Tether Just Outgunned Germany—$111B in US Treasuries Now Held by a Stablecoin

Move over, Bundesbank—Tether’s USDT reserves now hold more US debt than Europe’s largest economy. The stablecoin issuer’s Treasury pile quietly surpassed Germany’s $111 billion stake, marking another crypto milestone that’d make a central banker sweat.

Who needs sovereign credit when you’ve got a 1:1 peg? Tether’s growing dominance in short-term Treasuries is either a masterclass in liquidity management or a ticking time bomb—depending on which regulator you ask.

Bonus jab: At least Tether’s quarterly attestations are more transparent than some banks’ stress test results.

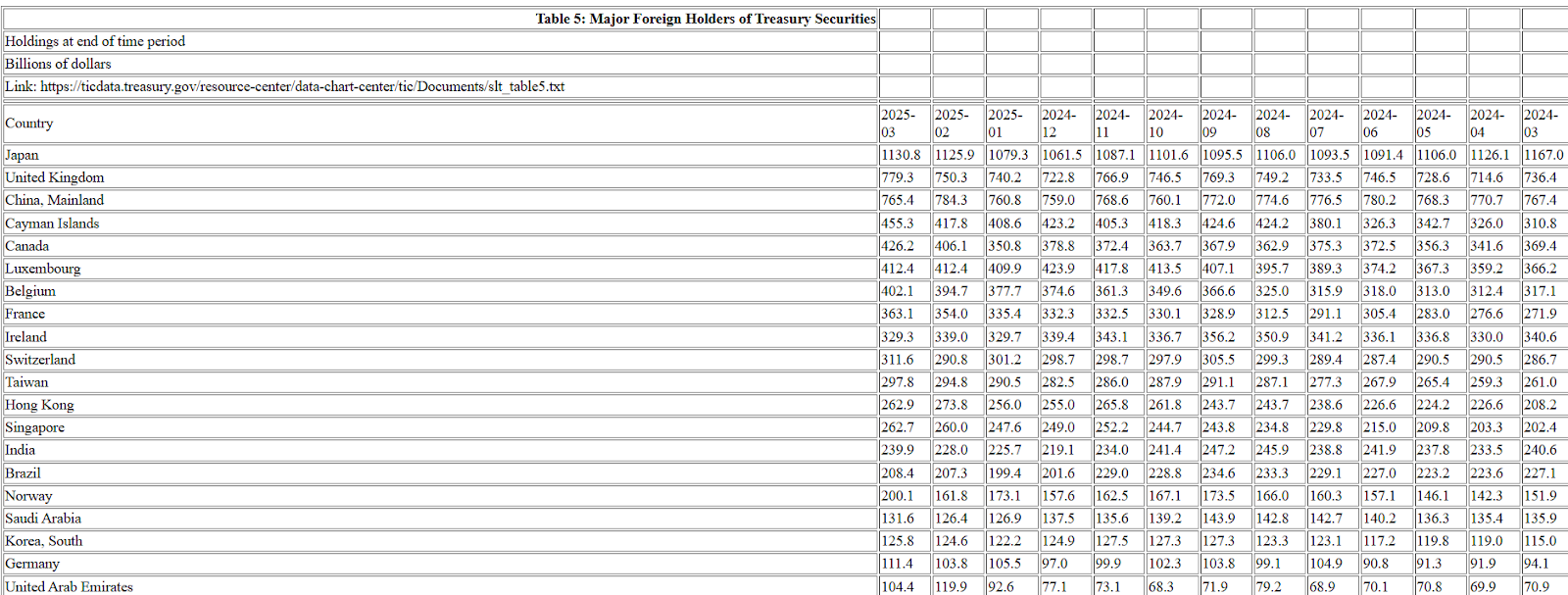

Foreign countries by US Treasury holdings. Source: Ticdata.treasury.gov

Tether has surpassed $120 billion worth of Treasury bills, the firm shared in its attestation report for the first quarter of 2025. That makes Tether the 19th largest entity among all counties in terms of T-bill investments.

“This milestone not only reinforces the company’s conservative reserve management strategy but also highlights Tether’s growing role in distributing dollar-denominated liquidity at scale,” wrote Tether in the report.

