Hyperliquid’s HYPE Token Eyes $50 Breakout as USDH Stablecoin Goes Live

Hyperliquid's native token HYPE surges toward the $50 threshold as the platform launches its USDH stablecoin—creating instant liquidity and fueling bullish momentum across decentralized exchanges.

Stablecoin Integration Fuels Momentum

The USDH launch injects immediate utility into Hyperliquid's ecosystem, allowing traders to collateralize positions without exiting the protocol. This eliminates traditional stablecoin bridging delays—cutting settlement times from hours to seconds.

Technical Breakout Pattern Emerges

HYPE's chart shows consolidation near historic resistance levels, with the $50 mark representing a psychological barrier. Previous attempts to breach this level failed due to thin liquidity—now addressed by USDH's built-in market making mechanisms.

Institutional Interest Grows

Major liquidity providers are allocating capital to USDH pairs, creating deeper order books than typical DeFi launches. This institutional participation signals confidence in Hyperliquid's architecture—bypassing the 'vaporware' accusations plaguing other Layer 1 projects.

Regulatory Arbitrage Plays Out

The timing coincides with renewed stablecoin scrutiny from traditional regulators—a familiar pattern where decentralized protocols innovate while legacy finance debates compliance frameworks. Because nothing says 'financial revolution' like watching bankers form another committee.

With USDH achieving immediate traction and HYPE testing key technical levels, Hyperliquid's ecosystem demonstrates how native stablecoins can accelerate adoption—provided traders look past the inevitable volatility ahead.

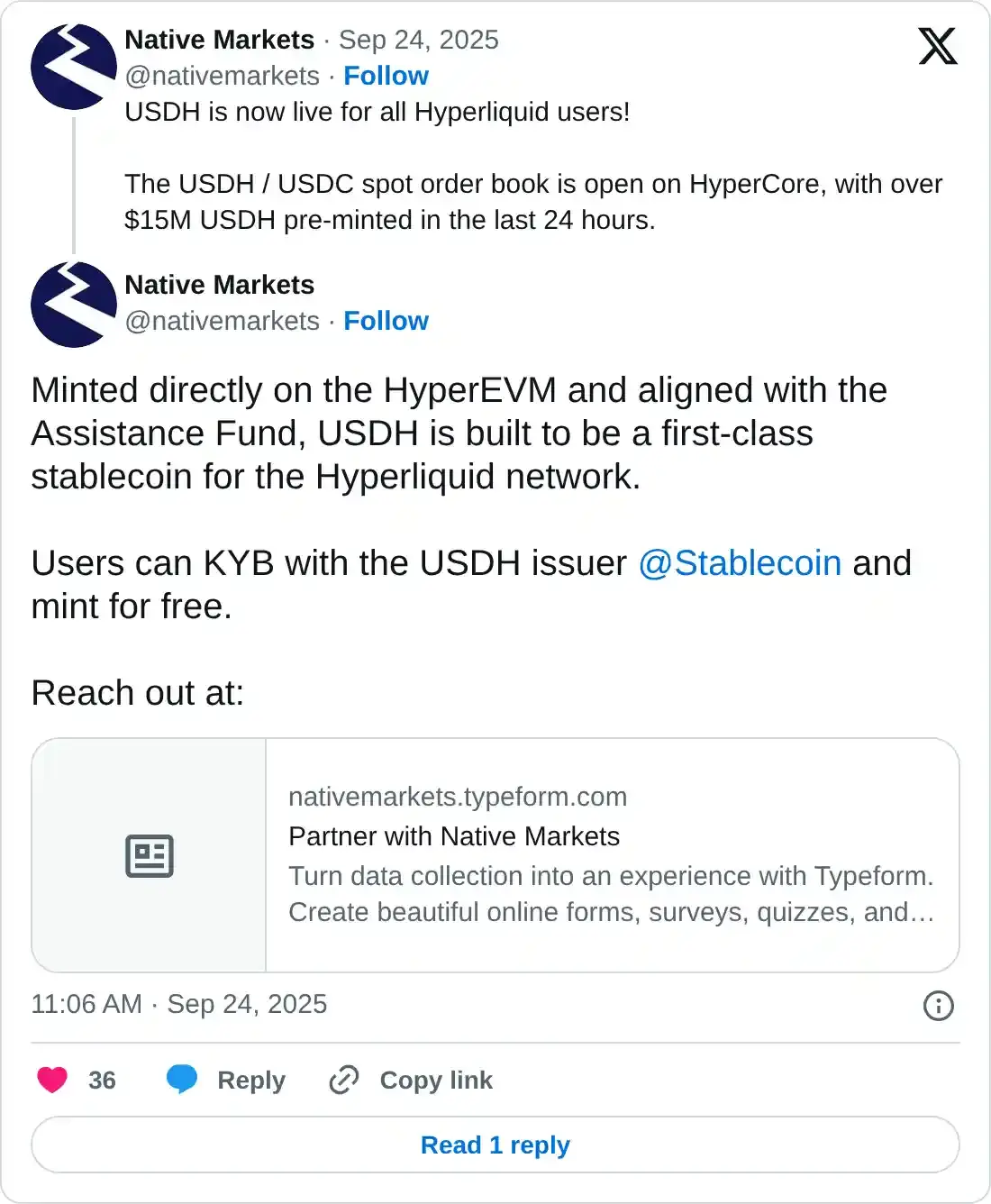

Native Markets debuts USDH stablecoin on Hyperliquid

Native Markets, the issuer of USDH, a native stablecoin on Hyperliquid perpetual contracts trading DEX, has officially announced the token’s launch on X. According to the social media post, “USDH is now live for all Hyperliquid users,” featuring a spot order book on HyperCore. The order book comprises $15 million USDH pre-printed over the last 24 hours.

Native Markets emphasized its commitment to the agreed-upon framework, where $0.50 of every US Dollar (USD) earned will be channeled to an Assistance Fund. The contribution begins accruing on Wednesday.

However, the launch is not complete, with Native Markets expected to continue the phased rollout of USDH over the coming months, including HyperEVM integrations and additional features such as USDH as a spot quote asset, native minting on HyperCore, as well as USDH-margined perpetual order books via HIP-3.

Meanwhile, retail interest in HYPE has declined over the past few days, with the futures Open Interest (OI) dropping to $2.17 billion from $2.54 billion on Friday.

The decline in OI, which represents the notional value of outstanding futures contracts, indicates a lack of conviction in Hyperliquid sustaining an uptrend in the short term. If retail demand remains subdued in the coming days, bulls may struggle to sustain the uptrend, targeting highs above $50.00.

Hyperliquid Futures Open Interest | Source: CoinGlass

Technical outlook: Hyperliquid bulls attempt recovery

Hyperliquid trades above the 100-day Exponential Moving Average (EMA), which currently holds at $43.94. If bulls sustain the intraday gains on Wednesday, they could break five consecutive days of declines, increasing the probability of a sustained uptrend above the ascending trendline and the critical $50.00 level.

HYPE/USDT daily chart

Still, traders should pay attention to the 50-day EMA at $48.10, a supply-rich level that could delay the breakout. Additionally, the Moving Average Convergence Divergence (MACD) indicator has maintained a sell signal since Sunday, which encourages investors to reduce their exposure, potentially contributing to increased selling pressure.

If the immediate support provided by the 100-day EMA support at $43.94 crumbles, the Hyperliquid Price could resume the downtrend, bringing the next support at $40.38, which was previously tested on August 22, within reach.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.