Ondo Finance Smashes $3B Valuation as CEO Nathan Allman Takes Tokenized Securities Pitch to SEC

Ondo Finance just joined the crypto big leagues—hitting a $3 billion market cap as its CEO Nathan Allman sits down with SEC regulators. The topic? Tokenized US securities, Wall Street’s worst nightmare and crypto’s golden ticket.

Tokenization is eating traditional finance alive—one asset class at a time. Allman’s SEC meeting signals a make-or-break moment for institutional DeFi adoption. Will regulators play ball, or throw another ’protective’ red flag?

Meanwhile, legacy finance still thinks ’blockchain’ is a type of ski binding. Good luck keeping up.

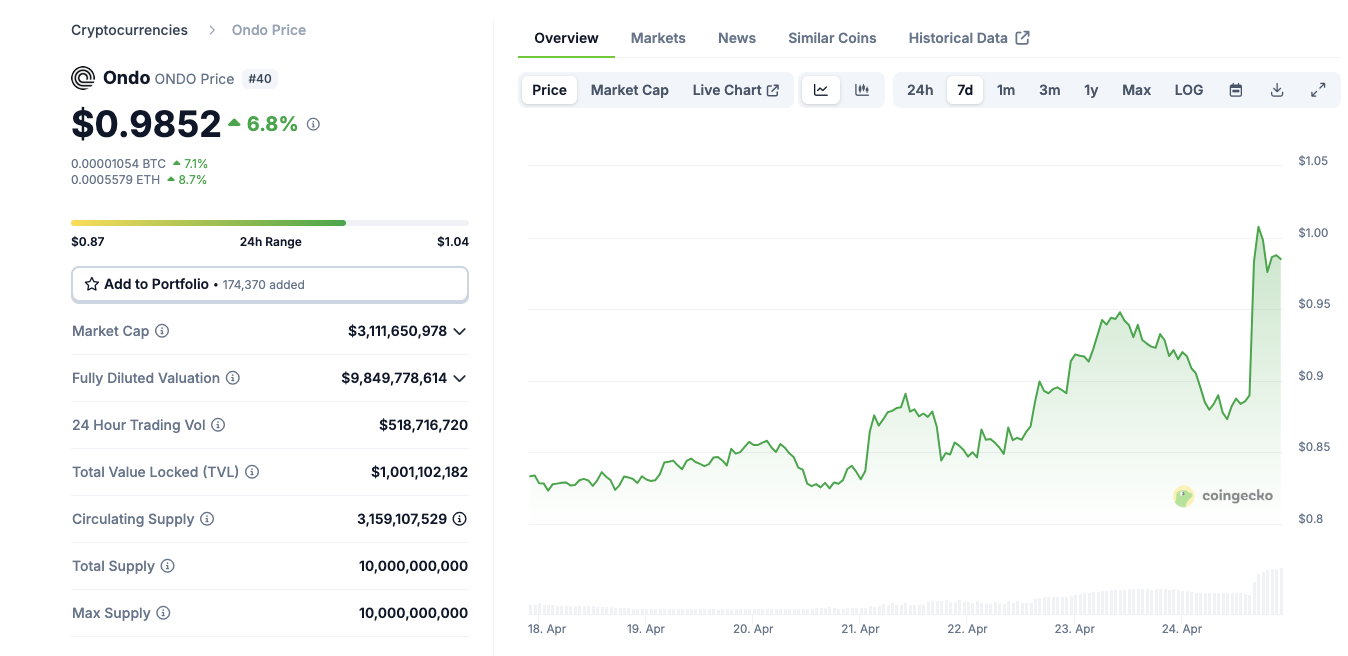

Ondo finance price crosses $1 amid regulations meeting with SEC

The United States (US) Securities and Exchange Commission’s (SEC) Crypto Task Force met with representatives from ONDO Finance and Davis Polk & Wardwell LLP on Thursday to discuss a regulatory framework for issuing tokenized versions of publicly traded US securities.

The meeting was part of the SEC’s ongoing engagement with crypto market participants on potential oversight mechanisms for tokenized financial products.

Ondo finance price action | Coingecko

Within hours, Ondo token price ROSE 7.5%, breaking above the $1 mark to reach the $3 billion valuation for the first time in 50 days, dating back to March 7.

According to the memorandum published by the SEC, the meeting covered a wide-ranging agenda, including tokenized securities structuring models, registration requirements, broker-dealer obligations, financial crimes compliance, and market structure regulations.

Ondo also raised the possibility of sandbox environments or other forms of regulatory relief to enable compliant innovation in the digital assets space.

Ondo’s delegation was led by CEO Nathan Allman and included key executives and legal counsel, while Davis Polk was represented by partner Zachary Zweihorn and associate Justin Levine.

The meeting signals growing regulatory attention on efforts to integrate traditional securities into blockchain-based systems while ensuring compliance with existing financial laws.

Ondo finance price forecast: Bulls clear $1 resistance, next target at $1.20

Ondo finance surged over 7% to $0.983 on Thursday, marking its most decisive breakout in over a month as price climbed firmly above the 50-day simple moving average (SMA) at $0.851. The bullish momentum was further validated by a clean move above the 100-day SMA ($1.05) on intraday wicks, suggesting mounting buying pressure.

The next key upside target lies at $1.08, a confluence zone aligning with the 200-day SMA, last tested in early March. If that key resistance break, Ondo is likely to head towards the $1.20 level.

Ondo finance price forecast

The ONDO price forecast today reflects this shift in sentiment, underscored by a significant rise in the Bull and Bear Power (BBP) indicator, which now reads +0.158. This positive divergence in BBP is the strongest since early March, indicating increasing bullish volume strength as price expands.

However, failure to sustain above the 100-day SMA could lead to a short-term retest of support NEAR $0.90.