Litecoin ETF Showdown: SEC Opens Public Comment Period for Canary’s Bid—Will LTC Price React?

Wall Street’s latest crypto flirtation kicks into high gear as the SEC invites public input on Canary’s proposed Litecoin ETF. The move signals growing institutional interest—or just another paperwork shuffle before the inevitable ’concerns about investor protection’ rejection.

Market watchers brace for volatility: LTC price action could swing wildly on regulatory whispers, proving once again that crypto markets run on hopium and regulatory roulette. Meanwhile, Bitcoin ETF issuers quietly adjust their tie knots, wondering if altcoins are stealing their spotlight.

Key factors to watch: Grayscale’s legal team probably already drafting their next lawsuit, while retail traders FOMO into LTC calls. Because nothing says ’mature asset class’ like betting your rent money on a regulatory filing.

SEC opens pubic comment window on Canary’s Litecoin ETF application

The US Securities and Exchange Commission (SEC) has officially opened a public comment request on the proposed spot Litecoin ETF filing by Canary Capital.

The SEC’s latest move follows the regulator’s decision to delay verdicts on active altcoin ETF filings until June 17.

🚨NEW: @JSeyff nailed it with the delay.

The agency has indeed delayed making a decision on @CanaryFunds’ $LTC ETF, and is now seeking public comment on whether the proposal to list the ETF complies with regulatory requirements, particularly in preventing fraudulent and… https://t.co/tIqabeOpQ6 pic.twitter.com/9Zgw1xZeA6

During the formal comment period, the SEC seeks to obtain public input on whether listing the ETF complies with regulatory standards.

The Commission is particularly focused on evaluating the ETF’s ability to prevent fraudulent and manipulative practices.

Public comments are due by May 26, with rebuttals to follow by June 9, before the final verdict date on June 17.

Altcoin ETFs remain in regulatory limbo amid market volatility

The agency previously designated May 5 as the final date for acting on the LTC proposal, before opting last week to extend the timeline to June 17.

This SEC’s delay triggered short-term price dips across top altcoin markets with ETF filing under review, including Solana (SOL), Dogecoin (DOGE), Avalanche (AVAX), XRP, and Aptos (APT).

Yes, the SEC just punted on a bunch of alt coin ETF filings including Litecoin, Solana, XRP & DOGE. It’s expected as this is standard procedure & Atkins hasn’t even been confirmed yet. This doesn’t change our (relatively high) odds of approval. Also note that the final deadlines…

— James Seyffart (@JSeyff) March 11, 2025The public comment window announcement from the SEC allays fears regulatory skepticism, as many investors initially feared.

Amid the uncertainty, Bloomberg ETF analyst James Seyffart had maintained in March that the SEC’s delay do not change "relatively high" approval odds, referencing the SEC’s typical review process under Rule 19b-4.

This rule allows the Commission to extend review periods or request additional data before finalizing ETF decisions.

What’s next for Litecoin price and ETF prospects?

