Ethereum Stages Comeback as Market Share Rebounds From Historic Lows

ETH claws back dominance—proving once again that in crypto, today’s loser is tomorrow’s hedge fund darling. The ’flippening’ narrative gets dusted off as traders chase the next speculative high. Technicals show bullish divergence, but let’s be real—this market runs on hopium and leveraged positions.

BTC vs ETH performance and prediction. Source: Ash Crypto

Jeff Mei, chief operating officer at the crypto exchange BTSE, was not conviced Ethereum was moving idependently, and told Cointelegraph that Ether’s gain “was largely due to it tracking the price of Bitcoin and the overall market,” and that that Paul Atkins’ confirmation as chair of the US Securities and Exchange Commission had boosted overall market sentiment.

Earlier this month, ETH had fallen back to bear market prices and had seen its market share dwindle amid a wide market downturn marred by fears of a trade war.

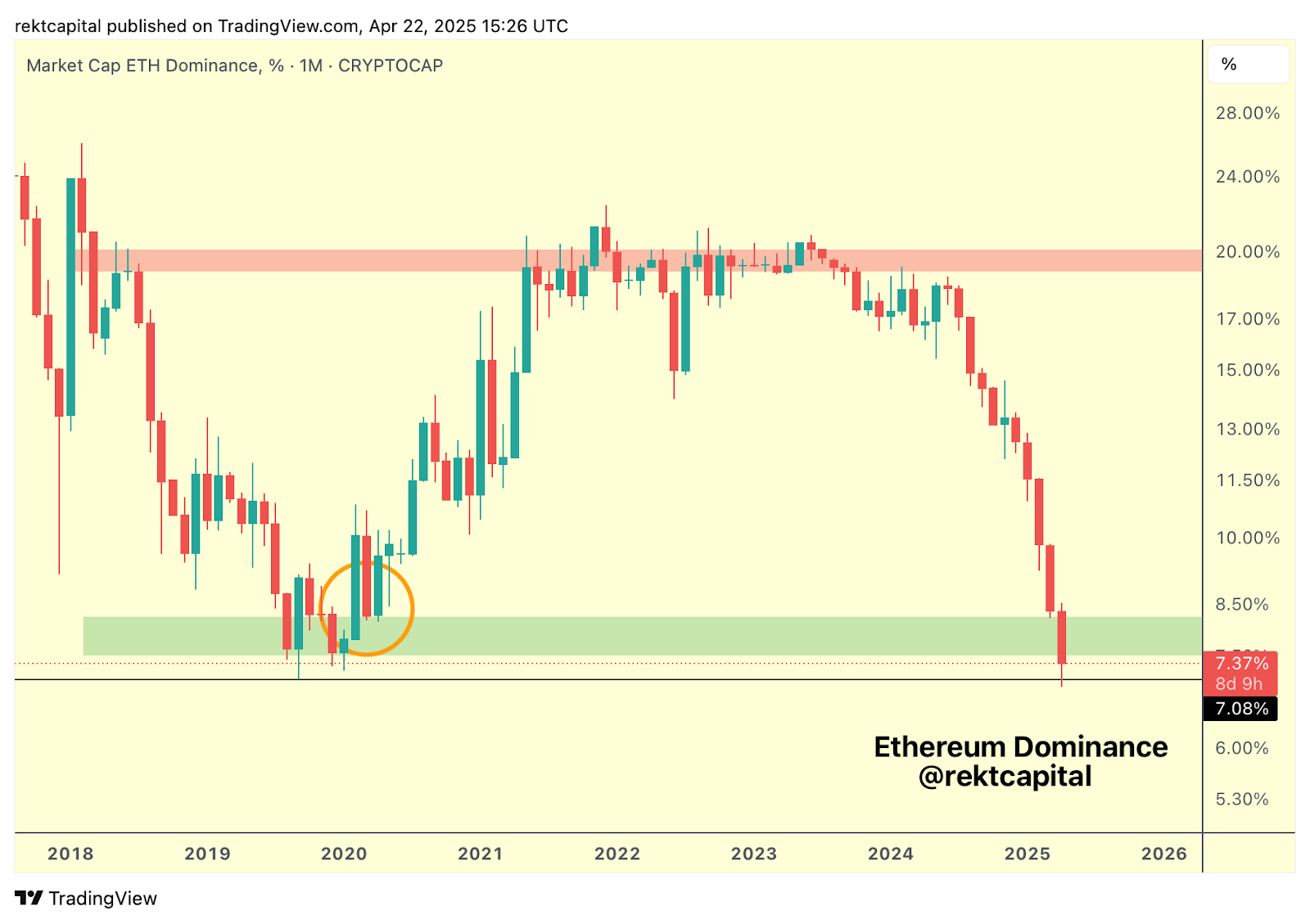

On April 22, analyst “Rekt Capital” said that ETH’s market dominance has fallen back to all-time lows but “managed to protect 2019 all-time lows as support.”

ETH dominance fell to its September 2019 low of 7% on April 22, according to TradingView. However, its subsequent price pump has seen that share bounce off this critical support level and return above 7.5% on April 23.

ETH dominance lows. Source: Rekt Capital

Fundamental catalysts supporting the move

10x Research’s Markus Thielen told Cointelegraph that it hasn’t taken much to drive Ethereum higher, as a “heavily shorted market is now experiencing a squeeze.”

Technically, Ethereum was oversold on both daily and weekly timeframes, setting the stage for a rebound, he said.

With the upcoming upgrade moving to mainnet, there’s also a fundamental catalyst supporting the move.