XRP Braces for Turbulence as Ripple Kills Quarterly Reports—Traders Eye Exit Doors

Ripple just axed its eight-year tradition of quarterly transparency reports—right when XRP holders needed clarity most. The move reeks of ’nothing to see here’ as the altcoin flirts with key support levels.

Market watchers now face a coin with dwindling institutional signals and retail bagholders left parsing CEO Brad Garlinghouse’s tweetstorms for clues. Another masterclass in crypto ’accountability.’

Technical charts show XRP clinging to the $0.50 psychological level like a drunk to a lamppost—more for support than illumination. Bulls argue this is healthy consolidation; bears see yet another dead cat bounce before the drop.

Ripple discontinues quarterly report amid evolving market dynamics

According to the company’s first-quarter report, Ripple’s quarterly report has long served as a tool to offer transparency on its XRP holdings while delivering timely updates on the crypto markets and the XRP ecosystem.

Despite championing transparency and open communication, Ripple believes the report has not achieved its intended purpose. The blockchain company behind the Ripple USD (RLUSD) stablecoin claims that the report has been used against it, "most notably by the former Securities and Exchange Commission (SEC) leadership."

Ripple will no longer release the report starting in the second quarter but promises to communicate transparently about the company, XRP and related projects through its official channels.

The first quarter report highlights the growing institutional demand for XRP-related products. Institutions like Franklin Templeton filed the S-1 form with the SEC seeking approval to operate a spot XRP Exchange Traded Fund (ETF). Additionally, CME Group listed XRP futures, underscoring growing institutional interest and engagement.

The SEC withdrew its appeal against Ripple in the first quarter, signaling a likely end to the longstanding lawsuit – a win for the broader cryptocurrency industry. Moreover, Ripple acquired Hidden Road, a brokerage firm, for $1.25 billion, driving more institutional use cases for RLUSD and XRPL.

"XRP exchange-traded products continued to gain traction globally, with increased listings and inflows. XRP-based investment products outperformed their Bitcoin and Ethereum counterparts, recording $37.7M in inflows and bringing their year-to-date total to $214M — just $1M shy of overtaking global Ethereum funds," Ripple states in the first quarter report.

XRP’s uptrend falters as downside risks emerge

XRP price sits below the 12-hour 50, 100 and 200 Exponential Moving Averages (EMAs), highlighting a sticky, bearish environment. Attempts to break above the descending trendline, as shown on the 12-hour chart below, have left more long traders liquidated.

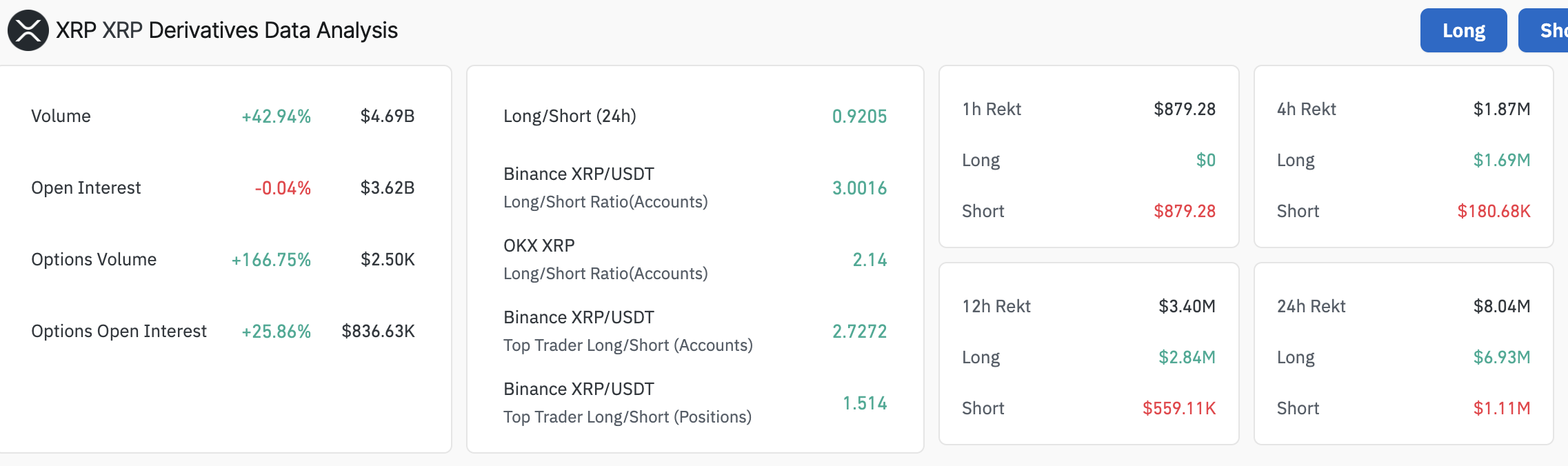

CoinGlass data reveals that out of the $8 million liquidations over the past 24 hours, $6.93 million comprised forcibly closed long positions. This signals that a stronger bearish momentum is in play, with over-leveraged bulls bearing the biggest brunt.

The relatively flat Open Interest (OI) at $3.62 billion suggests a lack of new buying interest to absorb the selling pressure from liquidations, potentially leading to further XRP price declines.

XRP derivatives’ data | CoinGlass

The Relative Strength Index (RSI) indicator’s sharp drop from a recent peak of 65.43 to the current position at 39.56 upholds the bearish outlook. Further dips toward the oversold region could create instability amid potential panic-selling from traders. Losses below $2.00 could accelerate toward the April 7 low at $1.62.

XRP/USDT daily chart

On the other hand, traders cannot rule out the possibility of an immediate reversal, especially if support at $2.00 holds and provides liquidity for the next run-up. Subsequent breaks above the 50 EMA at $2.17, the 100 EMA at $2.19, the 200 EMA at $2.21 and the descending trendline could shake off the bearish pressure and resume the anticipated rally eyeing $3.00.

Ripple FAQs

What is Ripple?

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

What is XRP?

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

What is XRPL?

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

What blockchain technology does XRP use?

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.