Solana Still Playing Catch-Up? Sygnum Says Ethereum’s Crown Isn’t Shaken

Solana’s speed and low fees keep making headlines—but banking giant Sygnum just threw cold water on the ’flippening’ hype. Their latest analysis shows Ethereum still dominates where it counts: developer activity, institutional adoption, and that elusive thing called ’network effects.’

Sure, SOL pumps harder during memecoin seasons. But when the hype dies down, ETH’s ecosystem keeps building while Solana’s validators play whack-a-mole with outages. Maybe that’s why TradFi dinosaurs still treat Ethereum like digital gold—and Solana like a risky altcoin. (Then again, these are the same suits who thought CBDCs would revolutionize finance by 2023.)

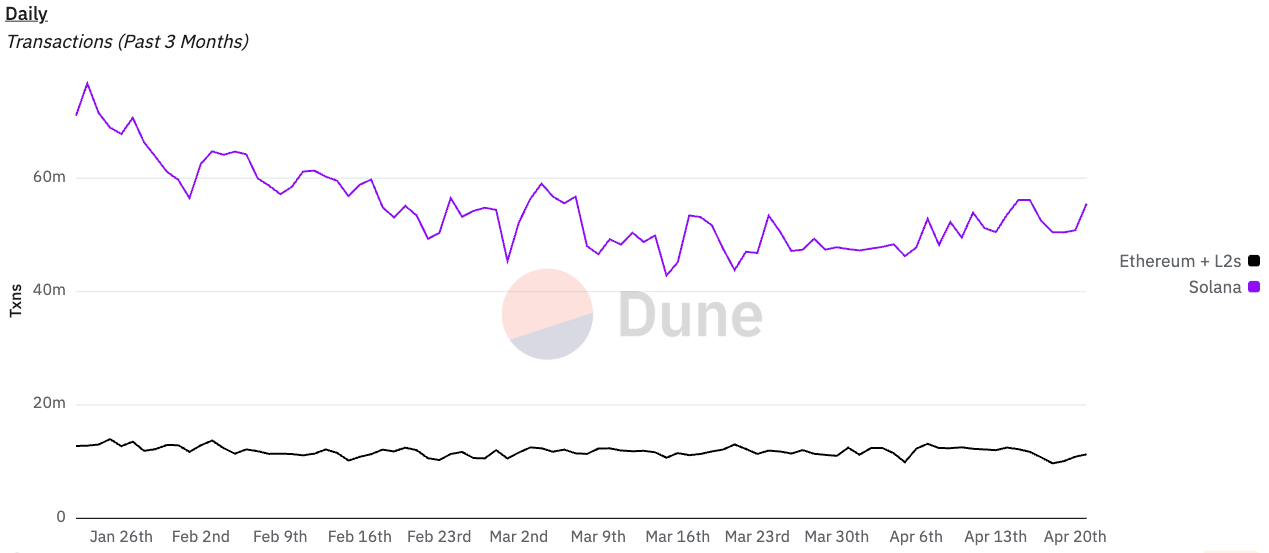

Transactions on Solana (purple) far exceed those on Ethereum and its LAYER 2s, but the latter has more value locked onchain. Source: Dune Analytics

Another factor is Solana’s tokenomics, which Sygnum said was “a comparable issue” to the criticism levelled at Ethereum over its mainnet’s stagnant transaction volumes due to it lowering the cost for its layer 2 networks.

The company said Solana is leading Ethereum in market share for layer-1 fee generation, but “most of the fees are paid to validators and do not grow the value of the Solana token.”

“In fact, when it comes to revenues, Ethereum still exceeds Solana 2- 2.5x,” Sygnum said.

It argued that Solana’s tokenomics are “easier to modify” than Ethereum’s scaling strategy. Still, it said that Solana “does not appear inclined to drive more value to the token,” as its community shot down a proposal to cut the SOL’s inflation rate in March.

Solana could gain with stable revenue focus

Sygnum noted that Solana, which some have hailed as an “Ethereum killer” that could challenge the network’s market share, could make some gains on the No. 2 blockchain.

The company said Ethereum has the dominant market share in “use cases that are showing traction” with support from governments, regulators, and traditional finance — such as tokenization, stablecoins, and decentralized finance.

However, it added that Solana had made progress in the amount of value locked on its decentralized finance protocols, and if it gains in “more stable revenue sources” such as tokenization and stablecoins, it could gain on Ethereum.

Sygnum added that Solana still has a strong backing, even with the Ethereum Foundation reshuffling its priorities to the layer 1 and recognising “the need to adjust its go-to-market strategy.”

However, that could give a sentiment tailwind to Ethereum as the blockchain’s “2-year-long underperformance vs Solana has been temporarily arrested” since the foundation’s pivot.