Crypto Market Tremors: Bitcoin, Ethereum, XRP Show Vulnerability Amid Widespread Weak Sentiment

Digital assets stumble as bearish pressure mounts across major cryptocurrencies.

Market Pulse Check

Bitcoin struggles to find footing below key resistance levels while Ethereum tests support zones that haven't been challenged in months. XRP's volatility amplifies the sector-wide unease—traders watching every tick with nervous anticipation.

Trading desks report light volumes and cautious positioning. The usual weekend momentum? Nowhere to be found. Institutional flows? Slower than a banker's understanding of DeFi.

Technical Breakdown

Charts painting a concerning picture across timeframes. Short-term indicators flashing warning signs while long-term trendlines hold—barely. The crypto faithful clinging to historical patterns that suggest this is just another shakeout before the next leg up.

Market veterans noting the unusual correlation between major assets. When everything moves together, it signals sentiment-driven trading rather than fundamental analysis. Professional money sitting on hands while retail panics—classic market behavior.

The silver lining? These pullbacks separate weak hands from strong convictions. Because nothing builds character like watching paper profits evaporate while traditional finance snickers from the sidelines.

Data spotlight: Bitcoin, Ethereum weighed down amid ETF outflows

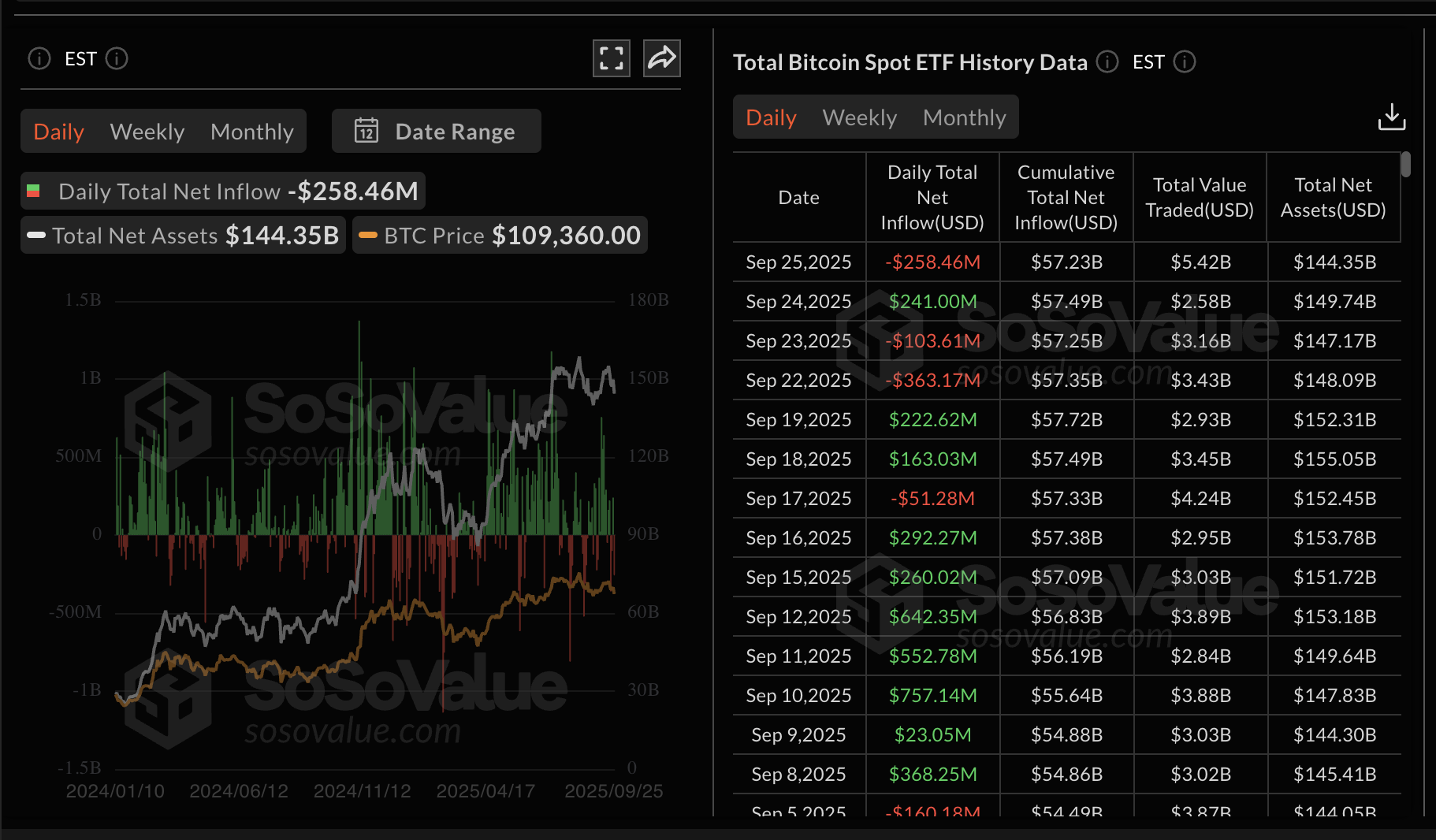

Bitcoin continues to face increasing pressure as investors reduce exposure, citing weak sentiment in the broader cryptocurrency market. This is evidenced by the United States (US) BTC spot Exchange Traded Funds (ETFs), which experienced outflows of $258 million on Thursday.

If the prevailing risk-off sentiment persists, prolonging ETF outflows, overhead pressure on Bitcoin will likely remain and increase the chances of the price falling toward the $100,000 level.

