Tether’s Bitcoin Treasury Surges Past 100,000 BTC—While Hoarding 7.7 Tons of Physical Gold

Tether just crossed a major milestone—its Bitcoin reserves now exceed 100,000 BTC, worth billions at current prices. Not content with digital dominance, the stablecoin issuer is also sitting on a mountain of physical gold—7.7 metric tons of it—because why trust central banks when you can literally stack the shiny stuff?

The move signals deepening institutional conviction in Bitcoin as a reserve asset—even as regulators keep squawking about volatility. Meanwhile, that gold stockpile? Enough to make a Wall Street commodity trader blush. Guess someone’s hedging against the ’stable’ in stablecoin.

Funny how the company behind crypto’s most-used dollar peg is quietly building a war chest fit for a bond villain. Just don’t call it a hedge fund—this is ’risk management,’ folks.

Tether’s Bitcoin and physical Gold stash is growing

Stablecoin issuer Tether generated nearly $14 billion in profits in 2024. A report from Pirate Wires identifies Tether as the most highly profitable firm in the world, per employee, generating nearly $93 million in profit per employee in 2024.

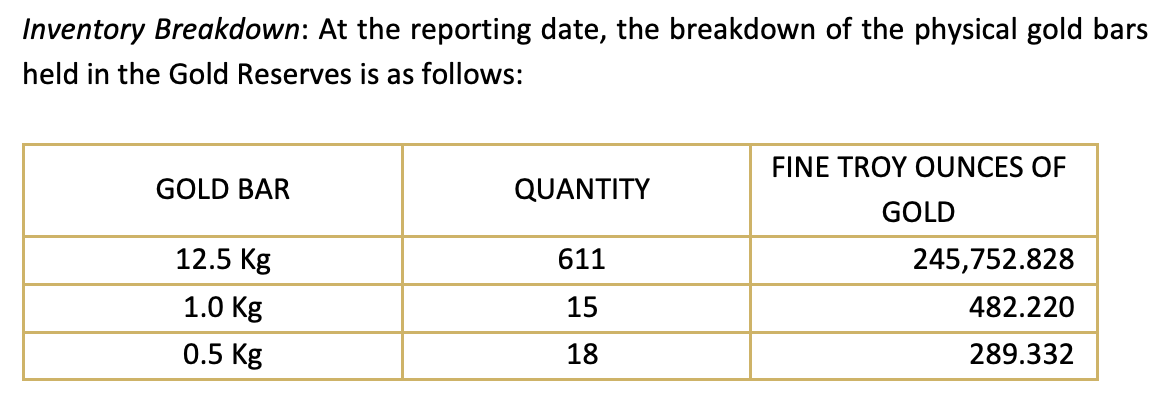

Tether is relevant for crypto traders for its stablecoin issuance, demand and physical reserves of the US Dollar and Gold. The Q1 attestation report shows that the giant holds over 7.7 tons of physical Gold.

