BlackRock’s Bitcoin ETF Gobbles $643M in a Day—Wall Street Plays Catch-Up

Move over, gold—the boomers’ new shiny toy is a ticker symbol. BlackRock’s spot Bitcoin ETF just racked up its biggest single-day haul yet, proving even suits can’t resist crypto’s siren song when fees are low enough.

The fund swallowed $643 million in inflows on April 23rd, officially making it the ’best new ETF’ by assets under management. Never mind that Bitcoin’s still 30% off its ATH—when BlackRock comes knocking, pension funds answer.

Cynical take: Nothing cures Wall Street’s skepticism like the smell of fresh management fees. The real question? Whether IBIT’s success is a crypto endorsement or just proof money flows wherever BlackRock points its marketing cannon.

IBIT clocks highest inflows in three months

“I’m pretty sure this is how I voted. Both of them did things no one has seen [before],” Balchunas said, also referencing the Vanguard S&P 500 ETF (VOO) winning the “ETF of the Year” award. Over the past 5 years, VOO is up 89%, according to Google Finance data.

IBIT was also the recipient of the Crypto ETP of the year.

IBIT’s two awards came on the same day IBIT recorded $643.2 million in inflows, according to Farside data. It was the highest inflow day since Jan. 21, when it saw $661.9 million, just a day after US President Donald Trump’s inauguration, when Bitcoin’s spot price hit an all-time high of $109,000.

Bitcoin is trading at $93,290 at the time of publication. Source: CoinMarketCap

Bitcoin commentator Vivek said this “is massive,” while Apollo Sats co-founder Thomas Fahrer said, “Huge inflow.”

The IBIT fund, which launched in January 2024 alongside 10 other US-based spot Bitcoin ETFs, has net assets of approximately $53.77 billion, according to BlackRock data. Over the past 30 days, it has traded, on average, 45.02 million shares per day.

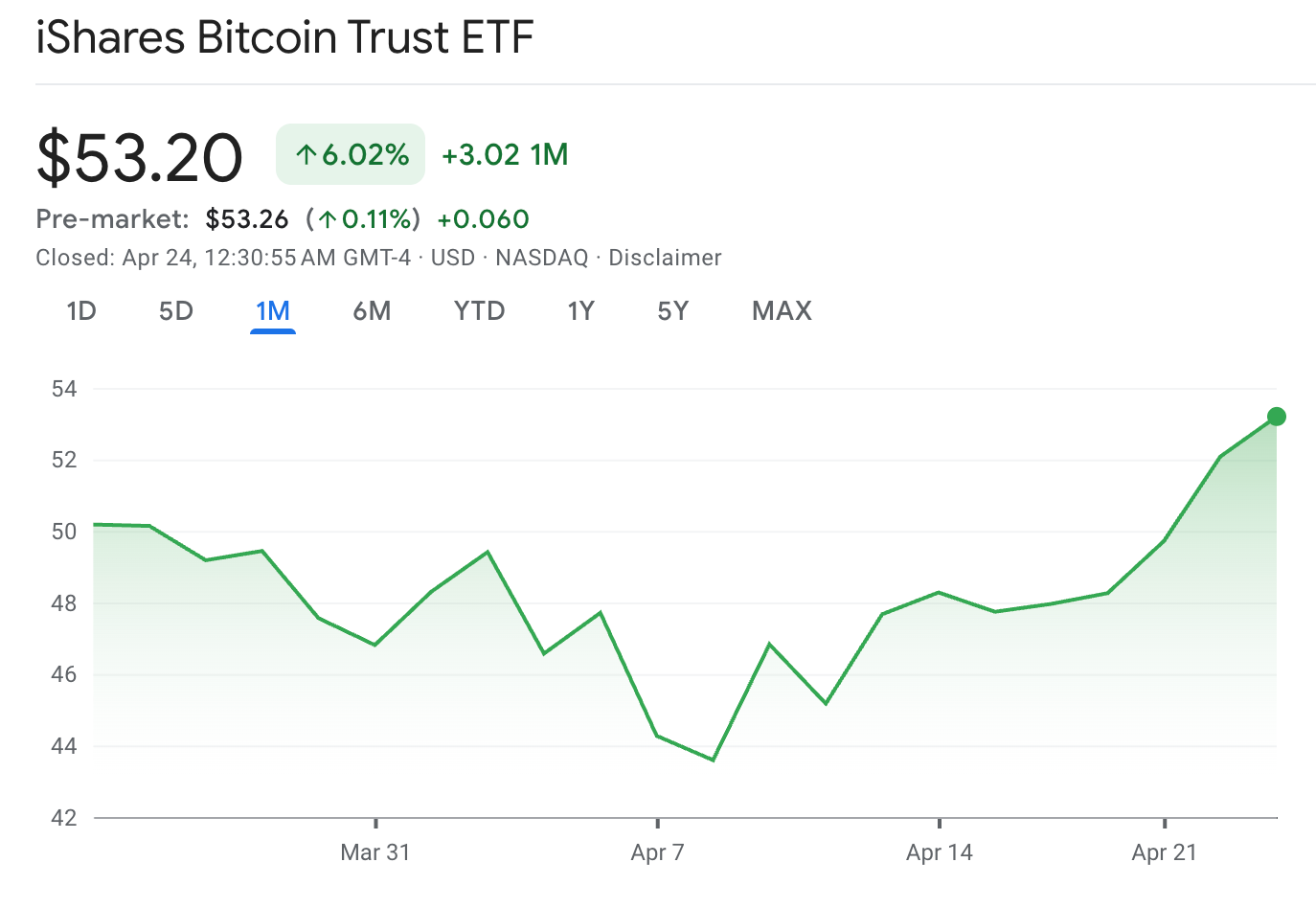

At the time of publication, a single IBIT share is trading at $53.20, as per Google Finance data.

The iShares Bitcoin Trust ETF is up 6.02% over the past month. Source: Google Finance

Meanwhile, VanEck Bitcoin ETF (HODL) received the award for “Best new ETF ticker.”

IBIT’s large inflow on April 23 made up most of the $917 million seen across all 11 spot Bitcoin ETFs that day. It was the second day in a row with over $900 million in inflows amid most of the month posting outflow days due to macro uncertainty.

On April 23, Glassnode pointed out that the $912 million ETF inflows the day prior equaled more than 500 times the 2025 daily average.