Crypto Breaks $3 Trillion as White House Teases Game-Changing Trade Deal

Crypto markets just smashed another psychological barrier—flipping Wall Street’s favorite ’trillion’ metric into a bullish rally cry. The timing? Suspiciously convenient as DC prepares to unveil what’s either a landmark digital asset framework or another regulatory Rube Goldberg machine.

Behind the numbers: Retail FOMO meets institutional chess moves. Bitcoin’s holding above $70K, ETH’s DeFi ecosystem keeps printing, and even the usual meme-coin suspects are riding the liquidity wave. Meanwhile in Washington, whispers of ’bipartisan cooperation’ have crypto lawyers reaching for their emergency bourbon.

The punchline? When traditional finance starts leaking capital into crypto like a sieve, suddenly everyone’s a blockchain believer. Even the suits.

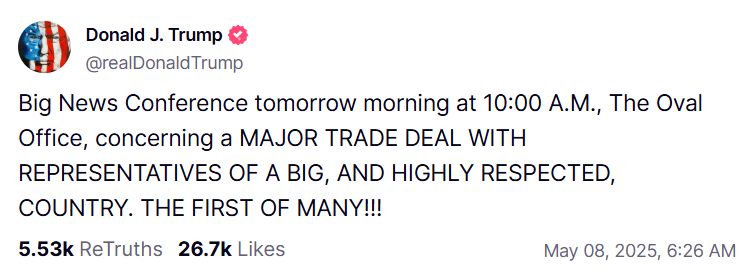

Trump announces major trade deal

US President Donald Trump announces on his Truth Social account that a “major trade deal” which would mark the first such agreement to be announced since he imposed tariffs on dozens of America’s trading partners.

Trump said on the Truth Social platform that he would hold a news conference at 10:00 in Washington, DC (15:00 BST), to announce an agreement with "representatives of a big, and highly respected, country."

