Trump and Regulatory Rumors Send BTC, SOL, SUI Surging to 50-Day Peaks

Politics meets crypto again—former President Trump’s latest comments and whispers of Paul Atkins’ regulatory influence sparked a rally. Bitcoin, Solana, and SUI blasted past resistance levels, leaving traders scrambling. Just another day where headlines move markets faster than fundamentals. (And yes, the usual suspects will claim they ’called it’ after the fact.)

Bitcoin market update:

- Bitcoin price broke above the $91,000 mark on Tuesday, testing new 50-day peaks.

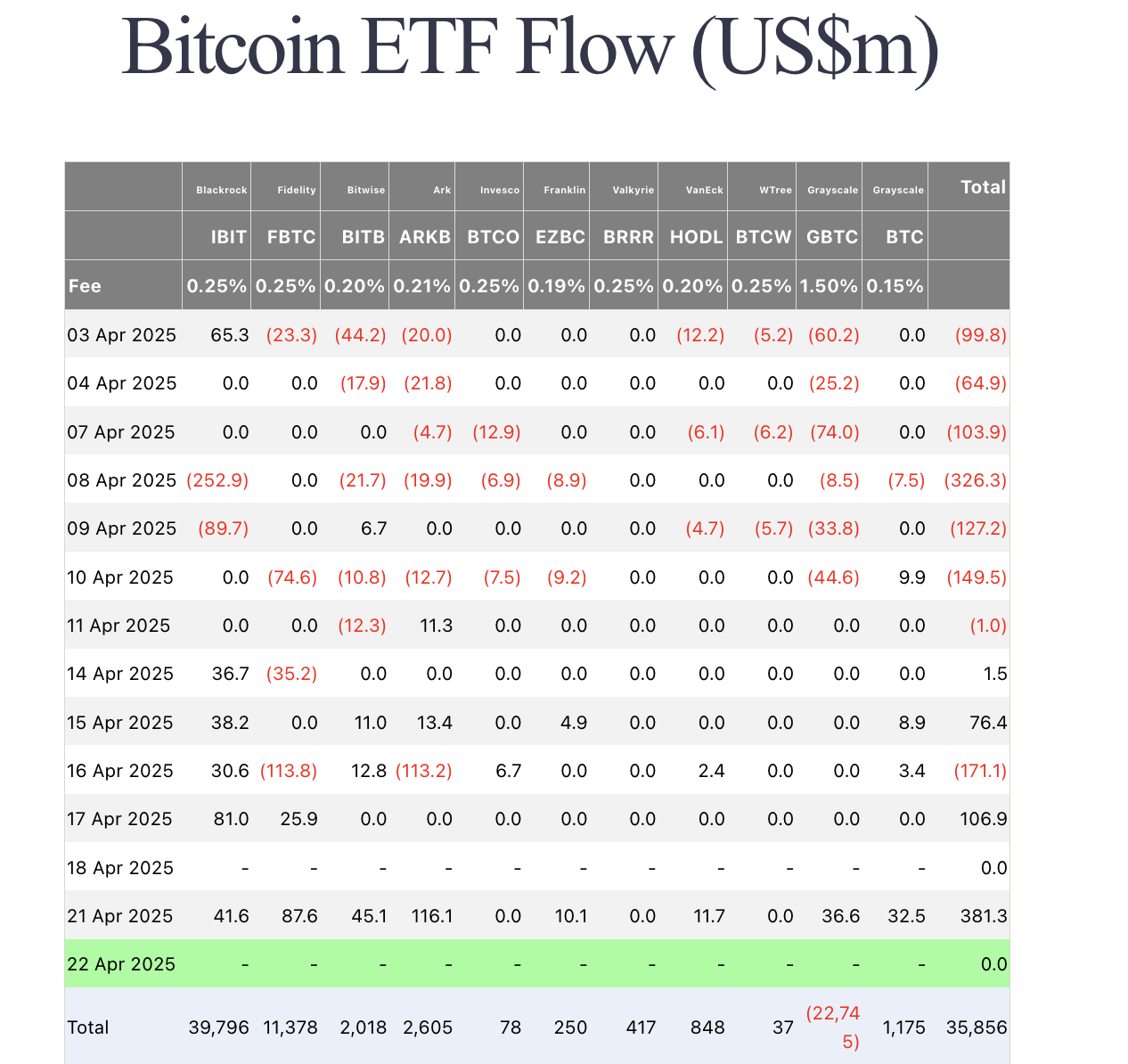

- US-based Bitcoin ETFs took in $381 million Tuesday, representing the highest single-day inflow since January.

