Corporate Bitcoin Hoard Hits 3% of Supply—Here’s Why That Matters

The Good:

Institutional adoption signals legitimacy—Tesla, MicroStrategy, and friends now treat BTC like digital gold.

The Bad:

Concentrated holdings risk market manipulation—remember when a single whale crashed prices in 2022?

The Ugly:

When the next financial crisis hits, these ’balance sheet assets’ will be the first liquidated—Wall Street always eats its young. Bonus jab: Nothing says ’hedge against inflation’ like CFOs panic-buying at ATHs.

Top ten publicly known Bitcoin treasury companies control 3% of supply

Bitcoin accumulation by sophisticated market participants, like corporates buying BTC with funds from their balance sheet and crossing a key milestone, controlling over 3% of supply is positive for the cryptocurrency’s growth.

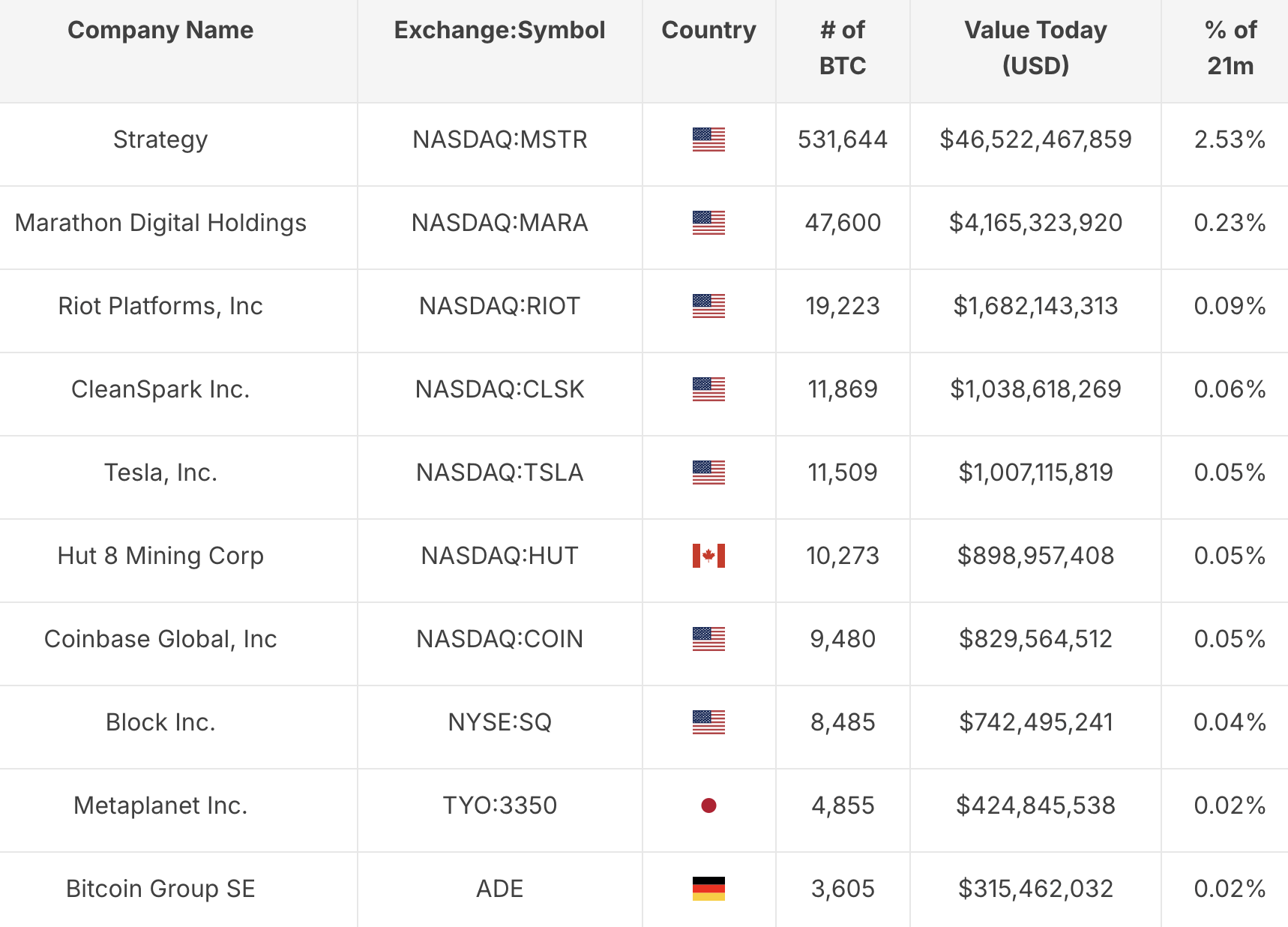

Data from Bitcoin Magazine shows the top 10 firms and their Bitcoin holdings, the total crosses 630,000 BTC, signaling their confidence and a shift in Bitcoin cycle structure from retail speculation to institutional accumulation.

Strategy, formerly MicroStrategy, leads the group, followed by Bitcoin mining firms Marathon Digital Holdings, Riot Platforms and CleanSpark.

Top ten publicly known firms holding Bitcoin on their balance sheet | Source: Bitcoin Magazine

On the one hand, Bitcoin ETF inflows are drying up and on the other firms are positioning themselves strategically with Bitcoin reserves in their treasury. Data from The Block shows that

US-based spot Bitcoin ETFs recorded $7.14 billion in volume last week, the lowest daily average for any week with at least four trading days so far this year.