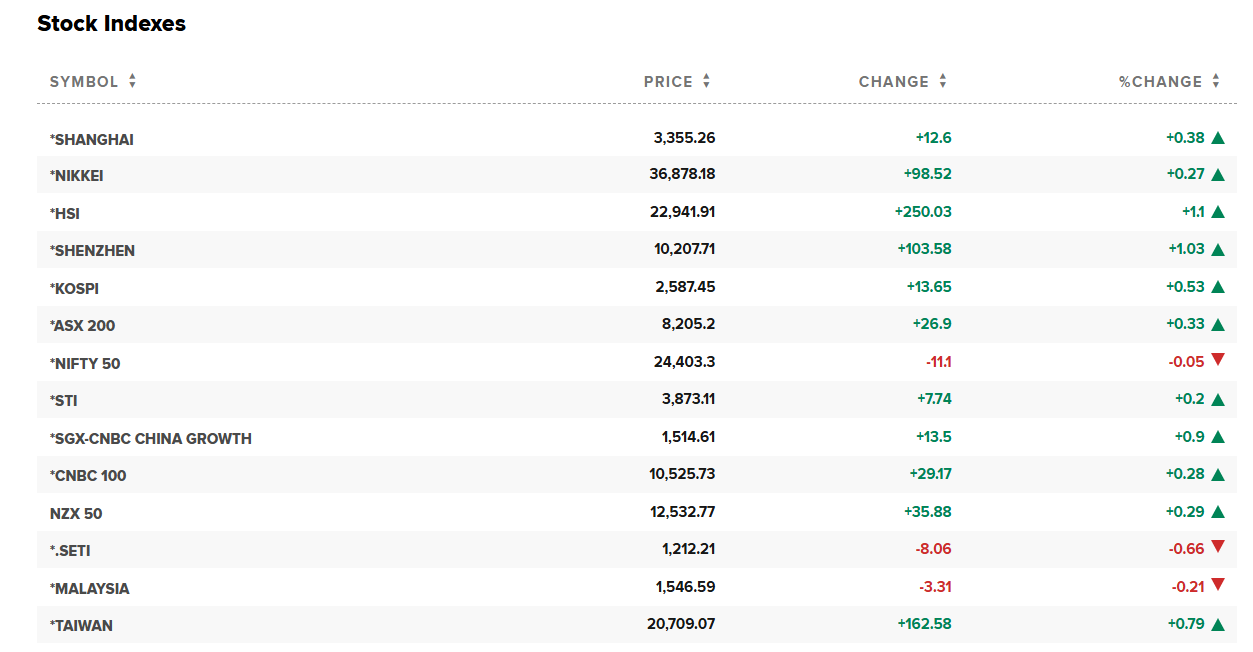

This news announcement had a positive reaction for the Asian equity markets, which traded green on Thursday. The tariff deals with major countries would ease the ongoing uncertainty in the global economy. The crypto market also reacted positively to this news as Bitcoin reached above $99,000 during the early Asian trading session.

Asian Markets chart

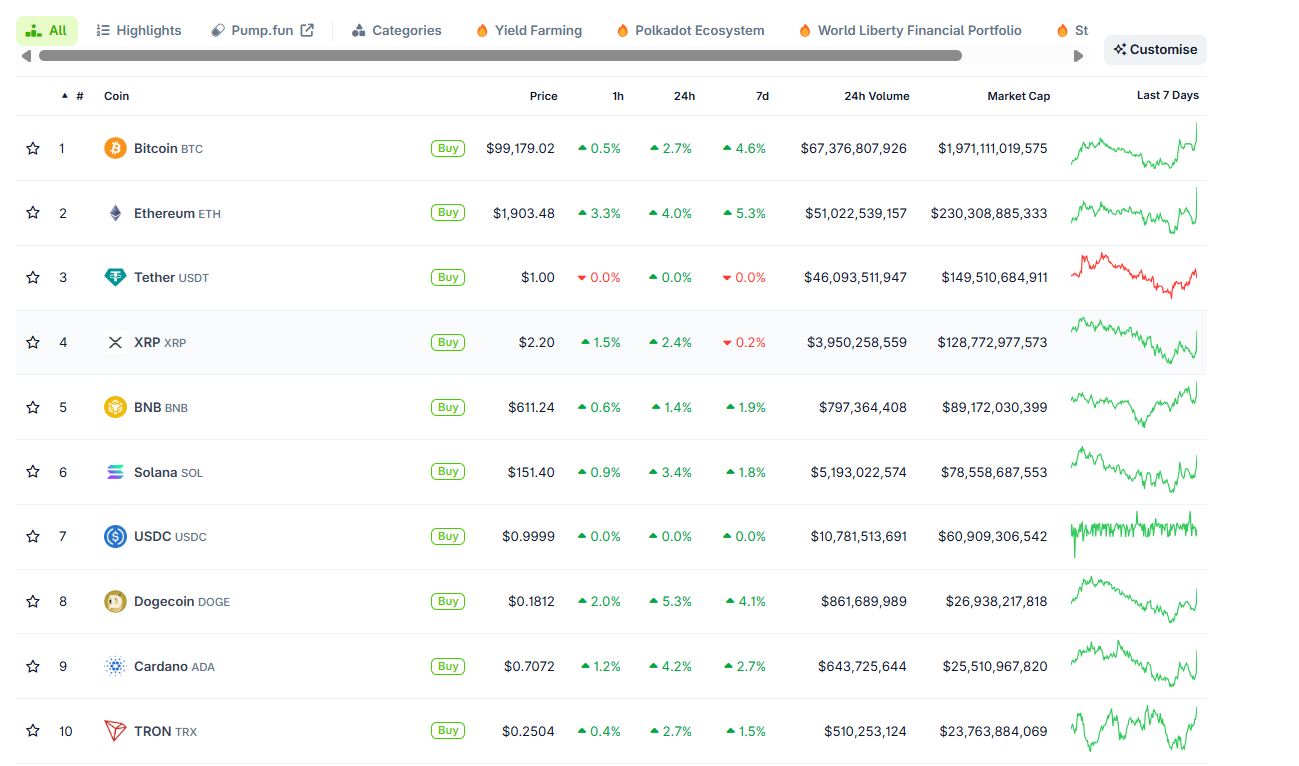

Crypto market cap reaches $3 trillion and wipes out 71% of short positions

The total cryptocurrency market capitalization reached above $3 trillion on Thursday, as shown in the chart below.

