Trump’s Tariff Reprieve Sparks Crypto Rally—Traders Bet on Risk-On Sentiment

Markets breathe a sigh of relief as geopolitical tensions ease—for now. Bitcoin and altcoins tick upward, capitalizing on the delayed 50% EU tariff threat. Wall Street analysts yawn; crypto traders pounce.

Tariffs on hold, but volatility isn’t. The July 9 deadline looms like a Sword of Damocles—perfect for leveraged positions and sleepless nights. Meanwhile, traditional finance still can’t decide if crypto is an asset class or a nuisance.

Risk appetite returns? Or just another headfake in the casino of global macro? Either way, the charts don’t lie—green candles taste sweeter with a side of schadenfreude.

Trump extends tariff deadline on imports from the EU

Donald TRUMP announced on Monday on his Truth social account that he has agreed to extend the implementation date for the 50% tariff on EU goods from June 1 to July 9. This news came following Friday’s announcement to impose 50% tariffs on imports from the European Union as Brussels sent an unfavorable trade proposal to Washington.

“I received a call today from Ursula von der Leyen, President of the European Commission, requesting an extension on the June 1st deadline on the 50%...,” Trump said.

He continued: “I agreed to the extension — July 9, 2025 — It was my privilege to do so.”

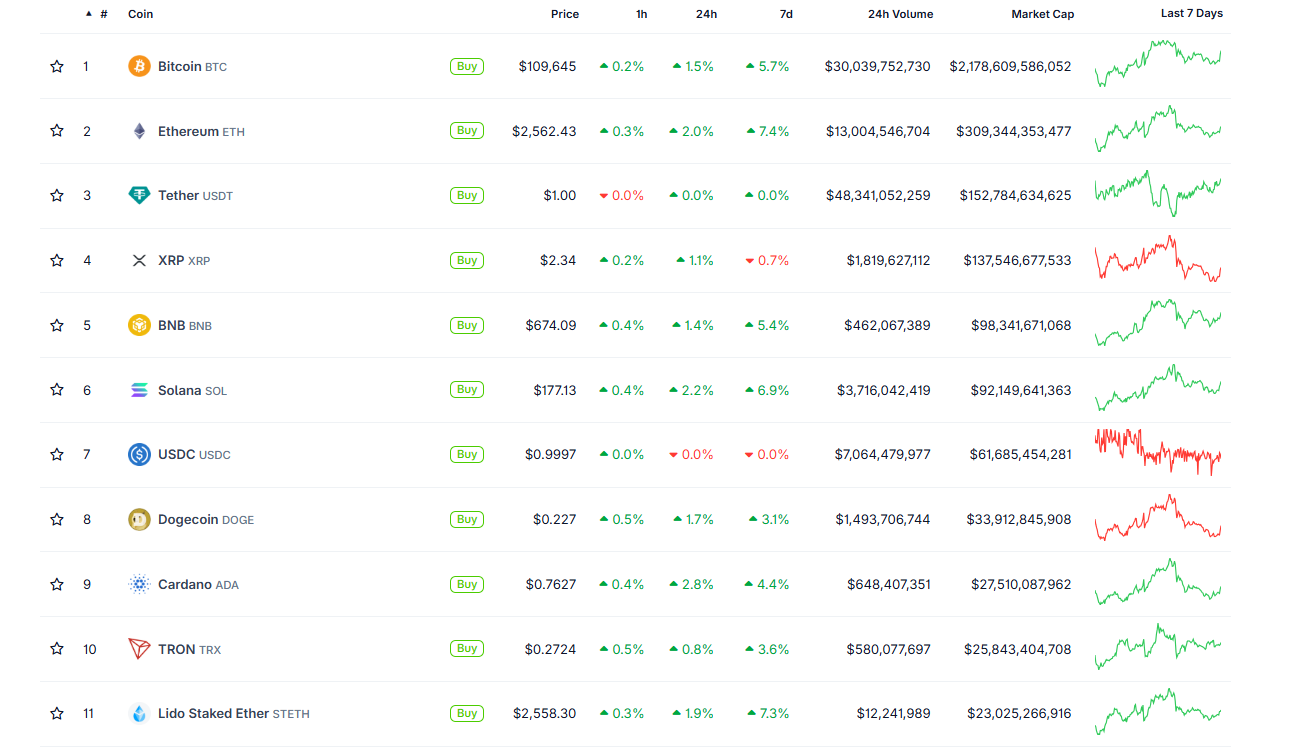

This announcement provided a slight boost to investor sentiment. During the early Asian trading session, the overall crypto market reacted positively, with major cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) edging higher, as shown in the chart below.