With tightening Bitcoin supply and rising demand from firms gobbling BTC tokens for their treasuries, BTC could see a shift in its scarcity narrative and its four-year market cycles.

Why more CEOs could follow in the footsteps of Strategy’s former CEO Saylor

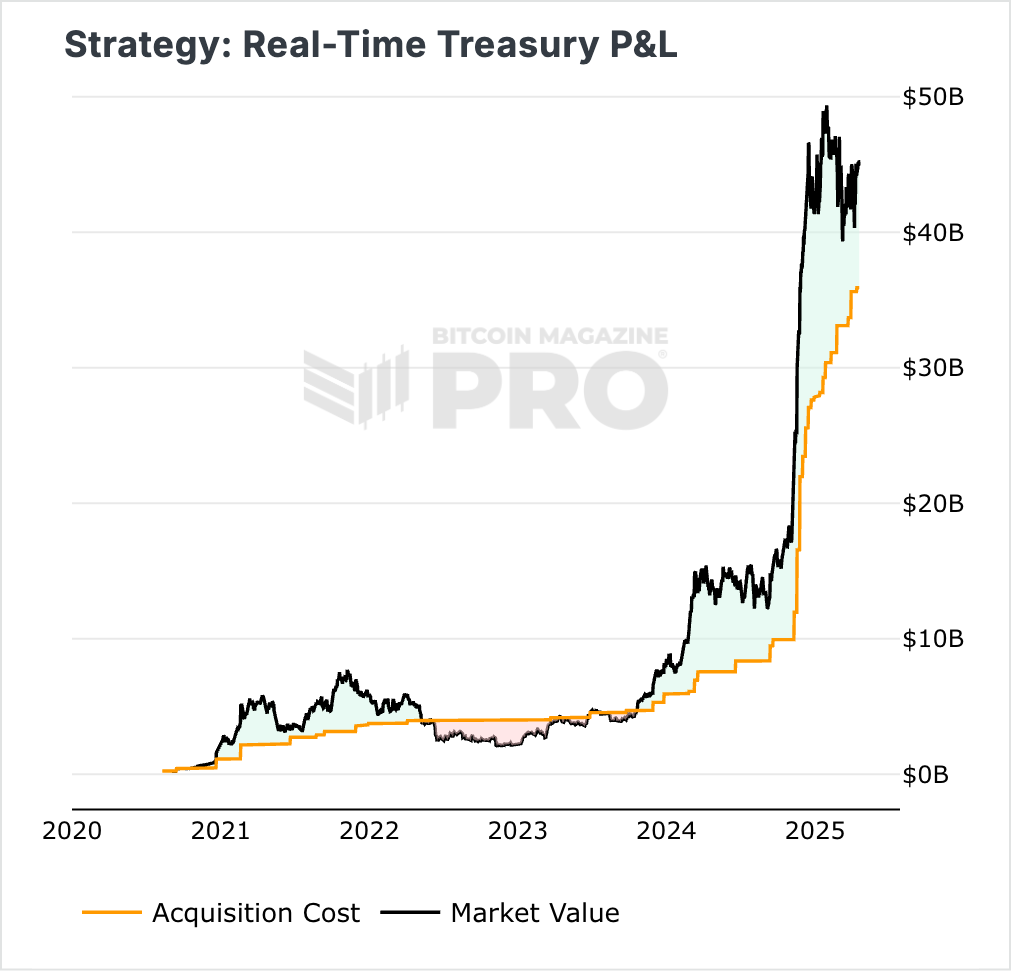

Strategy’s treasury is sitting on unrealized gain of $9.32 billion, and the stock price has rallied 2,466% since the firm started holding BTC. With fewer than 2 million BTC left to be mined, Bitcoin’s narrative changes and if firms follow in Michael Saylor’s (former Strategy CEO’s) plan, demand could increase further and support gains in the token.

Strategy’s real-time P&L of treasury as of April 20 | Source: Bitcoin Magazine

Metaplanet announced earlier today that with the acquisition of 330 Bitcoin tokens, their total holdings climbed to 4,855. Beyond BTC accumulation, Saylor’s playbook involves funding future Bitcoin purchases and managing of BTC as part of a corporate treasury.

Will Bitcoin gain from corporate BTC supply dominance in the long term?

While markets continue to deal with the uncertainty of President Trump’s pressure on the Federal Reserve to cut interest rates, there is higher volatility in top cryptocurrencies. While traders grapple with the uncertainty, Bitcoin could benefit from retail investment, accumulation by whales and large wallet investors.

The digital gold narrative could make a comeback and Bitcoin could emerge as an asset relevant to traders in the long-term.

Bitcoin eyes re-test of $90,000

Bitcoin is nearly 2% away from the closest resistance of $90,000. Less than 5% gains could push Bitcoin to test resistance at $92,540, the February 25 high for BTC. Two key momentum indicators, Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) support a bullish thesis for Bitcoin.

RSI is sloping upwards and reads 59 and MACD flashes green histogram bars above the neutral line.

BTC/USDT daily price chart

Bitcoin trades at $88,086 at the time of writing, traders await a re-test of the $90,000 level.