Tether’s Gold Inventory | Source: Q1 attestation report

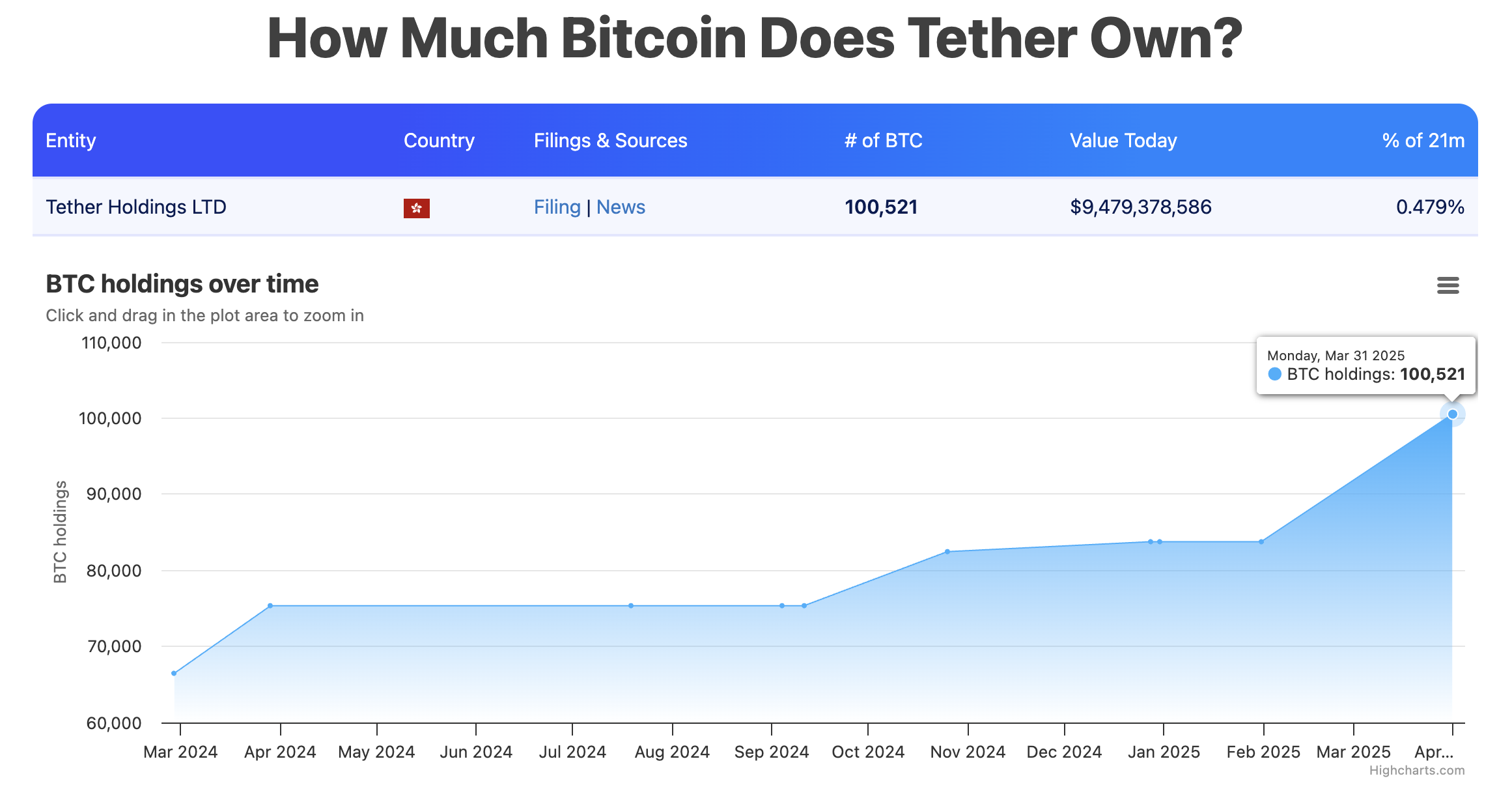

Data from Bitbo Treasuries reveals over 100,500 BTC holdings by Thether at the end of the first quarter.

Tether’s Bitcoin holdings | Source: Bitbo Treasuries

Rising profitability of Tether and larger volume of reserves could contribute to higher confidence from retail traders and institutional investors acquiring USDT. The firm recently unveiled plans to foray into Real World Asset tokenization (RWA) and stablecoins backed by other currencies (other than the USD) and physical assets like Gold.

Tether co-founder says stablecoins help preserve US Dollar dominance

The US Dollar is currently the dominant fiat currency backing stablecoins circulated by Tether.

Co-founder Reeve Collins told Cointelegraph,

“The stablecoin definitely helps preserve the Dollar dominance, especially in the crypto space. The Dollar is kind of the reserve currency of crypto. But now there are other currencies coming into play. But more importantly, it’s not currencies. It’s other types of backing.”

The stablecoin giant’s co-founder believes assets used to back stablecoins other than the USDT may soon catch up by offering a higher yield to users.

Collins shared her thoughts on funds backed by higher-yield generating assets (relative to US Treasury bills) like money market funds.