Chainlink Whales Go on a Buying Spree—$25 LINK Price Target in Sight

Whale wallets are loading up on Chainlink’s LINK token, fueling speculation of a push toward $25. The surge in large transactions suggests big players are betting on momentum—or just trying to pump their bags before the next ’institutional adoption’ press release drops.

Active addresses and exchange outflows paint a bullish picture, but let’s see if retail gets left holding the bag again. Crypto never changes.

Chainlink targets $25 with a trend reversal pattern

Chainlink trades at $16.45 at the press time, building over the 2.48% jump on Wednesday. With the second positive candle, LINK exceeds the 200-day Exponential Moving Average (EMA) at $16.01, targeting a surge to the $18 supply zone.

The overhead zone at $18 keeps the LINK price within a high-volatility price range with a lower boundary at $10.93. However, the gradual surge in underlying bullishness leads to an inverted head-and-shoulders pattern in the daily chart, signalling a potential trend reversal.

The bullish pattern is highlighted in the technical chart below, with the ongoing price recovery aiming to FORM the right shoulder. A 40% bullish breakout target is calculated by extrapolating the pattern’s depth over the breakout point, targeting $25.34. Notably, this coincides with the 78.6% Fibonacci level, retraced over the 63% drop from $29.26 to $10.93 between December 15 and April 8.

The Relative Strength Index (RSI), at 58, takes off from the midline, signalling a surge in buying momentum. Moreover, the rising RSI shows room for growth as it maintains distance from the overbought zone.

LINK/USDT price daily chart. Source: Tradingview

However, a reversal closing below the 50-day Exponential Moving Average (EMA), near the lower boundary of the right shoulder around $15.00, will invalidate the bullish pattern. This WOULD extend the decline to $13.20, a previous higher low of the ongoing uptrend.

