Theta Capital Drops $175M War Chest on Blockchain’s ‘Wild West’ Phase

Another day, another VC firm betting big on crypto’s future—this time with enough dry powder to fund half the metaverse.

Early-stage blockchain startups just hit the jackpot. Theta Capital’s $175M fund targets founders still scribbling whitepapers on napkins—because nothing says ’sound investment’ like pre-product hype.

Wall Street’s still clutching its pearls over DeFi, but institutional money keeps flowing into the space. Maybe they’ve finally realized 10,000% APYs beat Treasury bonds.

Crypto VC deals rebound

The fund’s close comes as crypto venture capital begins to rebound. According to Galaxy Digital, VC investment in digital assets ROSE 54% in the first quarter of 2025 to $4.8 billion, signaling renewed confidence in the sector after a prolonged downturn.

A report from PitchBook also showed that crypto venture capital funding surged in early 2025, even as deal activity declined.

The report showed that 405 VC deals were completed in Q1 2025, a 39.5% drop from the 670 recorded in the same period last year. However, that’s a modest uptick from the 372 deals seen in Q4 2024.

Despite fewer deals, total funding more than doubled year-over-year, reaching $6 billion in Q1 compared to $2.6 billion in Q1 2024, also doubling from the previous quarter’s $3 billion.

PitchBook’s senior crypto analyst Robert Le noted that even amid macroeconomic uncertainty, “capital continued to seek crypto’s Core utility rails.”

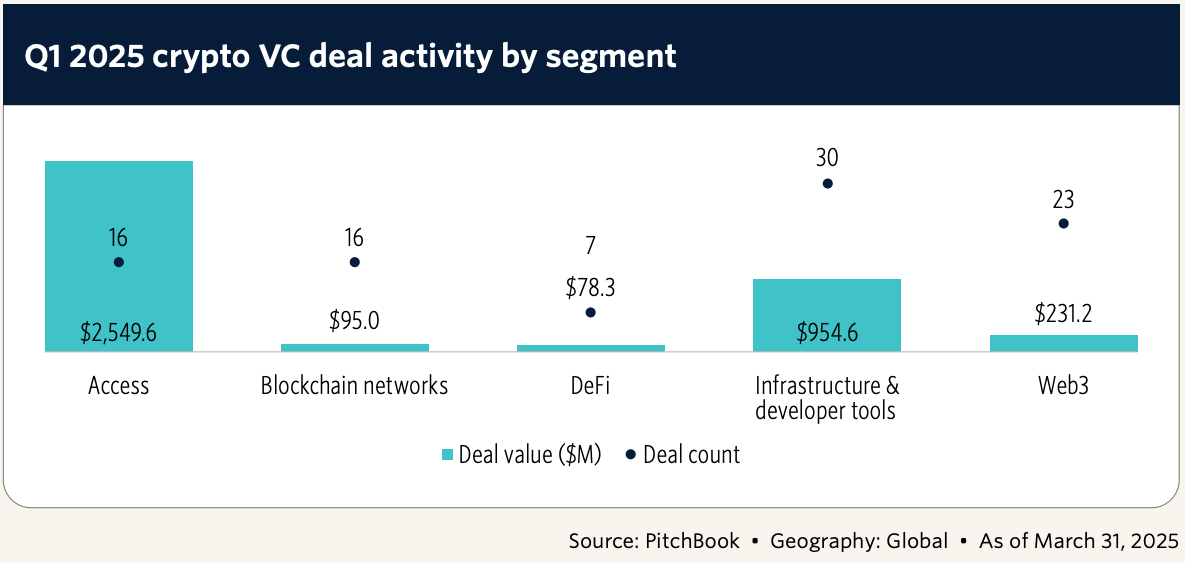

The bulk of the investment — around $2.55 billion across just 16 deals — went to companies in asset management, trading platforms and crypto financial services. Infrastructure and development firms followed, raising nearly $955 million across 30 deals.

Web3-focused companies saw the third-most deals and funding, at 23 and $231.2 million, respectively. Source: PitchBook.

Circle IPO could be crypto’s next benchmark

PitchBook also said that Circle’s anticipated IPO may be the most significant crypto equity pricing event since Coinbase’s 2021 debut.

If Circle secures a valuation above the rumored $4 billion to $5 billion range, it “could therefore crowd in new late-stage capital and reset valuation expectations upward across the payments and infrastructure stack,” Le said.

With $1.18 billion in VC funding raised so far, PitchBook estimates a 64% chance that Circle will ultimately go public.