CoinGecko data shows that the top 10 cryptocurrencies trade in green during the early Asian session.

Top 10 cryptocurrencies chart. Source: CoinGecko

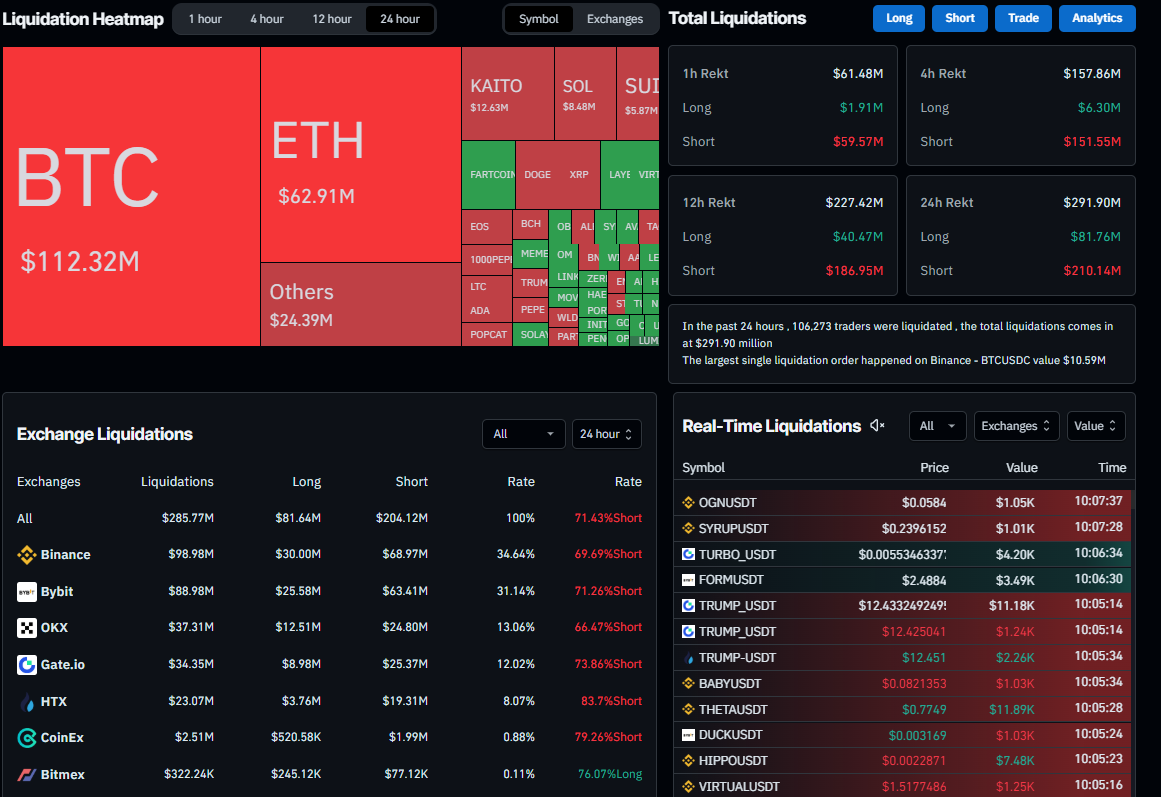

These gains in market value reflect a broader risk-on sentiment due to the ease of tariff uncertainty, which triggered a wave of liquidation. According to the CoinGlass Liquidation Map chart, in the last 24 hours,106,273 traders were liquidated, out of which 71.43% were Leveraged short positions. The total liquidations came in at $291.90 million. The largest single liquidation order happened on Binance - BTCUSDC value $10.59 million.

Liquidation Heatmap chart. Source: Coinglass