$58M Token Unlock Threatens to Rock Ethena and Movement Markets

Volatility alarms sound as two major crypto projects approach cliff-like token releases.

Ethena and Movement brace for turbulence—just when traders thought macro conditions couldn’t get more unpredictable.

Bonus jab: Another day, another ’scheduled’ liquidity dump dressed up as ’ecosystem development.’ How very decentralized.

Ethena and Movement token unlocks could spell doom

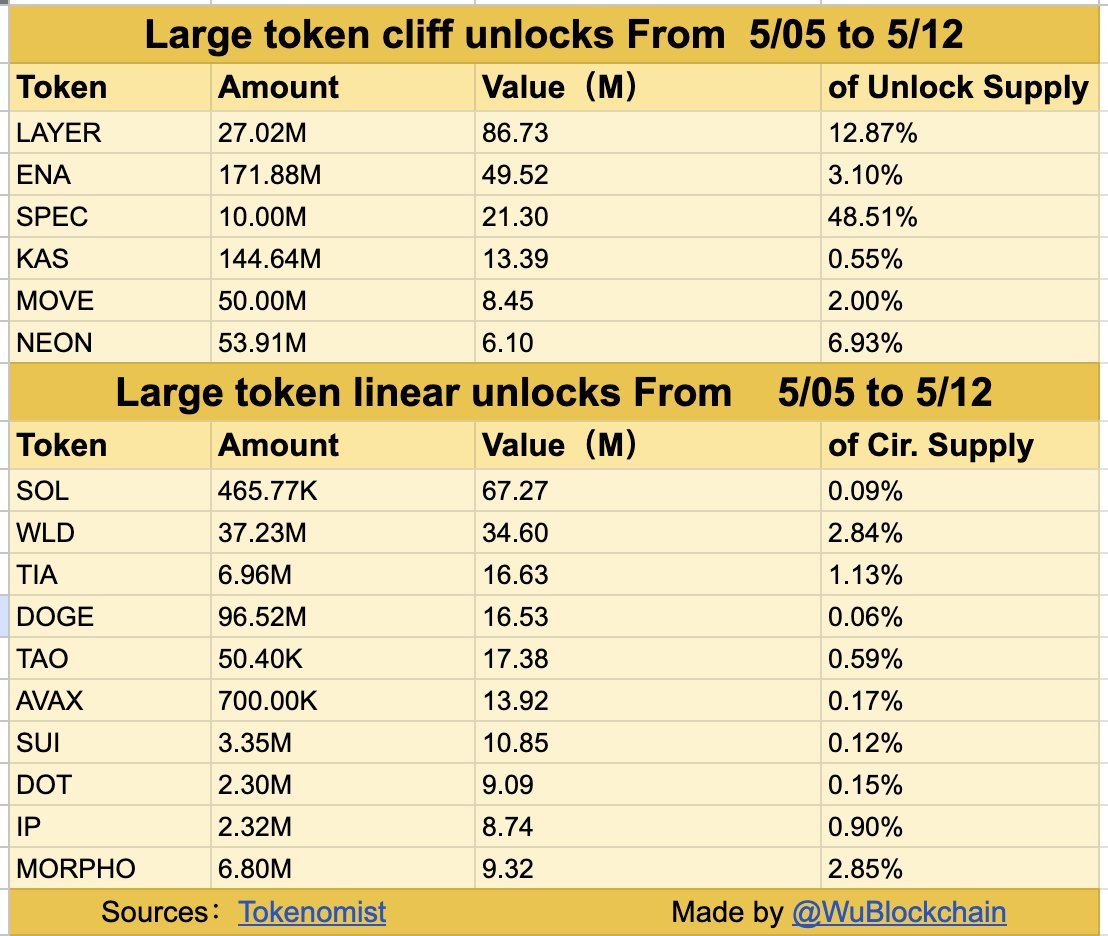

Ethena and Movement are among the tokens bracing for significant token unlocks between Monday and May 12, which have the potential to shake up their respective market dynamics.

The Ethena network will release 171.88 million tokens, valued at approximately $49.52 million, amounting to 3.1% of ENA’s circulating supply.

Meanwhile, Movement will unlock 50 million tokens, worth around $8.45 million, which accounts for 2% of its circulating supply. Combined, the two cliff tokens unlock a total of $58 million.

Cliff unlocks refer to significant events where a large batch of tokens is released into circulation, increasing liquidity and potentially paving the way for volatility and bearish momentum if the recipients of the tokens, who could be early investors or team members, cash out on the open market.

Weekly token unlocks | Source: Tokenomist

The 3.10% supply increase for Ethena can potentially change the token’s dynamics and possibly create instability. In the first quarter, a large 2.07 billion token unlock, worth roughly $728 million, triggered an 18% price drop for the token to $0.3476 in 24 hours. The upcoming unlock, although significantly smaller than the previous one, still poses a risk, especially if demand is insufficient to absorb the new supply.

Similarly, Movement’s 2% supply increase could impact MOVE’s price as the token is still relatively new in the ecosystem, which could translate to high sensitivity to supply shocks. Moreover, if traders sell ahead of the unlocks, any decline could prove larger than expected.

Besides Ethena and Move, other tokens facing upcoming cliff unlocks include Solayer (LAYER), Spectral (SPEC), Kaspa (KAS) and NEON. Additionally, significant linear unlocks (daily unlocks surpassing $1 million) expected during the week include Solana (SOL), Worldcoin (WLD), SUI, Polkadot (DOT), IP (Story), and MORPHO. According to Wu Blockchain, “the total value of unlocked tokens is projected to exceed $389 million.”

In the next 7 days, major one-time token unlocks (with unlock amounts exceeding $5 million) will include projects such as LAYER, ENA, SPEC, KAS, MOVE, and NEON. Additionally, significant linear unlocks (daily unlocks exceeding $1 million) are expected for SOL, WLD, TIA, DOGE,… pic.twitter.com/i7REIHk5mK

— Wu Blockchain (@WuBlockchain) May 5, 2025Ethena’s price recovery elusive

Ethena’s price hovers at $0.29 at the time of writing on Monday, up nearly 3% on the day. Its recovery from the tariff shocks in April was rejected by the 50-day Exponential Moving Average (EMA) around $0.36, which slashed gains before starting a fresh rebound from $0.28 support.

The token’s position below the 50-day, 100-day, and 200-day Exponential Moving Averages (EMA) underscores the growing downside risks. This weak technical structure and the upcoming cliff token unlock could trigger extended losses toward September lows at $0.20.

ENA/USDT daily chart

Movement’s downside risks persist

Movement exchanges hands at $0.17 at the time of writing, down roughly 2% on the day. Any recovery has been elusive for the token amid heightened volatility, especially after Coinbase announced last week that it will delist it on May 15.

Movement Labs, the company behind MOVE, has come under scrutiny regarding allegations of market manipulation and insider trading. Following the delisting announcement, MOVE dropped 20%, while its market capitalization plummeted below the $500 million mark.

MOVE/USDT daily chart

The Relative Strength Index (RSI) indicator is now flat at an oversold 30, reflecting intense bearish momentum. With a 2% supply increase looming, any recovery seems unlikely in the coming sessions.

Cryptocurrency prices FAQs

How do new token launches or listings affect cryptocurrency prices?

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

How do hacks affect cryptocurrency prices?

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

How do macroeconomic releases and events affect cryptocurrency prices?

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

How do major crypto upgrades like halvings, hard forks affect cryptocurrency prices?

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.