BNB Chain Goes Full AI—And Binance Coin Breaks Out

BNB Chain just dropped a plug-and-play AI integration—no coding PhD required. Cue the ’decentralized future’ buzzword bingo.

Price action? Binance Coin sliced through resistance like a hot wallet draining a memecoin gambler’s funds. Technicals now flashing bullish as traders pile in.

Funny how these ’game-changing’ upgrades always coincide with pumps. But hey, at least this one might actually ship.

BNB Chain launches plug-and-play AI integration with MCP

Binance Chain is tapping into the fast-growing intersection between AI and blockchain by adding plug-and-play integration utilizing the Model Context Protocol (MCP). The move is designed to unlock the larger ecosystem, including BSC and opBNB for AI agents.

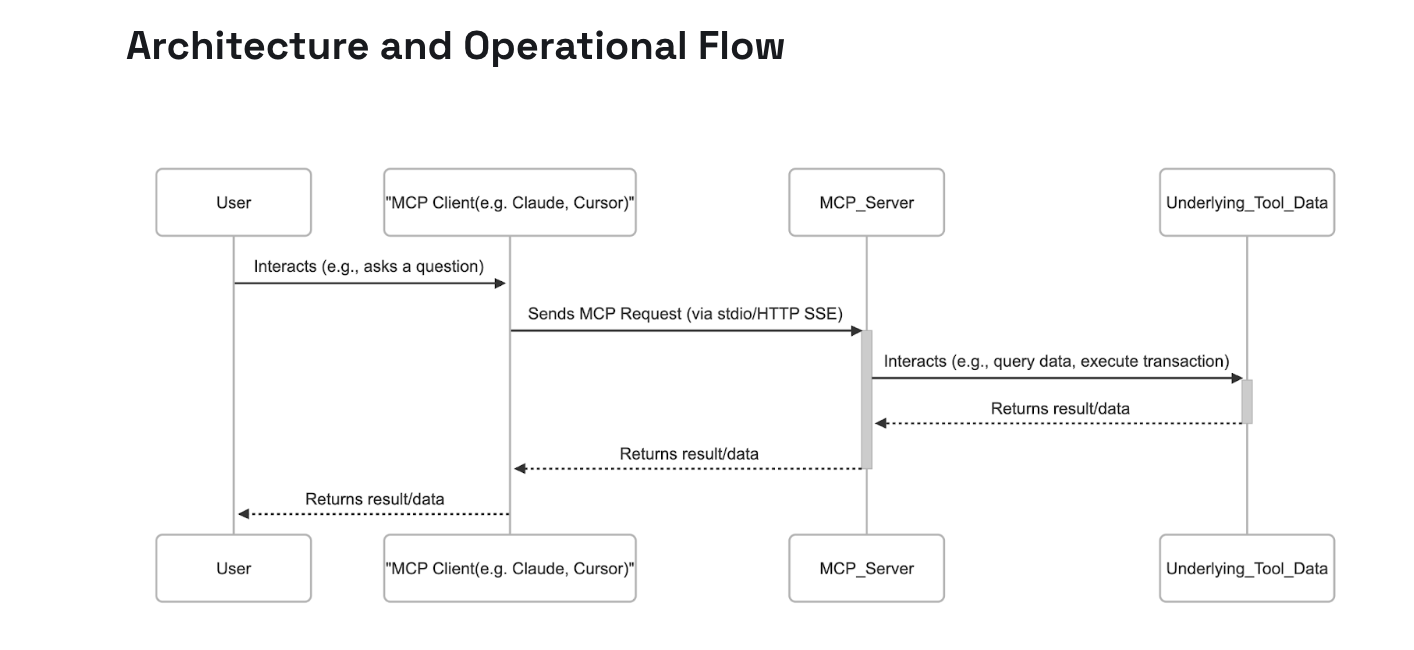

The MCP is an open standard that streamlines secure, two-way communication between AI applications – acting as hosts or clients – and external systems like servers that supply data or tools.

“It replaces bespoke integrations with a unified approach, making it easier for AI to get the context and capabilities needed for relevant actions and responses,” BNB Chain said in a blog post.

BNB chain AI integration with MCP | Source: BNB Chain

The BNB AI integration is critical for Machine Learning (ML) models analyzing complex and high-stakes data across the decentralized finance (DeFi), trading, and security sectors.

Moreover, MCP is adopted to solve real crypto challenges like enhancing blockchain security and enabling reproducible and auditable trading and DeFi strategies. At the same time, MCP exists beyond the BNB Chain, ensuring seamless infrastructure in the context of the broader Binance ecosystem’s AI strategy.

BNB price teeters at the edge of a breakout

BNB price holds below the 50-day Exponential Moving Average (EMA) at $600, coinciding with an extended descending trendline resistance from December. The Relative Strength Index (RSI) indicator’s rebound, from the previous day’s low at 42.97 to the midline, signifies growing momentum and confidence in the token’s recovery.

A break above the 50-day EMA and the trendline resistance would cement the bullish outlook, with a subsequent step past $612, a confluence level formed by the 200-day EMA and the 100-day EMA, encouraging traders to buy BNB, anticipating a stronger uptrend. Beyond the moving averages, BNB could test resistance at around $640, as marked in red on the daily chart below.

BNB/USDT daily chart

However, the token’s position below all three moving averages could complicate matters for the bulls, as downside risks will likely increase.

The descending trendline has remained unbroken for five months, which could hinder the anticipated breakout. On the downside, tentative support areas lie at this week’s low NEAR $580 and April’s low at $520.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.