Cryptocurrency Market Analysis: XRP, BTC, and OM Price Forecasts — Asia Market Update April 21

As the Asian trading session commences on April 21, market participants are closely monitoring key cryptocurrency assets including Ripple (XRP), Bitcoin (BTC), and MANTRA (OM). Technical indicators suggest potential breakout patterns for XRP following its recent consolidation phase, while Bitcoin demonstrates resilience above critical support levels amid fluctuating market sentiment. The OM token shows unusual volatility as staking rewards approach their distribution cycle. Traders should watch for: 1) XRP’s reaction to the 50-day moving average at $0.52, 2) BTC’s ability to maintain the $63,800 support zone, and 3) OM’s liquidity profile during the Asian trading window. Regulatory developments from Japan’s FSA regarding crypto derivatives may introduce additional volatility during today’s session.

Ripple Price Forecast: Could open interest, buy signals, Coinbase Derivatives-backed XRP futures drive price to $3?

Ripple (XRP) edges higher on Monday, climbing 1.54% on the day to trade at $2.11 at the time of writing. Bulls have shown resilience and determination in the last week, upholding XRP above the $2.00 level. Several factors that could be contributing to the token’s bullish momentum include the launch of XRP futures trading by Coinbase Derivatives, a spike in open interest and technical indicators flashing buy signals amid improving sentiment across the crypto market.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC finally breaks out, ETH and XRP could follow

Bitcoin’s (BTC) price broke above its key resistance level after facing multiple rejections around it the previous week. Ethereum (ETH) and Ripple (XRP) prices are approaching their key resistance levels; a breakout could signal a rally ahead. Bitcoin price has faced multiple rejections around its 200-day Exponential Moving Average (EMA) at $85,000 since April 13. At Monday’s start of this week, BTC finally broke above the $87,000 resistance level.

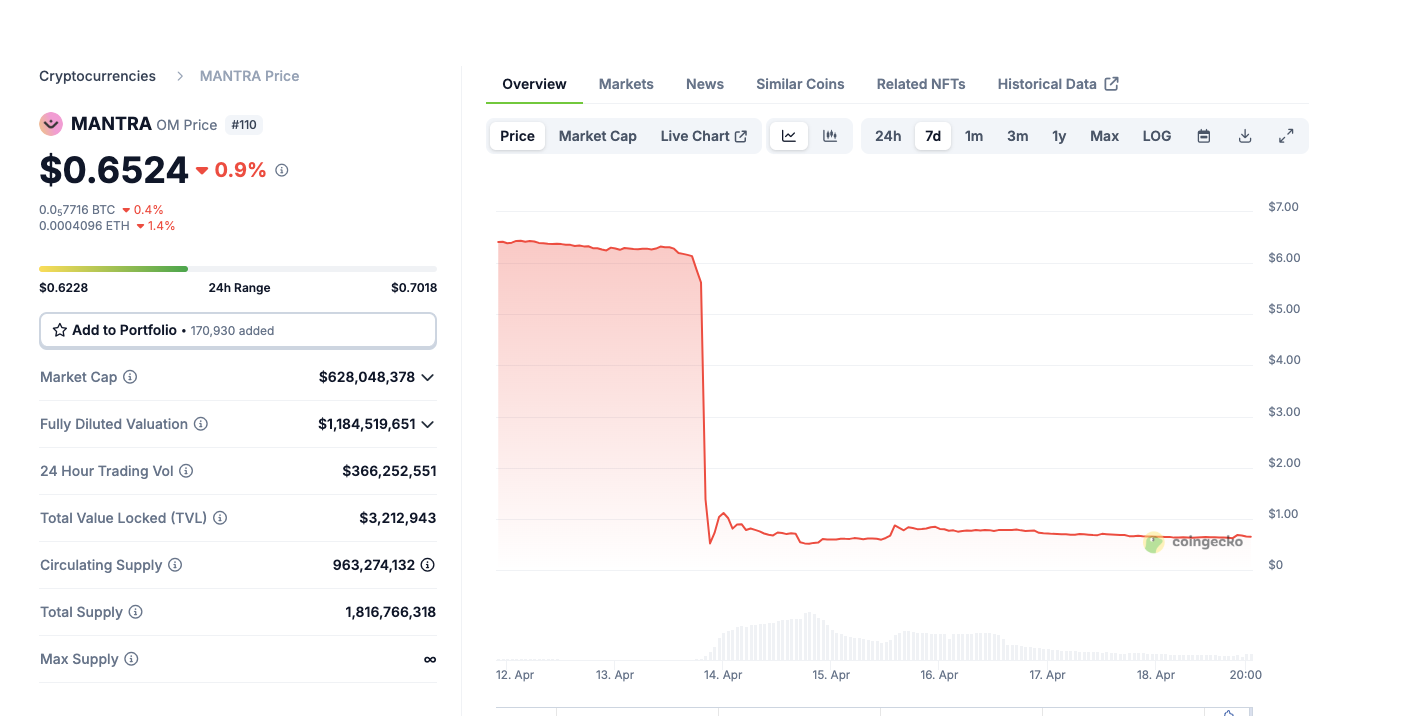

Mantra shares buyback and 300M token burn details as CEO commits personal holdings

Mantra intensifies recovery efforts following a 90% price crash this week. CEO John Patrick Mullin commits personal holdings to the upcoming burn. Mantra’s CEO John Patrick Mullin said on Friday that the company is finalizing details of a token burn program designed to stabilize the OM token after a steep 90% collapse that erased nearly $5 billion in market capitalization.