Bitcoin ETF stats | SoSoValue

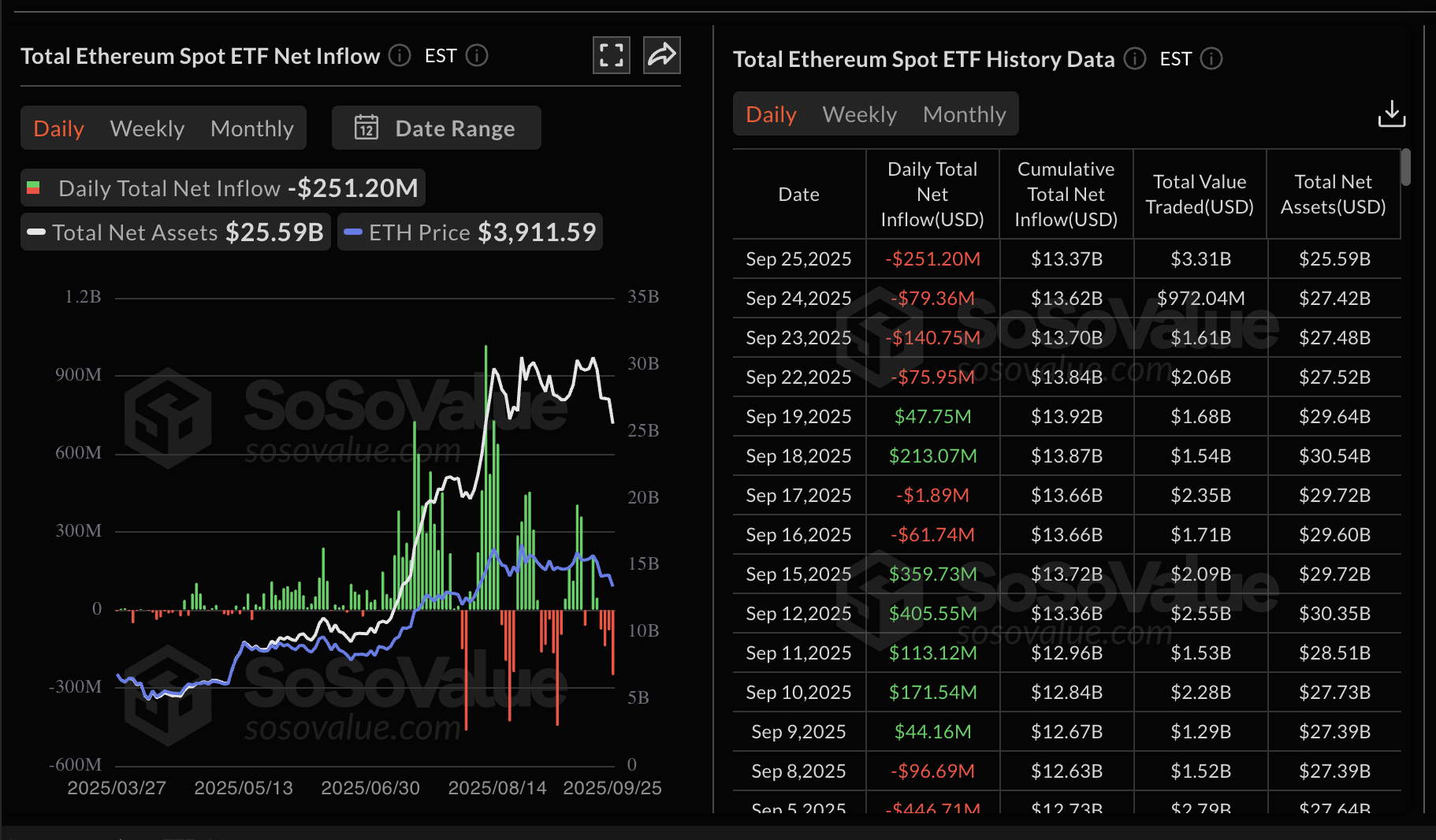

Similarly, demand for Ethereum ETF products has also declined significantly this week, with outflows now on their fourth consecutive day. According to SoSoValue data, ETH US ETFs saw outflows of $251 million on Thursday, bringing the cumulative net inflow to $13.37 billion.

Ethereum ETF stats | SoSoValue

Meanwhile, XRP has faced a noticeable slump in retail interest. The futures Open Interest (OI), which currently averages at $7.4 billion, peaked at $8.95 billion in September. OI refers to the notional value of outstanding futures contracts. Hence, a sticky decline in the metric implies that traders are increasingly losing confidence in the token’s ability to sustain gains. It could also indicate that bets on higher XRP prices are on a free fall, increasing the chances of an extended downtrend.

XRP Futures Open Interest | Source: CoinGlass

Chart of the day: Bitcoin holds near support

Bitcoin remains above a support range between $107,000 and $108,500, which was tested on Wednesday and in early September. Bulls appear intent on pushing for a recovery above the $110,000 round-number resistance. However, weak sentiment in the broader cryptocurrency market and declining demand could delay the breakout.

A sell signal from the Moving Average Convergence Divergence (MACD) indicator has remained intact since Monday, encouraging investors to reduce their exposure.

Bitcoin price is also positioned below the 50-day Exponential Moving Average (EMA) at $113,487 and the 100-day EMA at $111,781.

If the $107,000 to $108,500 support range crumbles, attention will shift to the 200-day EMA at $106,163 and the round-number support at $100,000.

BTC/USDT daily chart

