Monero Flips Pepe in Market Cap Showdown as Privacy Coin Hits 4-Year Peak

Privacy’s paying off—Monero just bulldozed past meme-coin darling Pepe after rocketing to its highest valuation since 2021. The stealth-capitalist’s crypto now commands more digital fiat than the frog-themed gamble token, proving once again that fundamentals occasionally matter between degens’ casino binges.

While traders chase the next vaporware shitcoin, XMR’s actual utility as a censorship-resistant asset keeps attracting buyers who prefer their financial history... nonexistent. Take that, surveillance economy.

Monero’s market capitalization soars to $6.43 billion

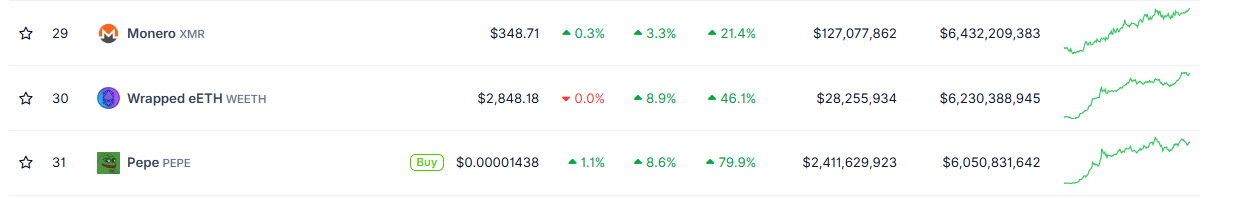

CoinGecko data show that Monero’s market capitalization reached $6.43 billion on Wednesday, surpassing that of the Pepe meme coin and currently taking the 29th position in the overall crypto market capitalization table.

The renewed interest and rising demand for privacy coins came at the end of April, when a massive transfer of 3,520 BTC, worth approximately $330.7 million, was potentially a theft. The funds were laundered through over six instant exchanges and swapped for Monero, which caused a sharp price spike in XMR due to the sudden demand, as explained in the previous report.

Monero’s market capitalization chart. Source: CoinGecko

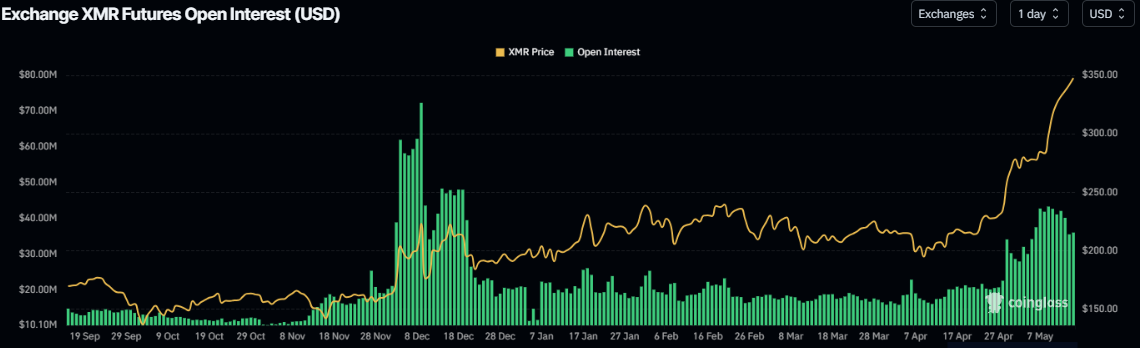

Monero’s on-chain metrics show strong buying interest and increased investor participation. CoinGlass’ data shows that the futures’ Open Interest (OI) in XMR has constantly risen since early May, reaching its highest year-to-date level. An increasing OI represents new or additional money entering the market and new buying, which could fuel the current XMR price rally.

XMR open interest chart. Source: Coinglass

Monero’s Price Forecast: XMR bulls aim for $356

Monero’s weekly chart broke above the key resistance level at $340.98 last week, continuing its five-weekly streak since early April. As this week begins, it continues its gain, reaching above $340, a level not seen since August 2021.

If XMR continues its upward trend, it could extend the rally toward at $356.59, which aligns with the 61.8% Fibonacci retracement level (drawn from the May 2021 high of $517.60 to the June 2022 low of $96.10).

The Relative Strength Index (RSI) on the weekly chart reads 80, above its overbought level of 70, pointing upward, indicating strong bullish momentum. However, traders should be cautious as the chances of a pullback are high due to the extremely overbought condition.

XMR/USD daily chart

If XMR faces a correction, it could extend the decline to retest its 50% price retracement level at $306.85.