Pi Network Defies Crypto Market Downtrend: PI Price Holds Steady Amid Chaos

While Bitcoin tumbles and altcoins bleed, one cryptocurrency stands firm against the storm.

The Unshakeable Performer

PI coin demonstrates remarkable resilience as the broader digital asset market faces significant pressure. While major cryptocurrencies experience double-digit declines, Pi Network's native token maintains its position with minimal fluctuation.

Technical Strength Prevails

The asset's stability suggests underlying technical fundamentals that bypass typical market sentiment. Unlike projects driven purely by speculation, PI's architecture appears to cushion against the volatility that plagues more established cryptocurrencies.

Market Defiance Strategy

This performance challenges conventional wisdom about crypto correlations. While traditional finance experts predict synchronized movements, PI charts its own course—proving that not all digital assets dance to the same tune.

In a sector where most projects can't survive a bad tweet, Pi Network's steady hand offers a refreshing contrast to the usual crypto casino antics. The real test comes when markets rebound—will conservative stability outperform reckless speculation?

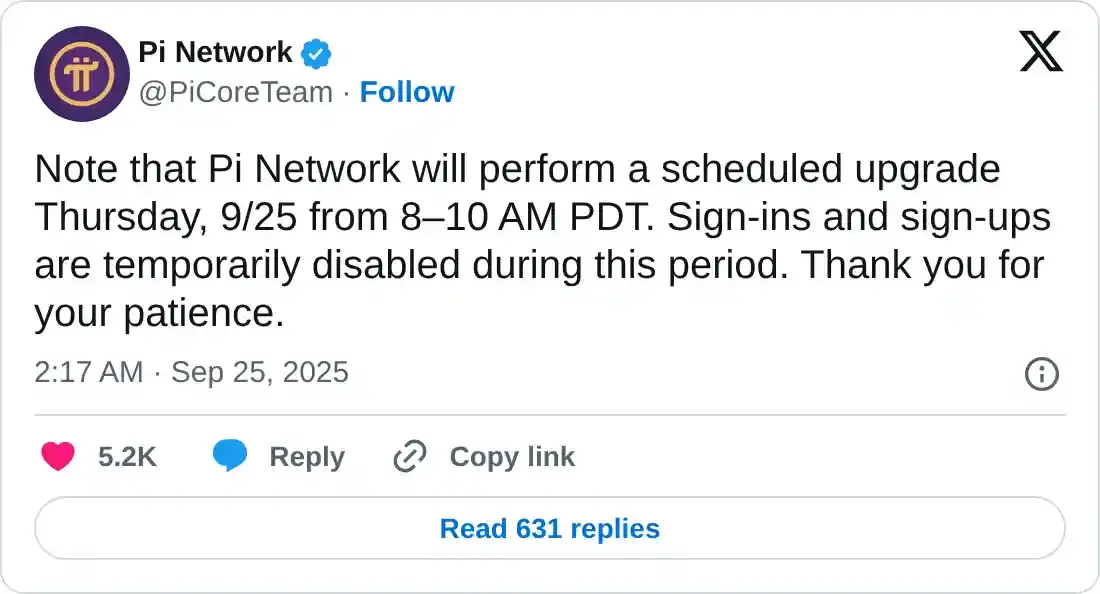

Scheduled upgrade and declining CEXs' balances flash mixed signals

Pi Network announced in an X post on Thursday that a scheduled upgrade between 15:00 and 17:00 GMT will temporarily disable features. This upgrade comes as part of the stellar protocol version 23 shift, which would enable smart contract functionalities on the Pi Network. As of Thursday, the Pi Network Testnet 1 has undergone a complete shift, with Testnet 2 under upgrade. Following this, the Pi Mainnet will initiate its upgrade.