Bitcoin ETF Flows | Source: Farside

The unusual ETF inflows on Tuesay affirm that US-based corporate investors are de-risking from US-denominated investors, under fears that Trump’s criticisms of and attempts to replace Federal Reserve (Fed) Chair Jerome Powell could undermine confidence in the US Dollar.

Paul Atkins’ confirmation as SEC Chair also further boosted crypto market sentiment.

Altcoin market updates: Solana, SUI among top gainers as XRP stalls at $2.15

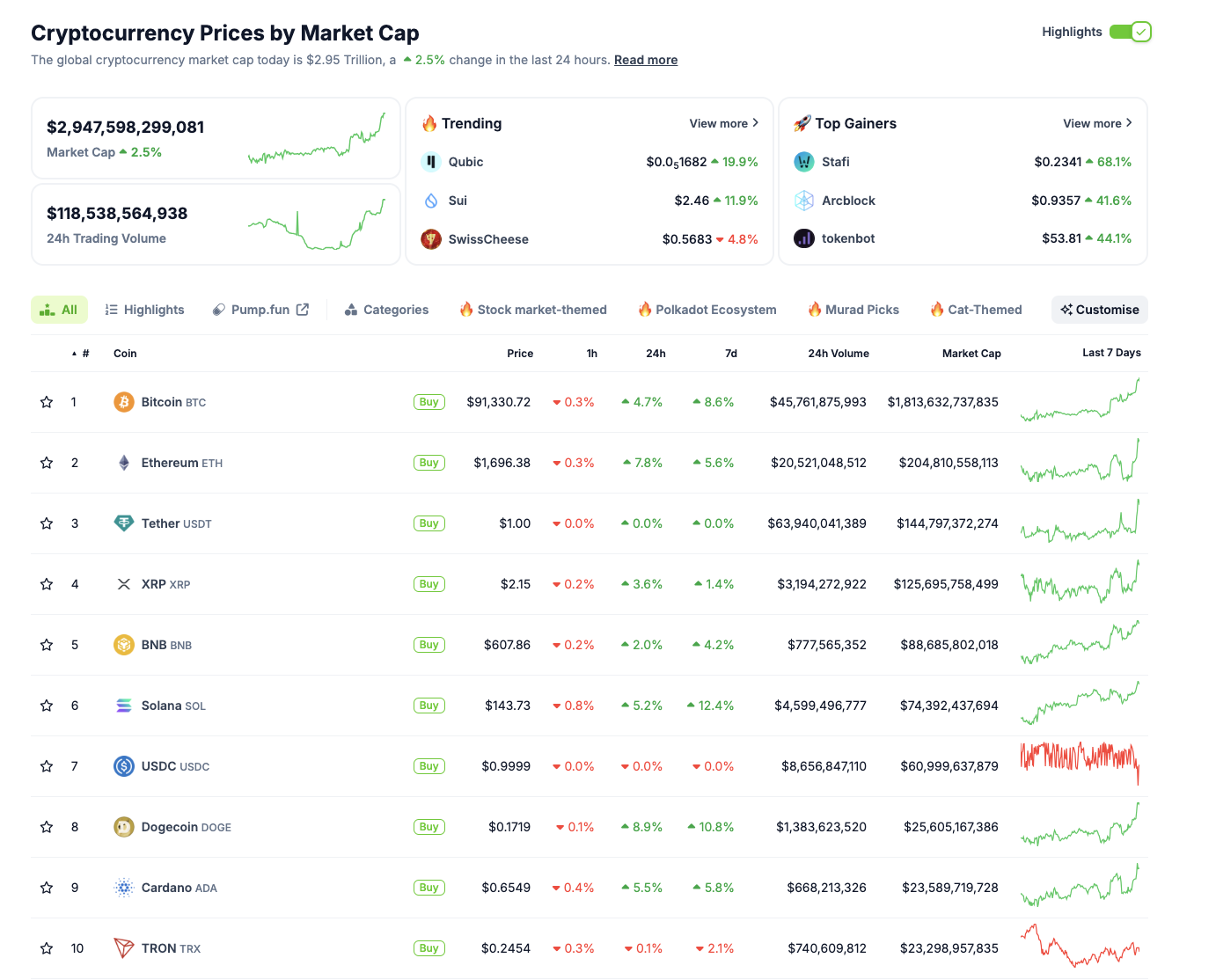

The altcoin market continued its bullish momentum over the past week, with Solana (SOL) and SUI leading the charge among top-performing assets. Solana surged 12.4% over the last seven days to trade at $143.73, reflecting strong investor appetite and increasing on-chain activity. In the past 24 hours alone, SOL jumped 5.2%, reinforcing its position as one of the most resilient large-cap tokens amid current market dynamics.

Crypto market performance, April 22, 2025 | Source: Coingecko

SUI, featured under trending coins, posted an impressive 11.9% gain in the last 24 hours, priced at $2.46, further signaling increasing traction in Layer 1 ecosystem plays.

Meanwhile, XRP saw minimal movement, holding steady at $2.15 with a modest 1.4% weekly uptick, suggesting cooling momentum despite broader altcoin enthusiasm.

Dogecoin (DOGE) and Cardano (ADA) also saw notable advances, up 10.8% and 5.8%, respectively, over the week, driven by retail trading flows and network development updates.

At press time, aggregate crypto market cap climbed to $2.95 trillion, a 2.5% increase in the last 24 hours, with daily trading volume rebounding to over $118 billion.

Crypto news updates:

Monad partners with Chainlink to integrate oracle services and launch CCIP on Testnet

Monad, a Layer 1 blockchain optimized for Ethereum Virtual Machine (EVM) compatibility, has joined the Chainlink Scale program to integrate Chainlink’s decentralized oracle services into its network.

