Bitcoin shrugs off Fed’s rate freeze as crypto markets yawn

Another day, another non-move from the Fed—and digital assets just keep doing their thing. While traditional traders hyperventilate over every basis point, crypto’s decentralized heartbeat barely flutters.

The irony? Wall Street still thinks its rate decisions move markets. Meanwhile, Bitcoin’s 24-hour volatility makes the S&P look like a retirement home bingo night.

Here’s the real takeaway: When your asset class matures beyond reacting to legacy finance’s puppet strings, that’s when you know you’ve won. The suits will catch up eventually—probably around the next halving.

Bitcoin sees slight gain after Fed decision to leave rates steady

The Federal Reserve kept interest rates unchanged at 4.25% to 4.50% in May, in line with market expectations. Market participants have highly anticipated the decision, following weeks of tension surrounding the US economy.

Fed Chair Jerome Powell stated in a press conference that the economy is still in good condition despite recent uncertainties. He also shared that the FOMC’s decision allows the agency to observe economic developments properly.

"We believe that the current stance of monetary policy leaves us well positioned to respond in a timely way to potential economic developments," Powell stated.

Powell emphasized that trade policy remains a major source of uncertainty, reinforcing the Fed’s cautious approach. He added that it’s still unclear how things will unfold, particularly with tariff policies, while stressing the importance of remaining patient and observant in the current environment.

"I think there’s a great deal of uncertainty about, for example, where tariff policies are going to settle out," Powell said.

The decision follows recent criticism from President Donald Trump over the Fed’s reluctance to lower interest rates. Trump called Powell "too slow" and highlighted that cutting rates is best for the economy.

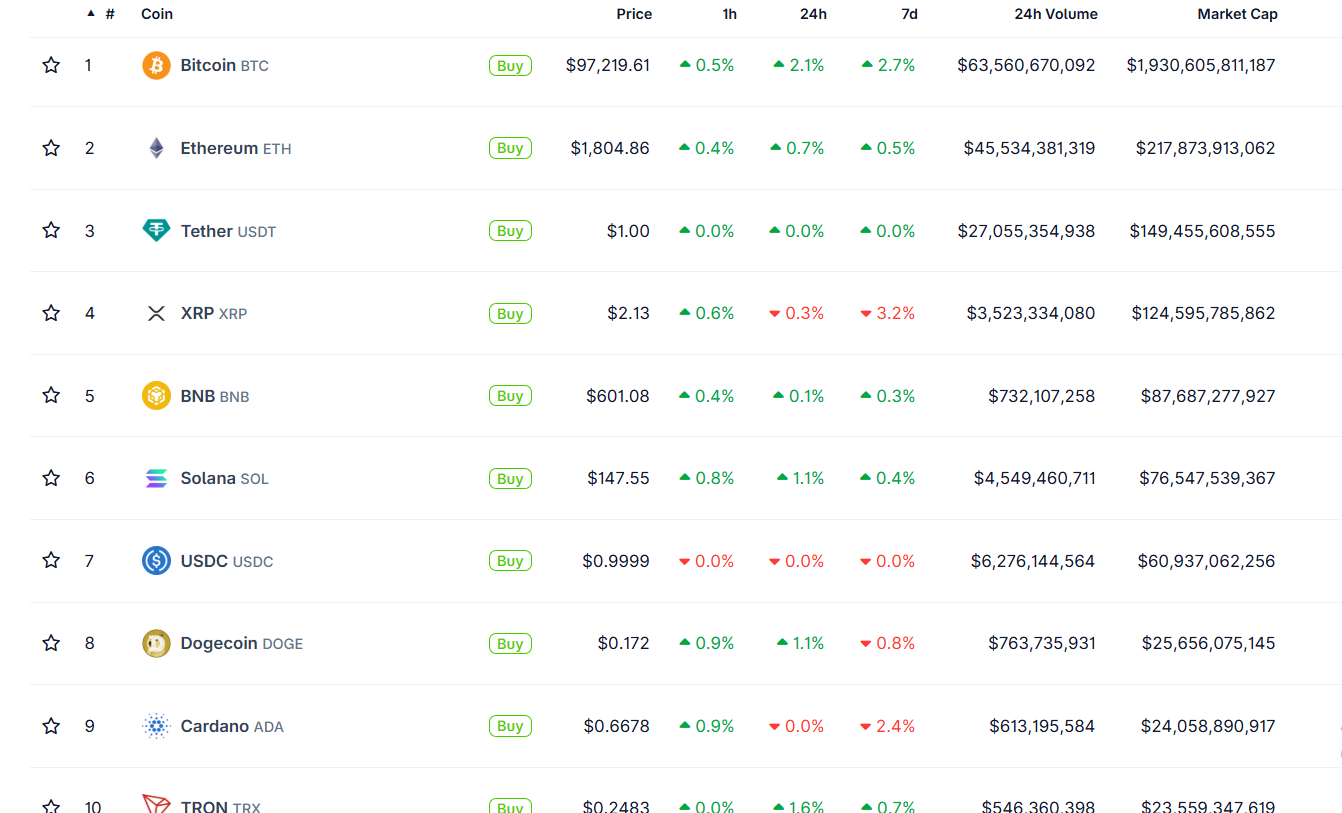

Bitcoin traded above $97,000 on Wednesday, maintaining a 2% gain as the crypto market remained unfazed following the Fed’s decision. Other top assets, Ethereum (ETH), XRP, Solana (SOL) and Dogecoin (DOGE), also held steady with little price changes.

Top Cryptocurrencies. Source: CoinGecko

Several sectors witnessed mixed reactions following the FOMC meeting, as many failed to retain gains from earlier in the day. The Artificial Intelligence (AI) and DePIN sectors dipped 3% while the real-world asset (RWA) and meme coin categories remained fairly muted.