Whales’ activity supports LINK breakout chances

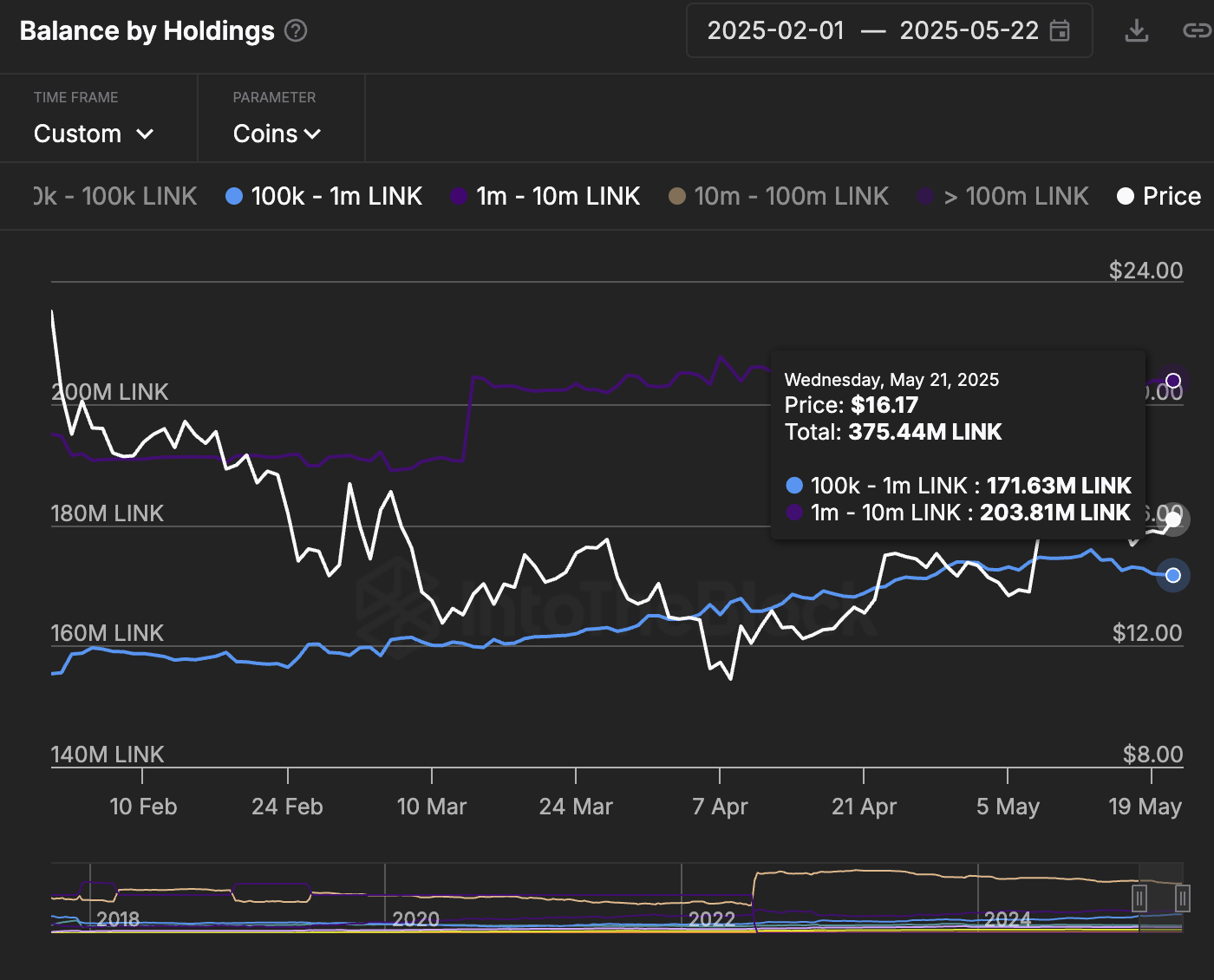

Optimistic whales have been on a buying spree as chainlink has formed a reversal pattern since February. As per IntoTheBlock’s data, the balance by holding of investors with 100,000 to 10 million LINK tokens has witnessed a growth to 375 million from 350 million since February. The increased balance of large holders shows a growing confidence in Chainlink among smart investors.

LINK balance by holdings. Source: IntoTheBlock

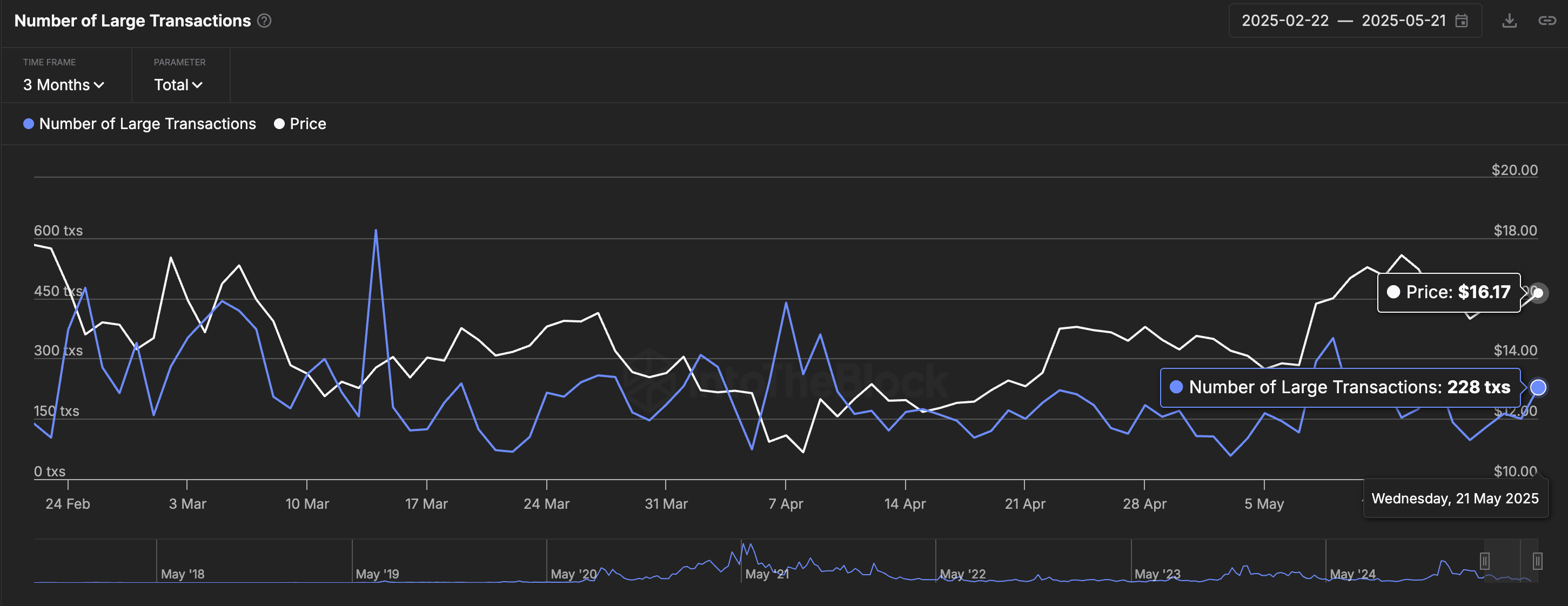

Further up, the on-chain data platform highlights a spike in large transaction counts worth more than $100K. Such a large volume generally correlates with institutional or whale movement, as retail investors lack this much capital.

Number of large LINK transactions. Source: IntoTheBlock

Since May 17, the number of large transactions has increased to 228 from 97, a 135% increase. Thus, the increasing whale activity and holding support the bullish outlook on Chainlink.