Crypto Markets Stage Elliott Wave Rebound—Just in Time for Traders to FOMO Back In

After months of bleeding out, digital assets are flashing green again. The Elliott Wave pattern suggests this isn’t just a dead cat bounce—but skeptics warn Wall Street’s algo-traders will pump-and-dump retail (again).

Key levels to watch: Bitcoin’s 200-day MA just got reclaimed, while Ethereum tests critical resistance. Meme coins? Still a casino—but hey, the house always wins.

Bonus cynicism: If history rhymes, this ’recovery’ will last exactly until the Fed’s next policy meeting.

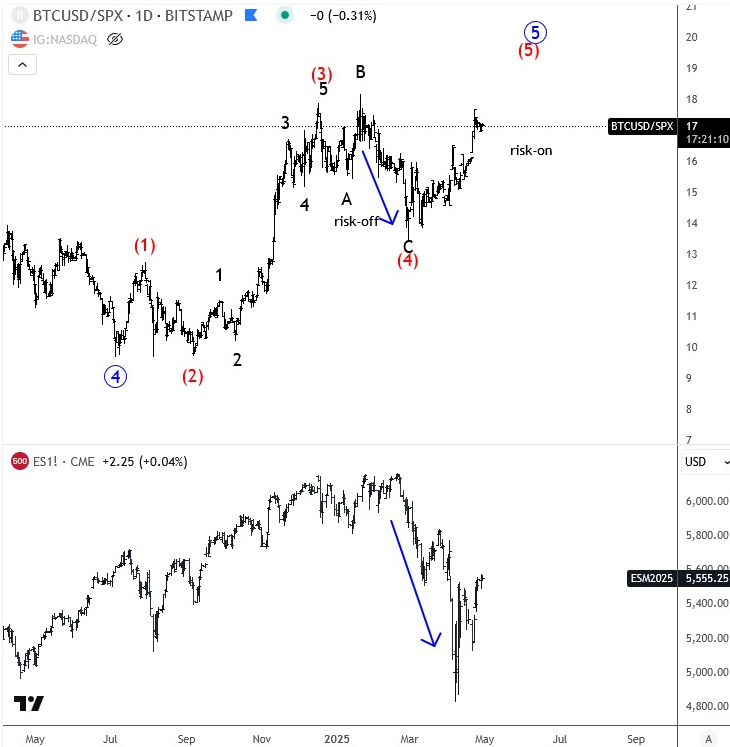

In terms of uncertainty or when we have a risk-off environment, we can obviously expect that cryptocurrencies will make a sharper retracement because they are much riskier assets than stocks and much more volatile. So typically, in a risk-off environment, when both Bitcoin and the stock market are trading to the downside, Bitcoin tends to lose much more value. But whenever there is a risk-on environment, Bitcoin can do well, especially when investors show confidence that the market has bottomed. So far, we can see that Bitcoin is doing pretty well now while the S&P 500 has bottomed around 5000. The Bitcoin-stock market ratio is pointing higher into wave five, so it looks like this current risk-on sentiment can resume and investors may have much more interest in cryptocurrencies in the near future while stocks are trading above the April lows.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.