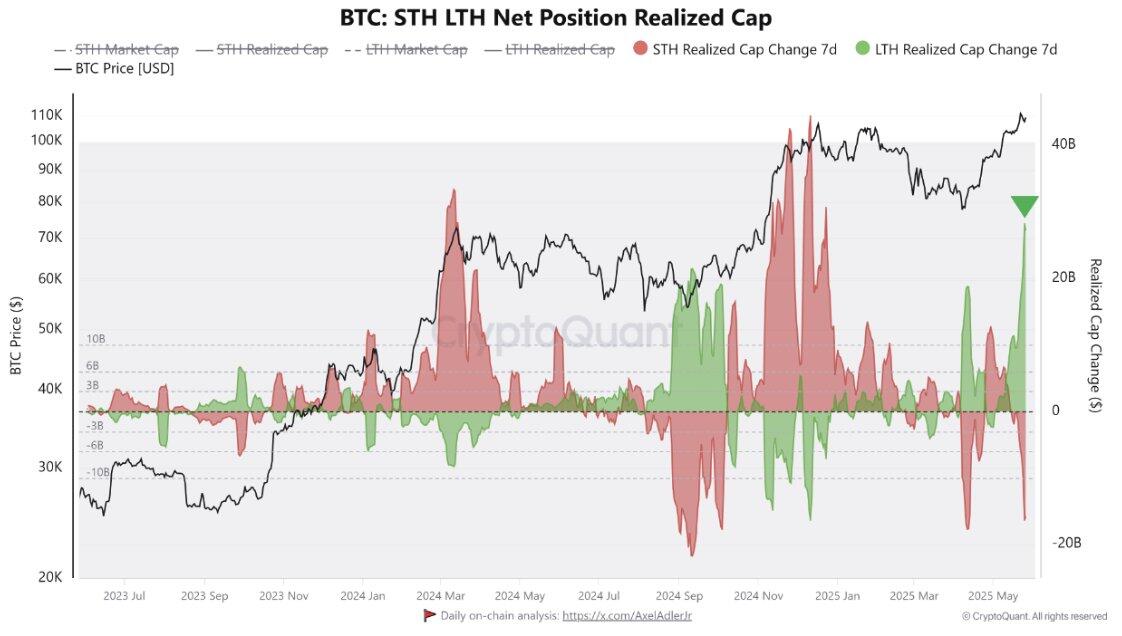

Following the dip, the Long-Term Holder (LTH) Realized Cap jumped to $28 billion for the first time since April.

BTC: STH/LTH Net Position Realized Cap. Source: CryptoQuant

"It’s clear that long-term investors are using this period of forced selling to increase their exposure and accumulate more Bitcoin for the long run," wrote CryptoQuant analyst Amr Taha.

Accumulation from LTH often reflects the potential for future price appreciation as Bitcoin moves into the hands of investors with lower spending tendencies.