Bitcoin Breaks Toward $100K as Macro Winds Fuel Crypto Rally

BTC/USD surges toward six figures—because nothing says ’safe haven asset’ like a volatile digital token climbing on the ashes of traditional finance’s latest stumble.

Bullish momentum builds as traders shrug off regulatory noise and chase the psychological milestone. Meanwhile, Wall Street still can’t decide if crypto is a scam or its next revenue stream.

Key drivers: Liquidity pumps from central banks, institutional FOMO, and that classic crypto narrative—’this time it’s different.’

Watch for: A messy consolidation if ETF flows stall, or a parabolic blow-off top that’ll make the 2021 cycle look tame. Either way, hodl on tight.

BTC/USD

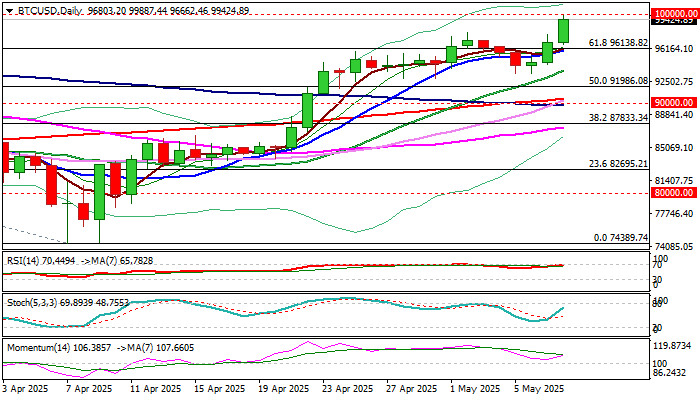

Bitcoin keeps firm tone and nears psychological 100K barrier as the latest bull-leg off 93352 (May 6 trough) extends into third consecutive day and continues to accelerate.

Easing trade concerns on signals of US-China negotiations and announcement of US-UK trade agreement, injected fresh Optimism in the markets and inflated Bitcoin price.

Bulls pressure 100K level, which naturally marks very significant barrier and is likely to produce strong headwinds to the latest rally.

Dips should be limited and mark positioning for further gains, in anticipated further de-escalation of trade tensions which WOULD improve positive environment.

Broken Fibo 61.8% of 109582/74389 pullback, reinforced by ascending 10DMA, offer solid support which should ideally contain dips and provide better levels to re-enter bullish market, guarding lower pivots at 93600 zone (former higher base).

Immediate barriers above 100K lay at 101/101250 zone (upper 20-d Bollinger band / Fibo 76.4%) with stronger bullish acceleration to eye 102600 and 106.400, violation of which to unmask new record high (109582) and round-figure 110K resistance.

100000; 101000; 101250; 102600.

97957; 96138; 93527; 91986.