Altcoins update: Ethereum, XRP eye short-term recovery

Ethereum held above the support provided by the 100-day EMA at $3,847 as of Friday, following a sharp drop to $3,816 the previous day. The Relative Strength Index (RSI) shows that it could stabilize above oversold territory – a move likely to be followed by a recovery toward the midline. Higher RSI readings WOULD indicate that bullish momentum is building and boost the uptrend above the $4,000 level.

On the other hand, traders cannot ignore the sustained sell signal from the MACD since Saturday, which could encourage de-risking activity and contribute to selling pressure. A drop below the 100-day EMA at $3,847 could force traders to shift their attention to the 200-day EMA support at $3,395.

ETH/USDT daily chart

As for XRP, bears are largely in control at the time of writing on Friday, underlined by a sell signal maintained by the MACD indicator since Monday. A steady decline in the RSI to 37 reinforces the bearish grip as bullish momentum fades.

The initial support at $2.70 could absorb the selling pressure, but if broken, the next leg could test the 200-day EMA support at $2.60.

XRP/USDT daily chart

Still, a trend correction from the support at $2.70 cannot be ruled out yet. If investors buy the dip and sentiment in the broader cryptocurrency market improves, the xrp price could rebound toward the critical $3.00 level.

Crypto ETF FAQs

What is an ETF?

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Is Bitcoin futures ETF approved?

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Is Bitcoin spot ETF approved?

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

Which are the pros and cons of crypto ETFs?

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.