The collaboration aims to provide Monad developers with secure access to off-chain data feeds, enabling more reliable and advanced decentralized applications within its ecosystem.

As part of the agreement, Monad will roll out Chainlink’s Cross-Chain Interoperability Protocol (CCIP) and Data Streams on its Testnet.

The integration is designed to strengthen Monad’s infrastructure for decentralized finance (DeFi) applications and other blockchain use cases, aligning with its strategy to drive ecosystem expansion and support long-term adoption.

Galaxy Digital swaps $106 million in Ethereum for Solana amid declining ETH market share

Galaxy Digital has traded approximately $106 million worth of Ethereum (ETH) for Solana (SOL) over the past two weeks, according to blockchain data from Lookonchain.

The transactions were executed on Binance, indicating a strategic portfolio adjustment as Ethereum faces mounting market challenges.

Ethereum’s market dominance recently fell below 7%, marking a historic low amid ongoing scalability concerns and reduced decentralized exchange activity.

Galaxy’s shift reflects broader institutional trends showing a reduction in ETH holdings, as investors explore alternative Layer 1 networks like Solana.

Janover acquires $11.5 million in Solana following rebrand and strategic pivot to crypto

DeFi Development Corporation, formerly known as Janover, has acquired 88,164 Solana (SOL) tokens valued at approximately $11.5 million, expanding its total SOL holdings to around $34.4 million.

The move follows the company’s recent rebranding to JNVR and its acquisition by former Kraken executives.

The investment is part of JNVR’s broader strategy to deepen its involvement in the crypto sector, with plans to leverage Solana for staking and long-term asset accumulation.

The firm also intends to integrate blockchain technology into its commercial real estate finance services.