Monero Spikes 20% After Alleged $200M Hack—Because Crypto Never Sleeps

Privacy coin Monero (XMR) ripped past $180 this morning—just as blockchain sleuth ZachXBT dropped evidence linking the surge to a nine-figure exploit. The timing? Impeccable, as always.

Hack first, ask questions later. A shadowy $200M breach at a yet-unnamed exchange appears to have sent thieves scrambling for XMR’s obfuscated wallets. Because nothing says ’exit strategy’ like a cryptocurrency designed to vanish.

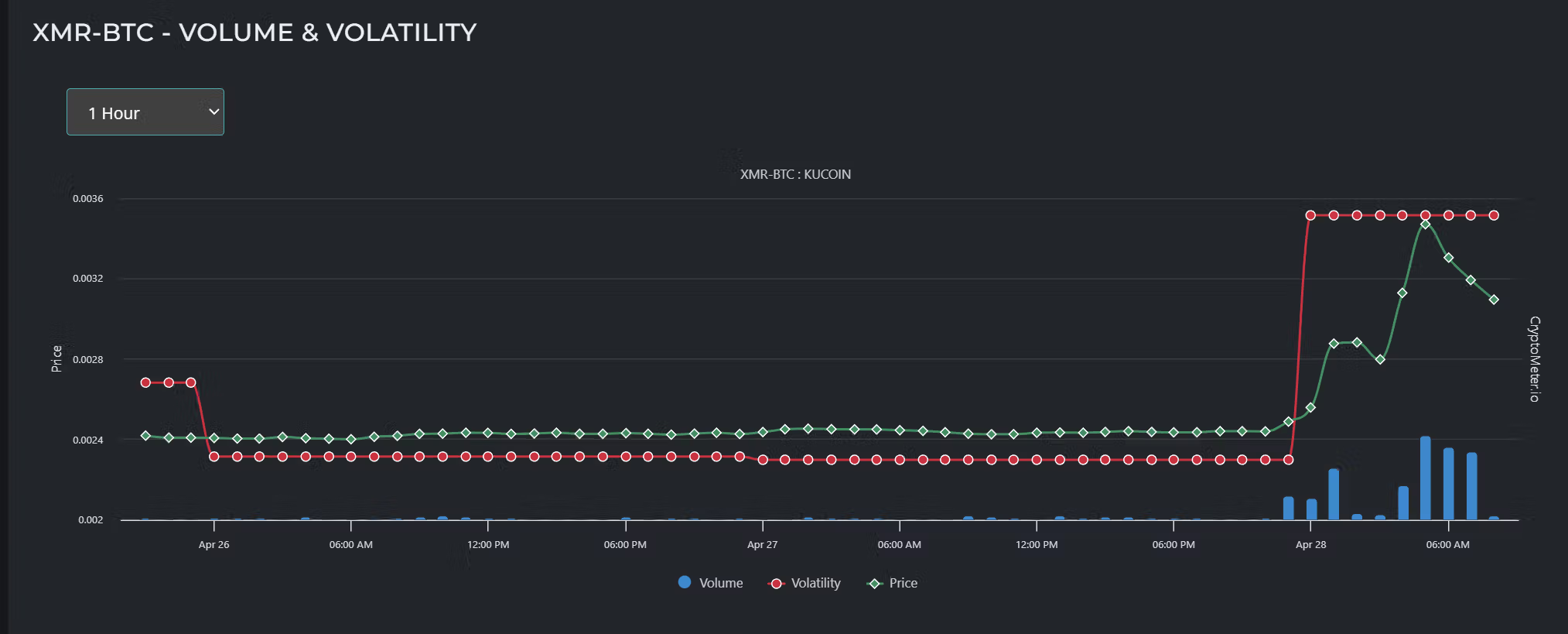

Meanwhile, traders are front-running the forensic report. XMR volumes doubled in 90 minutes as the rumor mill hit overdrive. Another day, another crypto crime fueling the very market it destabilizes. The circle of life—if life was a speculative casino with anonymous devs.

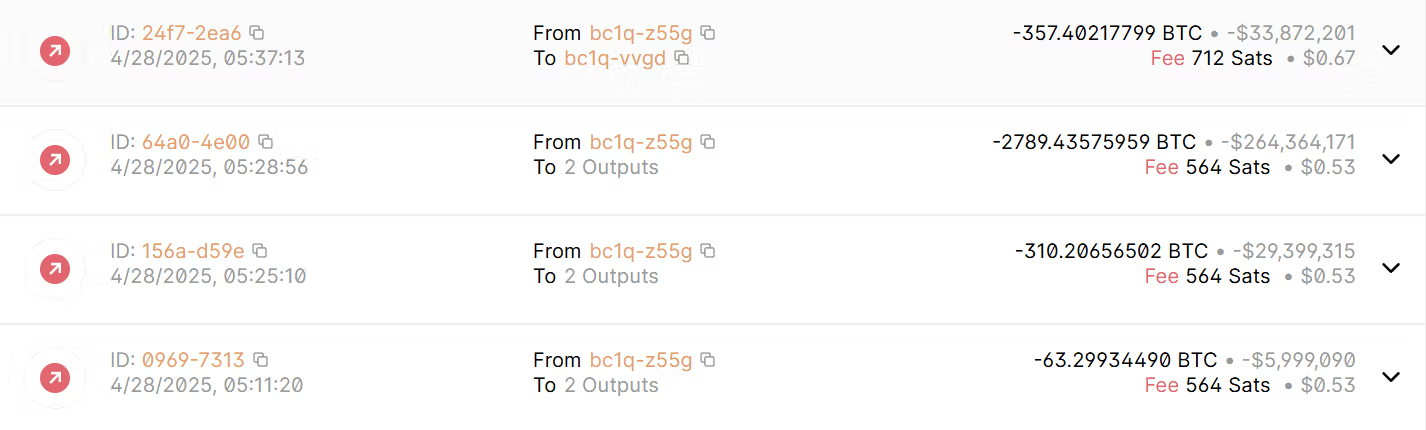

ZachXBT reported that 3,520 Bitcoin (BTC) ($330.7 million) was drained from an address and then swapped for XMR.

Market data shows a spike in volatility coming from an excess in buy orders for the XMR-BTC order book.

Market observers initially had a hard time determining what caused the major spike as metrics such as active wallets and network activity hadn’t risen accordingly.

Liquidity for XMR has been limited during the past few months as major exchanges delisted the privacy token in a bid to fight dark net markets. The lack of liquidity would have made any sizeable buy a catalyst for outsized pricing gains. CoinGecko data shows that the order depth for XMR is significantly smaller than for tokens of similar market cap.

XMR is trading for over $300 according to CoinDesk markets data.