Bitcoin Eyes $250K as Saylor’s AI Gambit Accelerates BTC Rally

MicroStrategy’s Michael Saylor just placed an AI-powered bet that could turbocharge Bitcoin’s ascent. His latest playbook—leveraging artificial intelligence to optimize BTC accumulation—signals institutional adoption is entering hyperdrive.

Meanwhile, altcoins Hyperliquid (HL) and Litecoin (LTC) show diverging trajectories. HL’s derivatives infrastructure gains traction among degens, while LTC’s payment-focused roadmap struggles for relevance against Layer 2 solutions.

European traders remain cautiously bullish, though one Frankfurt-based hedge fund manager quipped: ’Crypto winters come and go, but the blockchain grift machine never sleeps.’

Bitcoin tests may high ahead of the FOMC rate decision – Could BTC break out regardless?

Bitcoin has risen 2.8% over the past 24 hours, testing the upper bounds of the recent consolidation range within which it has traded over the past 2 weeks. It’s worth noting that Bitcoin’s previous consolidation phase in April lasted 2 weeks before a sharp move higher.

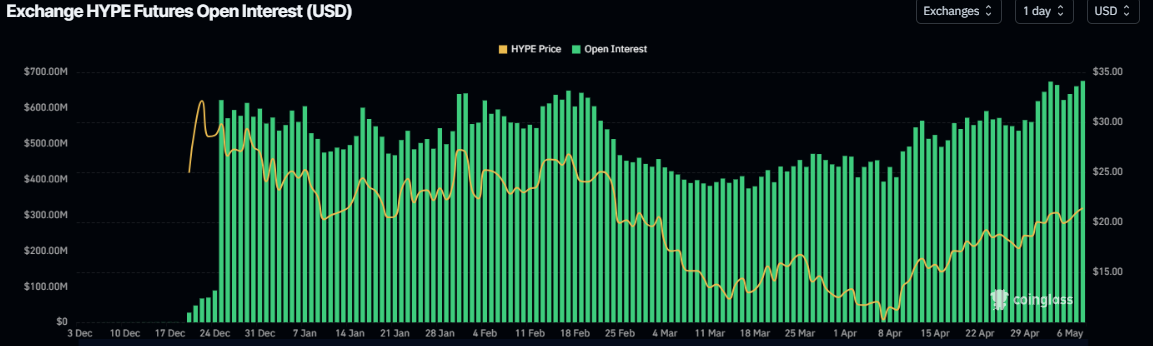

Hyperliquid Price Forecast: HYPE bulls aim for the $25 mark as open interest reaches a new all-time high

Hyperliquid (HYPE), the decentralized perpetual trading platform and Layer 1 blockchain, edges higher and trades around $21.20 at the time of writing on Wednesday after rebounding nearly 6% so far this week. CoinGlass data shows HYPE Open Interest (OI) reaches a new all-time high of $697 million, suggesting a bullish outlook. Moreover, Ethena Labs launched USDe stablecoin on Hyperliquid on Monday, bringing the Dollar-pegged asset to a fast Decentralized Finance (DeFi) and derivatives hub.

Litecoin price runs into 6.83 million LTC resistance cluster as open interest expands

Litecoin (LTC) price gains bullish momentum, extending the previous day’s positive move to trade at $92 at the time of writing on Wednesday, as markets gauge the potential impact of the Federal Reserve’s (Fed) interest rates decision during the American session. Although the central bank is expected to leave the rates unchanged at the 4.25%-4.5% range, the Fed Chair Jerome Powell’s comments would expand on the policy amid thawing trade tensions. Planned trade talks between the United States (US) and China could give insight into the market’s direction later this week.