Saylor and ETF Investors: Strong Hands Stabilizing Bitcoin Market, Says Analyst

Prominent figures like Michael Saylor and institutional ETF investors are acting as ’stronger hands’ in the Bitcoin market, providing stability amid volatility, according to a recent analyst report. Their long-term holding strategies and substantial capital inflows through ETFs are creating a more resilient price floor for BTC. This trend marks a significant shift from previous market cycles dominated by retail speculation, as sophisticated players now set the tone for Bitcoin’s maturation as a mainstream asset class. The analysis highlights how these stakeholders’ disciplined approach contrasts with weaker hands that typically sell during corrections, potentially reducing extreme price swings in the future.

Bitcoin ETF holders hold despite market volatility

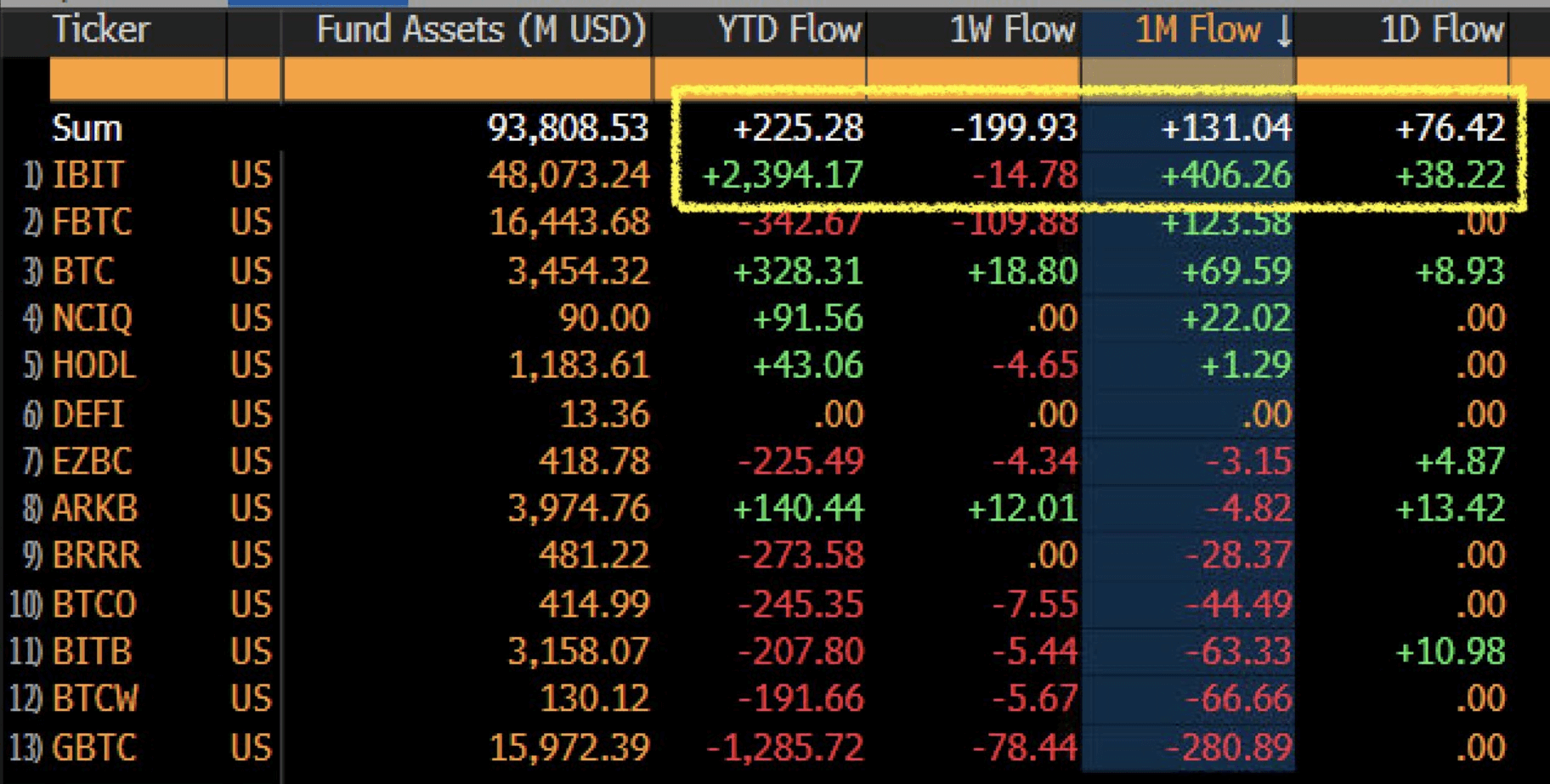

Balchunas pointed out that spot Bitcoin (BTC) ETFs have attracted $131.04 million over the past 30 days and are up $2.4 billion since Jan. 1. Balchunas called this “impressive,” noting it helps explain why Bitcoin has “been relatively stable.”

“Its owners are more stable,” Balchunas said. Balchunas said Bitcoin ETF investors have “much stronger hands than most people think.” He said this “should” increase the stability and lower Bitcoin’s volatility and correlation in the long term.

As of April 16, Bitcoin ETFs saw a total of $131.04 million in inflows over the past 30 days. Source: Eric Balchunas

Saylor’s firm, Strategy, made its latest Bitcoin purchase on April 14, acquiring 3,459 BTC for $285.5 million at an average price of $82,618 per coin. According to Saylor Tracker, Strategy holds 531,644 Bitcoin at the time of publication.

The Bitcoin Volatility Index, which measures Bitcoin’s volatility over the previous 30 days, is at 1.80% at the time of publication, according to Bitbo data. At the time of publication, Bitcoin is trading at $84,610, according to CoinMarketCap data.

Over the past 30 days, Bitcoin has traded between $75,000 and $88,000 amid macroeconomic uncertainty primarily driven by US President Donald Trump’s imposed tariffs and ongoing questions about the future of US interest rates.

Despite this, Bitcoin has remained above its previous all-time high of $73,679, first surpassed in November.

Bitcoin is trading at $84,610 at the time of publication. Source: CoinMarketCap

Participants in the broader financial market have also expressed surprise at Bitcoin’s relative strength in recent times, particularly in comparison to the S&P 500.

Stock market commentator Dividend Hero told his 203,200 X followers on April 5, after Trump’s “Liberation Day,” that he has “hated on Bitcoin in the past, but seeing it not tank while the stock market does is very interesting to me.”