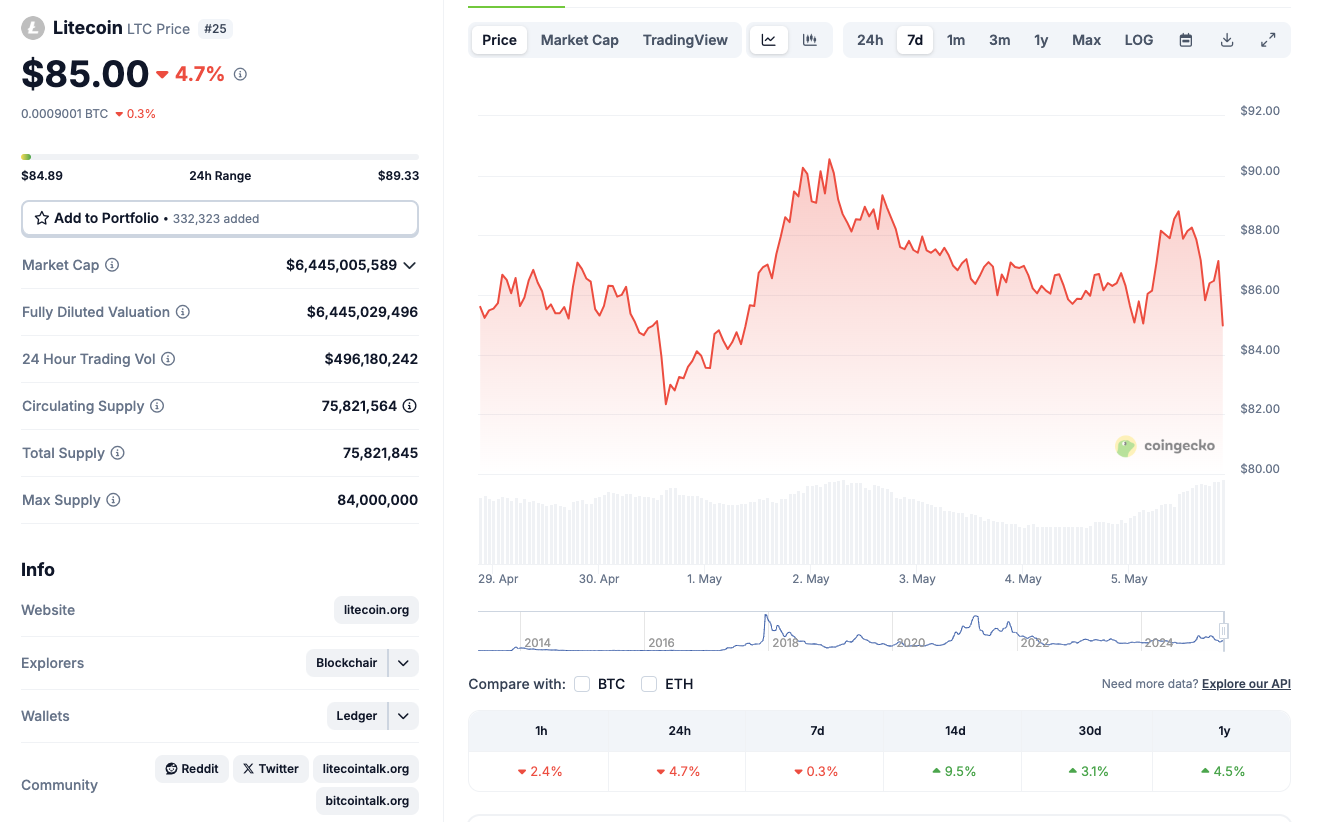

At press time on Monday, Litecoin (LTC) price was trading down 4.7%, tumbling below the $85 level. Zooming out to longer-time frames, LTC remains relatively resilient, showing a 3.1% gain over the past 30 days and a 4.5% increase year-over-year.

Litecoin price action, May 5, 2025 | Source: Coingecko

The intense LTC price volatility is expected to continue as the ETF comment period begins.

Should public commentary remain favorable and no significant objections arise, the SEC may approve the rule change after June 9.

Until then, strategic investors will likely track both LTC price fluctuations and regulatory developments closely, as ETF approval could emerge as a catalyst for the next major directional move.

LTC Price Forecast Today: ETF update could spark rebound toward $91 zone

Litecoin (LTC) price hovers around $83.16 following a modest pullback, yet signs of a potential rebound are quietly forming.

Despite a 2.22% decline on the day, the technical setup suggests bulls may soon regain momentum, particularly if sentiment around the ETF comment period improves.

The optimistic LTC price outlook is currently supported by the 50-day simple moving average (SMA) at $82.32, with a key resistance target near the 100-day SMA at $83.49.

These levels are converging, creating a short-term decision point for traders as the SEC’s public commentary window for the Canary LTC ETF approaches.

Litecoin (LTC) Price Forecast Today | Source: Coingecko

On the momentum side, the Moving Average Convergence Divergence (MACD) shows a weakening bullish crossover, but histogram bars are still in positive territory. This signals that while upward momentum has paused, it hasn’t reversed decisively.

A bullish resurgence in MACD above the 1.00 mark would likely confirm a renewed uptrend, placing $89 to $91 as immediate upside targets. Conversely, if MACD declines below the signal line at 0.61, sellers could push LTC toward the next support at $80.

The stochastic signal on the chart flashed a sell trigger two sessions ago, aligning with the recent retracement, but if Litecoin can close back above $84.00, the signal may be short-lived.