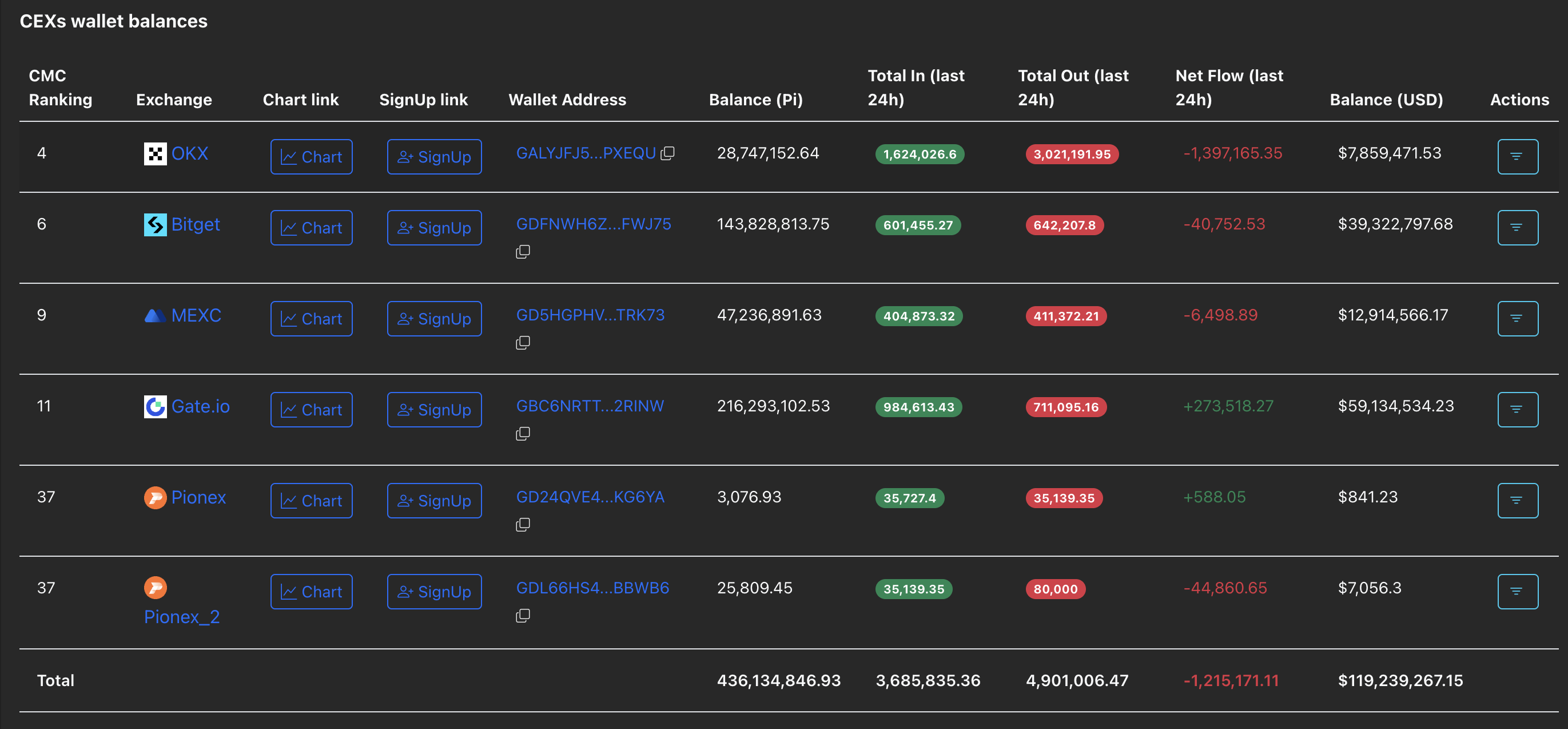

Flashing bullish potential, CEXs wallet balances maintain a net outflow, indicating that traders continue to buy the dip. The PiScan data suggest that over 1.21 million Pi tokens have been withdrawn from CEXs, continuing the net outflow trend of 1.94 million PI and 7.96 million PI tokens, as previously reported.

CEXs wallet balances. Source: PiScan

Pi Network stays weak as bearish momentum remains elevated

Pi Network edges lower by 3% at press time on Thursday, erasing the 2.89% gains from the previous day. The intraday pullback holds above the $0.2700 level as the risk-on sentiment in the broader cryptocurrency market decreases.

