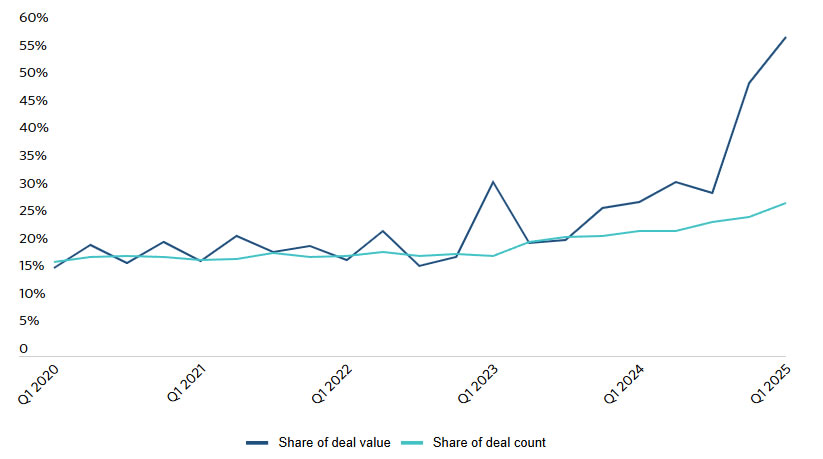

Artificial Intelligence Dominates Venture Capital Investments, Capturing 60% of Global Funding in Q1 2025

According to the latest data from PitchBook, artificial intelligence (AI) startups have secured nearly 60% of all global venture capital funding in the first quarter of 2025. This surge highlights the continued investor confidence in AI-driven innovations across industries. The report underscores a significant shift in capital allocation, with AI eclipsing other tech sectors in funding attractiveness. Analysts attribute this trend to breakthroughs in generative AI, autonomous systems, and enterprise AI solutions, which are reshaping market dynamics and driving high-growth opportunities.

AI deals as a share of all global VC deal activity. Source: PitchBook

Crypto venture capital creeps up

Comparatively, crypto and blockchain startups raised just $4.8 billion in Q1, according to CryptoRank. Almost half of that, $2 billion, was Abu Dhabi investment firm MGX investing in Binance.

This was still over four times as much as the $1.1 billion raised in the fourth quarter of 2024, and the biggest quarter for crypto venture capital deal value since the third quarter of 2022.

Crypto venture capital appears to be warming again with a friendlier regulatory environment emerging in the US.

On April 17, Mike Novogratz’s Galaxy Ventures Fund I was reportedly set to exceed its $150 million funding target and could hit $180 million when it closes at the end of June.