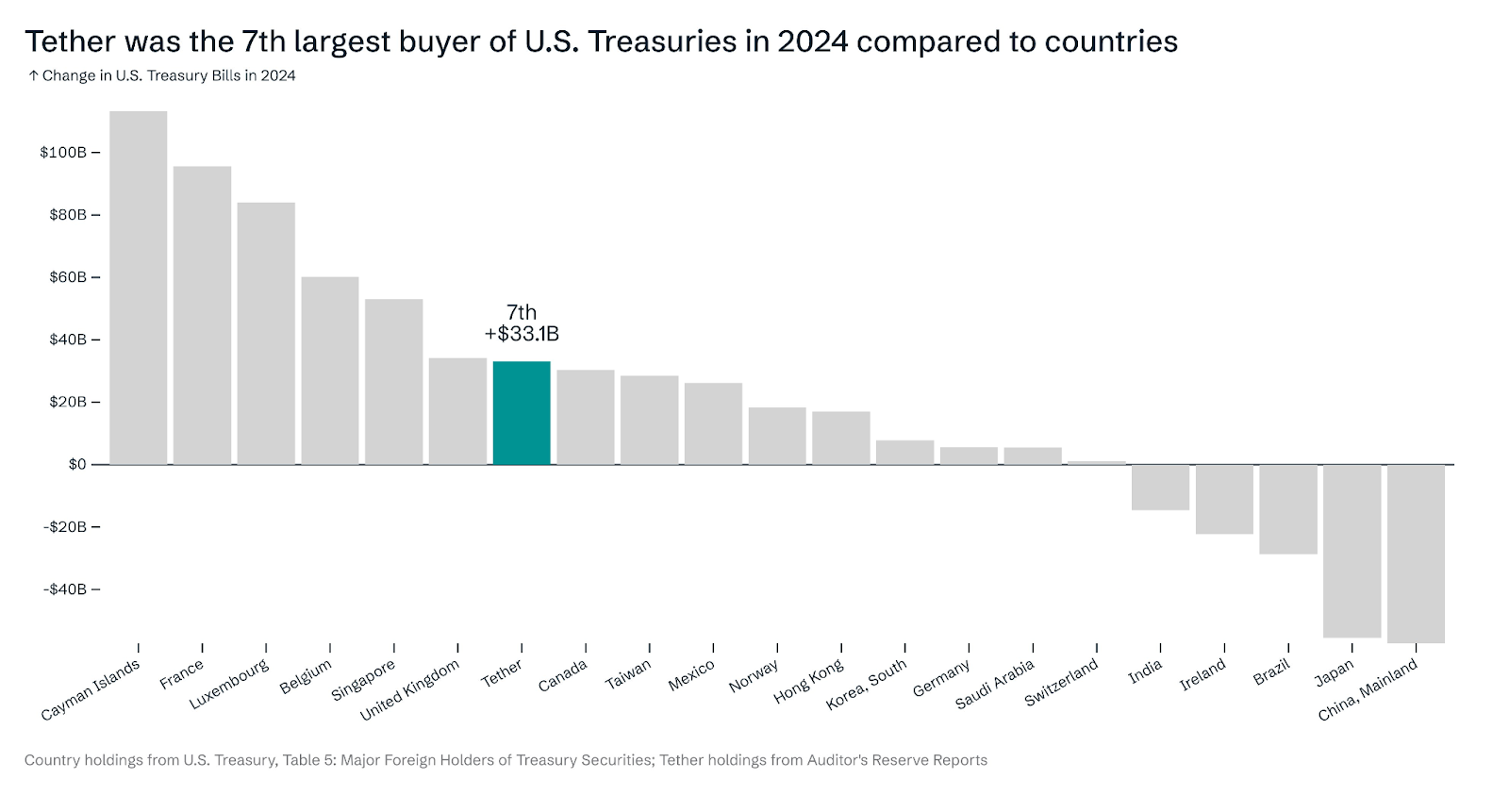

During 2024, Tether was the seventh-largest buyer of US Treasurys across all countries, surpassing Canada, Taiwan, Mexico, Norway, Hong Kong and numerous other countries, Cointelegraph reported in March 2025.

Source: Paolo Ardoino

Treasurys are debt securities issued by the US government, considered some of the safest and most liquid investments available worldwide. Tether invests in Treasurys as an additional reserve asset for its US dollar-pegged stablecoin.

Tether’s Treasury, Gold portfolio “almost offset” crypto market volatility losses for Q1 2025

Tether’s traditional reserve assets helped the stablecoin giant weather the downside volatility of the crypto market during the first quarter of 2025.

Tether reported over $1 billion in operating profit from “traditional investments” during the first quarter of the year, “driven by solid performance in its US Treasury portfolio, while the performance of Gold has almost offset the volatility in crypto markets,” according to the firm’s attestation report.

Growing clarity around US stablecoin regulations could lead to more investments in Tether’s dollar-denominated stablecoin, part of which will be used to further bolster the firm’s Treasury reserves.

The industry is currently awaiting progress on two pieces of legislation. The Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act currently awaits scheduling for debate and a floor vote in the House of Representatives, after it passed the House Financial Services Committee on April 2 in a 32-17 vote.

However, the Guiding and Establishing National Innovation for US Stablecoins, or GENIUS Act, stalled on May 8 after failing to gain support from key Democrats, some of whom voiced concerns about US President Donald Trump’s potential financial interest in clearer crypto regulations, due to his family’s digital asset ventures.

On May 14, at least 60 of the top crypto founders gathered in Washington, DC, to support the GENUIS Act, which seeks to establish collateralization guidelines for stablecoin issuers and requires full compliance with Anti-Money Laundering laws.