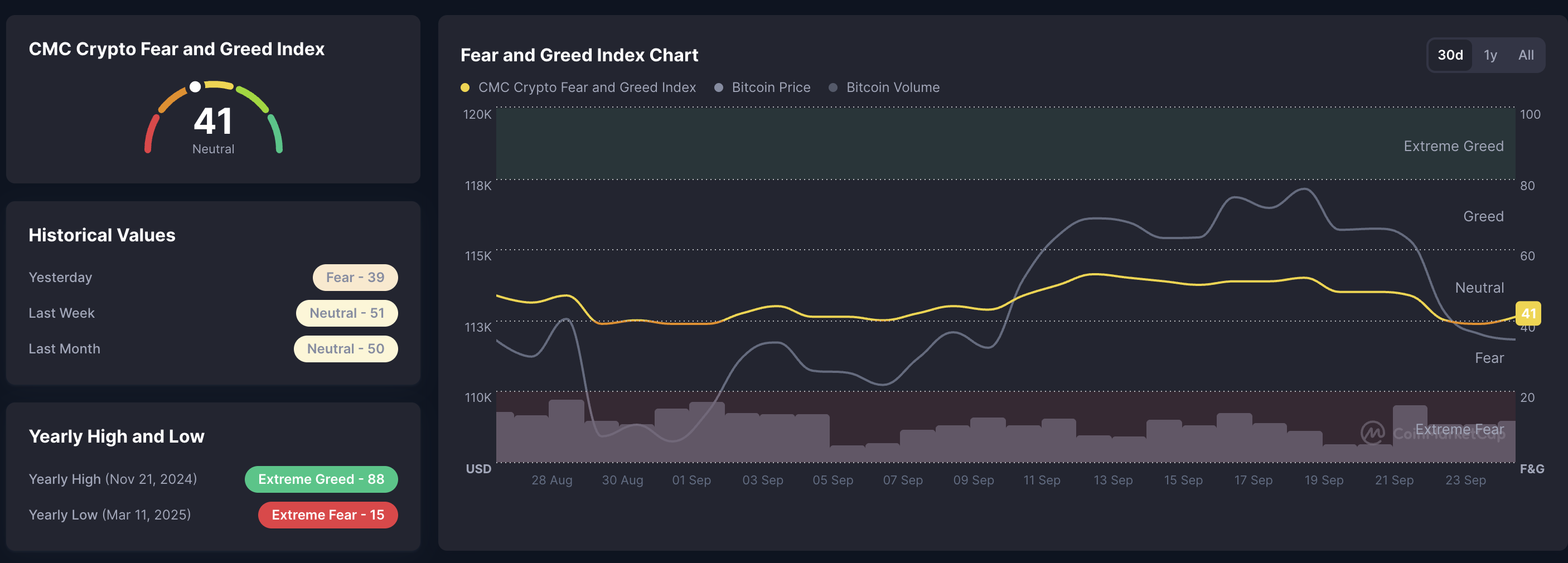

CoinMarketCap’s Fear and Greed Index remains steady in the neutral zone at 41, after a decline from 51 last week. If this index drops below 40, it will signal a risk-off sentiment in the broader market.

Fear and Greed Index. Source: CoinMarketCap

If PI extends the intraday pullback below $0.2700, it could result in a free fall to the S2 support level at $0.2387.

Flashing the bearish pressure, the Relative Strength Index (RSI) at 27 on the daily chart remains within oversold territory, suggesting that sellers are dominating the price trend. Additionally, the Moving Average Convergence Divergence (MACD) and its signal line take a nosedive in the negative territory, following the bearish crossover on Sunday. The steady rise in red histogram bars indicates that the bearish momentum is increasing.

PI/USDT daily price chart.

On the flip side, if PI rebounds upwards, it could challenge the 50-day Exponential Moving Average (EMA) at $0.3618.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a VIRTUAL currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.